Australian Crop Update – Week 7, 2024

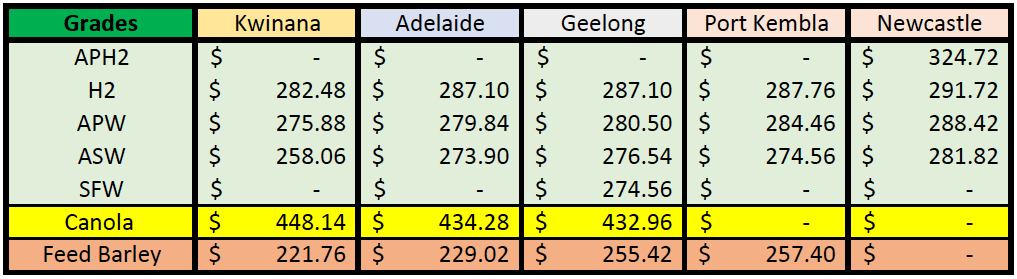

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

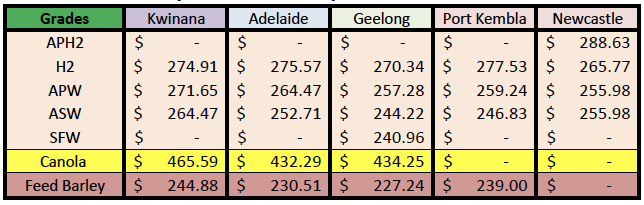

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian domestic grain markets fell in all port zones over the week. The biggest declines were seen in the northern areas on the east coast where farmers and traders are struggling for homes within the domestic market and the absence of export demand. The feed wheat market was down USD18 per metric tonne (/MT) for the week as longs finally came down to levels to uncover fresh consumptive interest.

Barley was also pressured lower, but not to the same extent as wheat due to northern barley suppliers remaining tight. Exporters have had little interest in buying at these levels from farmers as they struggle to garner export interest. Prices however are falling where we could see more exports. Overall, demand is soft and when it does emerge it's only for nearby needs.

Nearby demand is more intent on swapping supplies to more efficient export execution locations rather than adding to length, which is expected to reflect the lacklustre demand seen from Asian wheat importers. The same is said for barley which had previously been supported by the large China sales and the advanced export pace.

Ocean Freight & Shipment Stem Update:

Lacklustre shipping stem additions in the past week is offering support for exporter prices. Only 356 thousand metric tonne (KMT) of wheat was put onto the stem in the past week compared to the 4-week average of 532KMT. This included 189KMT in WA and 117KMT in VIC as well as 50KMT in Port Kembla, New South Wales (NSW). There was 106KMT of canola put on the stem which included 76KMT in WA and 30KMT in South Australia (SA). There was also 85KMT of barley put onto the stem made up of 60KMT in WA and 25KMT in SA.

Houthi rebel attacks on the Red Sea have led to Suez Canal revenues dropping by half in January. The major shipping companies have chosen to divert their vessels away from the Red Sea and the Suez Canal. Income at Suez Canal has dropped from $804 million in January 2023 to $428 million in January 2024, according to the Suez Canal Authority. The total number of vessels transiting through the Suez Canal dropped from 2,155 to 1,362 in the same period. Many carriers have re-routed vessels to the longer and more expensive route round the Cape of Good Hope. The Suez Canal offers the shortest route between Asia and Europe. Charter rates are rising as owners become more bullish and are pushing for higher-than-last-done levels across segments and regions.

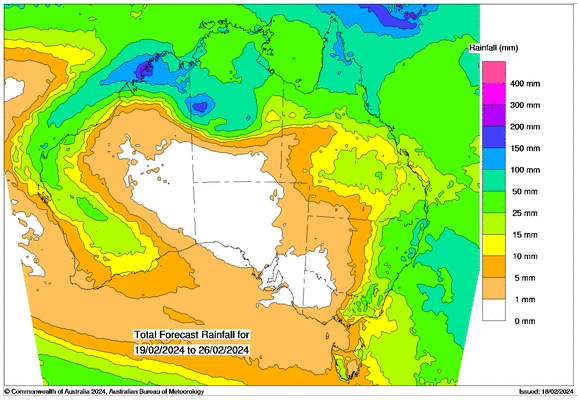

Australian Weather:

More general rain fell across northern Australia last week which is supporting the summer crop outlook. Most forecasters are coming around to the view that the sorghum crop may be significantly larger than early projections. We expect the crop will come in north of 2.1 million metric tonne (MMT) which will demand large exports into China. The long term weather outlook for the winter wheat, barley and canola crop looks favourable with general rains across the growing areas of Australia. Last week saw a heat wave across VIC and Northern NSW with temperatures exceeding 42 degrees for much of the week. This week looks favourable again with showers expected in WA and the eastern states.

8 day forecast to 26th February 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 19th February 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to close last week when valued against the USD trading at 0.6494. The AUD attempted to move into positive territory after trimming intraday losses early last week. Australian employment was surprisingly weak in January, while the jobless rate climbed to a two-year high in another sign the labour market was loosening in the face of a slowing economy and subdued consumer demand.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.