Australian Crop Update – Week 2, 2025

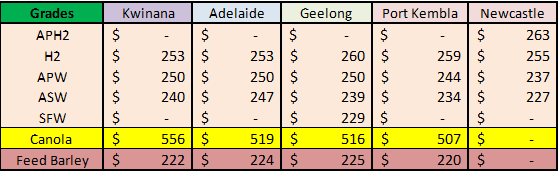

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Firstly, welcome back to our first weekly market report for 2025 and all the best for the year ahead from all Basis Commodities team.

Before we dive into the details of the Australian cash market, we have spent a bit of time with our analyst pondering market relativities to understand some of the potential market risks. At the start of the year, US equities at hovering close to record highs less than two week’s out from Trump’s inauguration. The US dollar index is approaching its COVID high and pushing the AUD into the lower end of its historical trading range. The US economy finished 2024 in good shape as the Fed successfully dodged a hard landing. However, in other parts of the world economies are struggling. After decades of continuous economic growth, Beijing is facing deflation and is looks to turn the economic malaise around with the previous economic leavers no longer working or available. They are still suffering from the impacts of the real-estate crisis with state government and provincial government enterprises crippled with debt. As a result, the soft commodity markets still feel muted, and it feels like demand is king for now. Consequently, it feels like consumers will continue to buy on a hand to mouth basis. However, there are some bull flags appearing on the production side for 2025, most notably Russia for wheat, that when combined with some of these other market relativities could lead to a relatively volatile year ahead for us all.

Australian Grains Market Update

The Australian domestic markets remained unusually quiet over the last two week with most participants still away on holidays or light duties with the Christmas and New Year’s holiday period. The weaker AUD is offering modest price support with basis sharply higher on Friday night with the selloff in Chicago.

Australia’s winter crop grain harvest for 2024 is now largely complete. Final production estimates are yet to be issued however there will likely be some modest adjustments to the New South Wales (NSW), Victoria (VIC) and South Australia (SA) numbers. The Western Australia (WA) receivals number continues to grow so our analysts have raised their Australian 2024 wheat production to 32.5 million metric tonne (MMT) and barley 12.5MMT.

Export Stem & Ocean Freight Market Update:

It’s a short and disjointed week for the shipping stem with New Years Day holiday in the middle and many people still away for the Christmas holidays. Even so, there was 305 thousand metric tonne (KMT) of wheat put on the stem in the first week of 2025. Half of this was in WA and the remainder was split between NSW and SA.

As we navigate the festive and New Year period, it appears the dry bulk market has also entered holiday mode. While the end of the year has been disappointing for owners, reflecting on 2024 it was a positive year overall. Freight rates for Capes averaged over $20kpd only the second time in the last 15 years while Smax/Umx rates averaged around $15k–$16kpd, which is strong performance. Additionally, the premiums achieved by large eco handies for trips and period were also historically impressive. However, much of the asset value gains recorded in the first half of the year have eroded as we enter 2025.

Looking ahead to the dry bulk shipping market in 2025, the outlook is more cautious. Around 90% of market players anticipate a weakening market. Stable new deliveries for Capes, Pmx, and Umx are expected, which could pressure supply-demand dynamics. Uncertainties surrounding the shipping routes through the Red Sea, as well as the ongoing conflicts in Ukraine and Russia, add further complexity. When combined with potential impacts such as Trump-era tariffs, and broader geopolitical developments, the dry bulk shipping market faces an interesting year ahead.

Bunkers prices has remained stable for the most part with major ports around the world averaging between 525-575pmt for VLSFO and 675-725pmt for LSMGO.

Australian Weather:

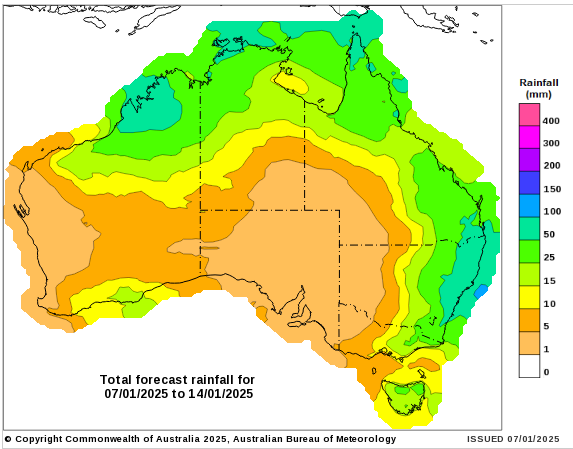

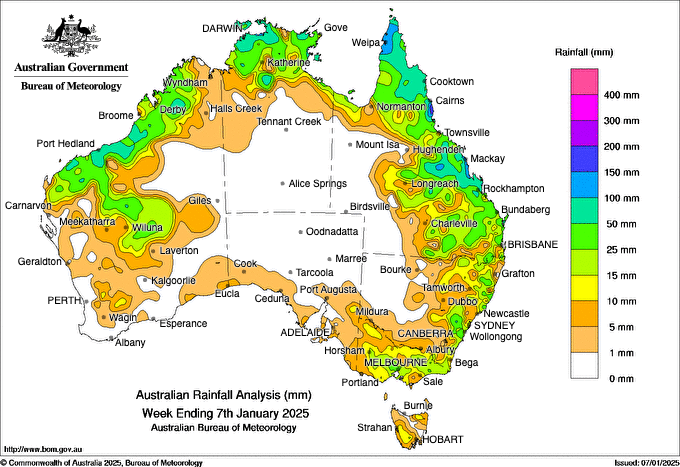

Queensland has seen good rain over the past 10 days and is set to see more in the next week. Summer crops in the western and eastern Downs are in line for above average yields.

8 day forecast to 14th January 2025

http://www.bom.gov.au/

Weekly rainfall to 7 January 2025

http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker again to finish last week when valued against the Greenback closing at 0.6220. The currency traded sideways for the past two weeks during the Christmas and New Years holiday period. The expectation is that the AUD / USD pairing will remain at these levels over the next few weeks and will see downside ahead of the US election with the USD strengthening once Trump is inaugurated for his second term.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.