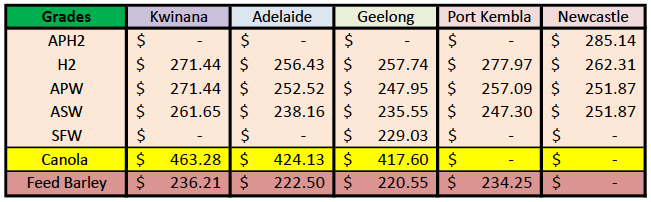

Australian Crop Update – Week 9, 2024

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian domestic markets continued to grind lower last week and with few exceptions but with little activity. These are difficult markets with demand limited to the nearby positions as buyers surface to cover needs but have limited appetite for deferred positions or significant quantities unless it’s discounted. Equally, farmers are slow sellers with prices now at the lowest levels in 24 months with consequent impact on their gross margins. Selling is limited to nearby positions and usually linked to logistics and growers have little interest in committing to forward sales at current values.

A lack of exporter demand in Victoria and South Australia is making wheat feel very heavy while a more advanced export program is offering a little more support in Western Australia (WA) although there is some talk of exporters walking away from deferred slots in the West. Wheat export demand remains sluggish with traders reporting that buyers are pushing some shipments backwards. The wheat markets in Victoria (VIC) and South Australia (SA) were back 2-3% for the week which is tied to the sliding global cash markets and the slow export pace while WA was steady.

Barley has found export support in recent weeks with reports of further Chinese sales. There are rumours that China may have bought 300-400 thousand metric tonne (KMT) of Aussie barley at USD255-260 CFR China but we think some, if not all, is optionalised so whether it is shipped against the Australian balance sheet is for avid watchers of the Australian stem!

Australian Pulses Market Update:

Australian Grain Export is set to open its next chapter in coming months with the launch of protein-powder production. Co-located with the AGE’s bulk-storage, container-packing and pulse-processing facilities at Dublin on the Adelaide Plains, It aims to produce 5000 metric tonnes (MT) of protein concentrates and 10,000MT of starch concentrates per annum from faba beans. With commissioning underway, Integra Foods is now looking for customers for its protein and starch concentrates in the human-consumption, pet food and animal feed markets.

Otherwise the pulses markets continue to be driven by short covering and further accumulation for future vessels.

Ocean Freight & Shipment Stem Update:

The Pacific market has continued to gain after the Chinese New Year. Activity levels remain high and tonnage lists are getting tigher by the day causing headaches for Charterers trying to cover old cargo bookings. Owners are reluctant to register or stand behind offers for long given the fast moving pace of the market this week. In contrast, the Altantic is trending sideways and may have even lost ground this week. This was a direct result of a lack of fresh demand appearing in the market. Period interest remained strong.

There was 505KMT of wheat, 168KMT of barley and 90KMT of canola added to the shipping stem in the past week. The shipping stem is now far enough advanced to assess how the shipping pace is going against forecasts.

Barley is the most advanced and wheat is the least advanced. Barley is 75% shipped (~5 million metric tonne (MMT) national) based on the exports for Oct/Mar and this is reasonably consistent across the states. The Australian Bureau of Statistics data shows exports of 2.5MMT Oct/Dec. Forecasters had China pencilled in for 3.0MMT of sales prior to the latest round of buying so it’s possible total sales could 3.5MMT plus after the latest round of purchases but if it is optionalised our sense is it may not be that high.

Australia’s Oct/Mar wheat exports are projected at 11.2MMT which includes a projected 7.1MMT in the Jan/Mar. This puts the forecast Oct/Sep exports of 19.4MMT at 58%. New South Wales (NSW) is the most advanced state with 1.1MMT already shipped or on the stem of the projected 1.25MMT. WA is also moving along briskly with 5.4MMT for Oct/Mar which is 64% of the forecast Oct/Sep 8.45MMT. WA only must average ~0.5MMT in the Apr/Jun to achieve the forecast 8.45MMT. SA and VIC export targets will be more of a stretch as both of the states are around 50% of the forecast Oct/Sep which means they will have to maintain the same pace in the second half of the marketing year to achieve the forecast.

Australia is on target to ship about 3.1MMT of canola in the Oct/Mar of the forecasted 4.75MMT. WA will be ~1.75MMT by the end of March which is about 50% of the Oct/Sep forecast. Exporters shorts still look to be chasing canola.

Australian Weather:

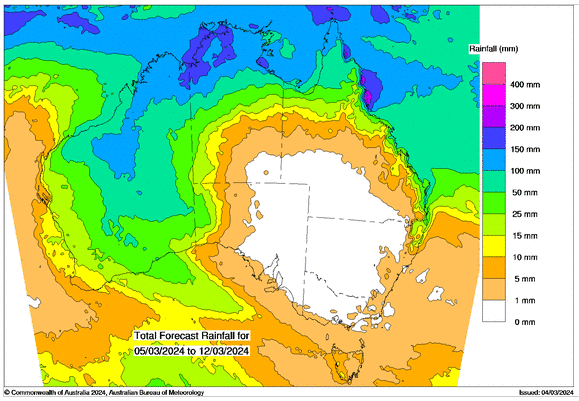

WA received beneficial rain in the northern cropping areas last week and over the weekend. There was 20-30mm in the Geraldton zone (80%) and this was expected into the eastern Kwinana zone which received similar amounts in the areas central to the state. Falls were lighter to the west although most still received 10-15mm.

Australia could be heading for its third-warmest summer on record, with many places likely to experience a warmer and drier period than normal from March to May, according to the Bureau of Meteorology’s latest update. There was a 60% to 75% chance of below median rainfall across large parts of the country, including most of the states of NSW, VIC, Queensland (QLD) and the Northen Territory (NT). The chances of above or below median rainfall however were roughly the same elsewhere, such as most of SA and southern and central WA.

8 day forecast to 12th March 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 5th March 2024

Source: http://www.bom.gov.au/

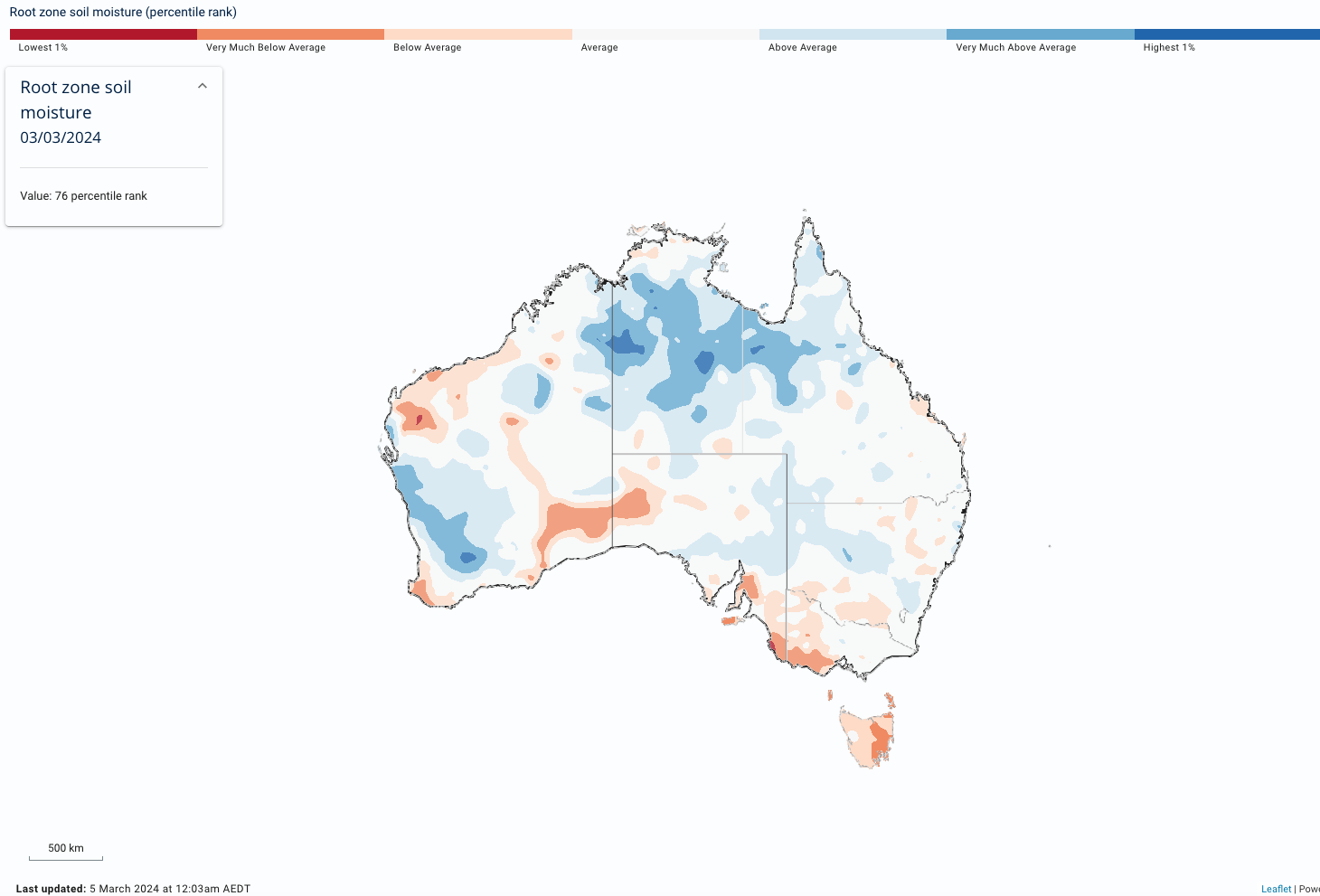

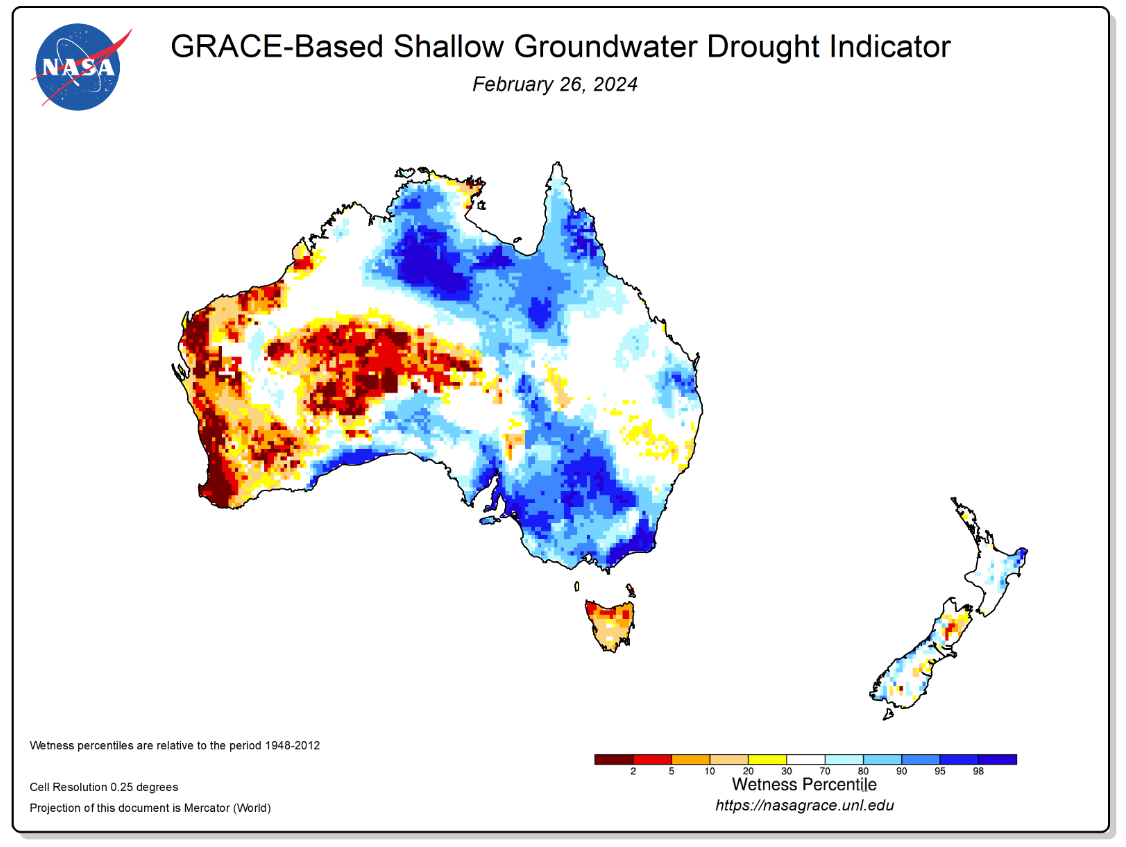

As we prepare for planting, we thought we would share these two moisture profile maps which seem to show a mixed picture. The east and south would appear to be in reasonably good shape and even the west appears to have benefited from rain last week. As things stand, we expect more barley to head into the ground, similar amounts of wheat and we expect pulses to take acres from Canola. Recent hot, dry weather has dried out topsoil moisture in VIC and SA. Farmers will be looking for planting rains in the next 8-12 weeks. The BOM’s ACCESS model is pointing to a slightly drier Autumn.

Source: http://www.bom.gov.au/

Source: https://nasagrace.unl.edu/

AUD/USD Currency Update:

The Australian dollar was slightly stronger to end last week trading at 0.6505 moving higher on Friday from 0.6490 as investors hope the Federal Reserve will start reducing interest rates from the June policy meeting. Friday’s market attention gravitated towards China’s economic performance, with the release of February’s private sector PMIs highlighting the country’s economic dynamics. The data paints a nuanced picture of China’s manufacturing sector, with production reaching its highest rate since May 2023, a resurgence in new export orders for a second consecutive month, and a strategic increase in purchasing activities by firms in light of improved demand.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.