Australian Crop Update – Week 8, 2024

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

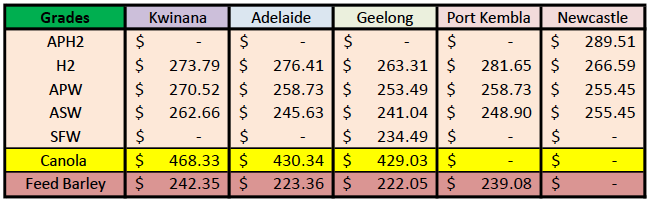

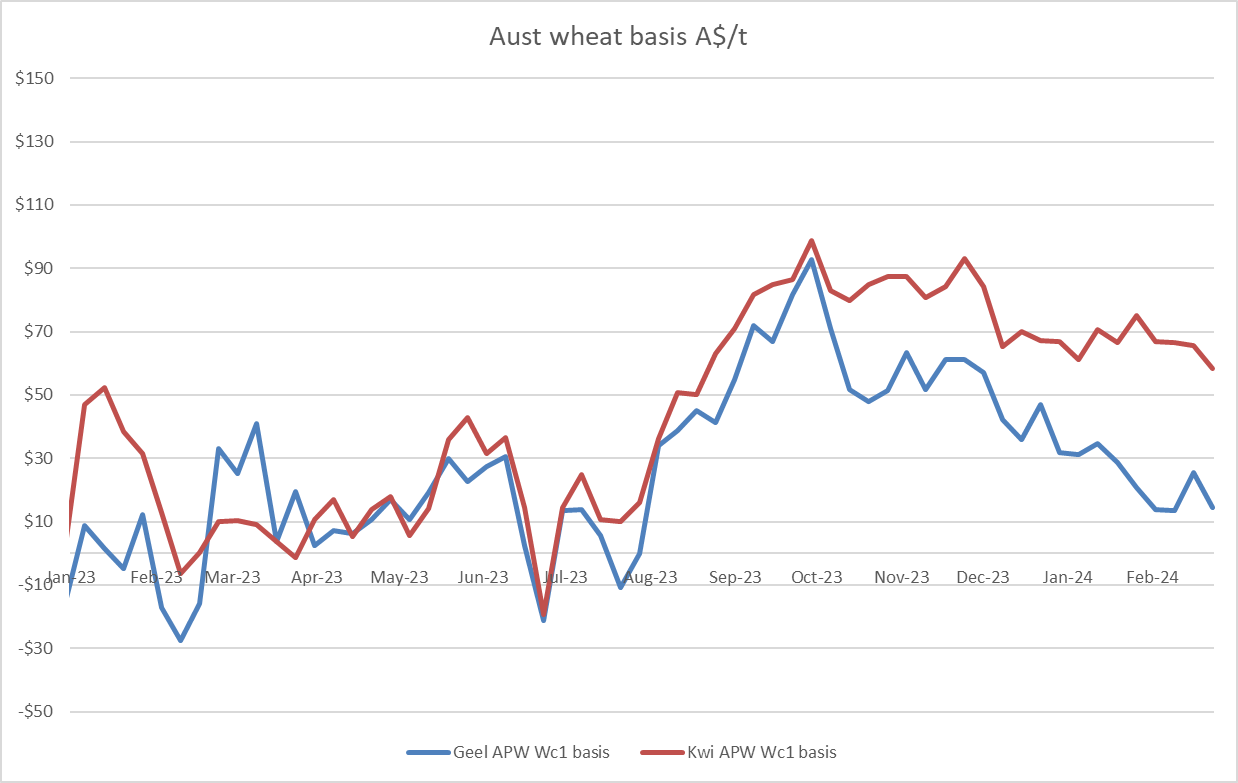

Australian domestic markets remain soft. However, slow farmer selling is helping to support values despite world market weakness and consequently, Australian cash remains “relatively” expensive. That said, from a basis perspective, Victoria (VIC) seems to be closer to the world market than Western Australia (WA).

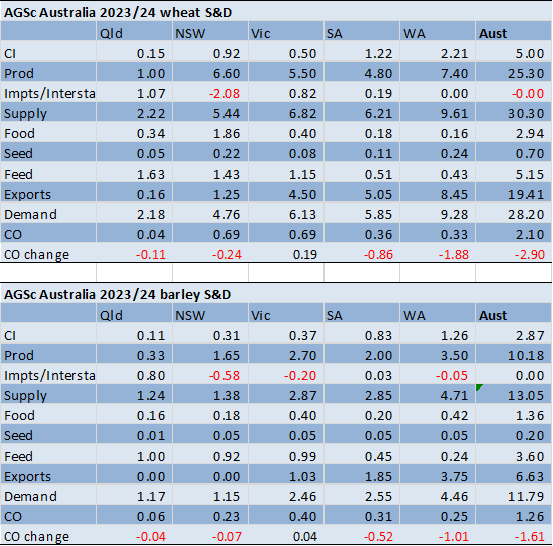

Barley was lower as China came back into the market at much lower levels. Unconfirmed reports of more Chinese barley demand emerging through the week failed to offer support to cash bids.

Domestic demand for east coast grain is edging higher due to slightly larger meat production and cattle on feed numbers. Australia's latest feedlot survey results reveal an increase in cattle on feed to 1,294,531 head in the December quarter, marking a record high.

Australian Balance Sheet Updates (Agscienta)

Australian Pulses Market Update:

Last week, chickpea prices increased around 4% on speculation of Increased Indian demand. Lentils were unchanged while faba beans declined around 4%.

The Indian government has extended its duty free import of yellow peas until the end of April, indicating government concerns remain around the availability and pricing of pulses as we move through 2024. Another factor to consider over the next few weeks for price increases in pulses is the Indian weather as it will determine the support for global prices this year. If the rains are poor and the Rabi crop production is affected, the Indian government may extend the current more flexible duty import program and pulse demand would be supported.

On faba beans, bulk shipments to Egypt are continuing at a steady pace, although containerised exports via the Red Sea have stopped due to the ongoing threat of Houthi attacks.

There has been steady farmer selling, although liquidity is much lower than during harvest

The flat lentils market reflects the shipping stem’s focus on getting wheat and barley out of VIC and South Australian (SA) ports in the next month or two.

Ocean Freight & Shipment Stem Update:

The first trading week after Chinese New Year did not disappoint from an owner's point of view. Activity levels have noticeably increased in the Pacific and rates across the board have improved. Tonnage is tight on prompt dates and some Charterers are still scrambling to cover requirements, with rates now at higher than last done levels. Period interest remained at healthy levels with fixing rates still ranging between 17/18k on supra/ultras for 1yr. The handysize are now fixing at 14/15k levels for same duration (for modern 38kdwt type).

Looking forward, it is still too early to say if this market will continue to push on. Although owners are anticipating a strong market in the Pacific for the next month or two.

A further 235 thousand metric tonne (KMT) of barley, 102KMT of canola and 376KMT of wheat has been added to the shipping stem in the past week. WA accounted for most of the barley apart from 40KMT in SA. WA also accounted for all the canola additional last week. SA was the major contributor to the weekly wheat additions with 200KMT, followed by SA with 140KMT and 36KMT of durum in Newcastle, New South Wales (NSW).

Barley exports are 75% complete based on the accumulative published ABS data for Oct/Dec and the stem projections for Jan/Apr. This is more advanced than wheat and canola which are 56% and 63% respectively.

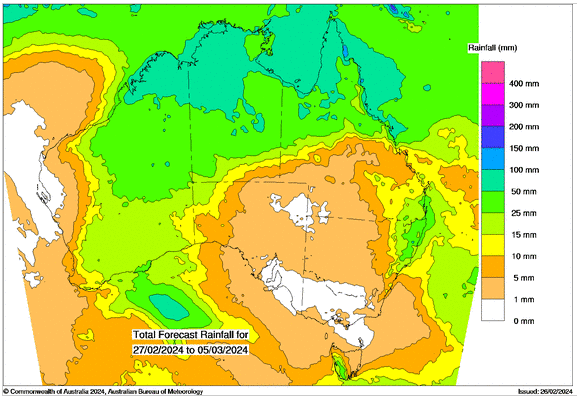

Australian Weather:

Ex Tropical Cyclone Lincoln brought welcome rain to WA through all the growing regions. General rains brought 25-50mm providing much needed sub-soil moisture ahead of planting for the region's growers. The Australian Bureau of Meteorology is showing a dry outlook over the next three months. There is no rain forecast over the next week on the eastern and southern states however in most areas the moisture profile is relatively full.

8 day forecast to 5th March 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 27th February 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to end last week when valued against the USD. The AUD continued to trade around the psychological level of 0.6500 retracing the losses registered in the previous two days. The Australian dollar may have found some support as the Reserve Bank of Australia reaffirmed the commitment to managing inflation, noting encouraging signs in inflation data. Last week the Reserve Bank left its interest rate unchanged for a second meeting in a row with the cash rate at 4.35%.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au