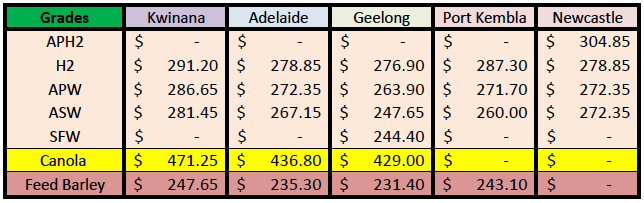

Australian Crop Update – Week 6, 2024

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian domestic grain markets fell in all port zones over the week. The biggest declines were seen in the northern areas on the east coast where farmers and traders are struggling for homes within the domestic market and the absence of export demand. The feed wheat market was down USD18 per metric tonne (/MT) for the week as longs finally came down to levels to uncover fresh consumptive interest.

Barley was also pressured lower, but not to the same extent as wheat due to northern barley suppliers remaining tight. Exporters have had little interest in buying at these levels from farmers as they struggle to garner export interest. Prices however are falling where we could see more exports. Overall, demand is soft and when it does emerge it's only for nearby needs.

Nearby demand is more intent on swapping supplies to more efficient export execution locations rather than adding to length, which is expected to reflect the lacklustre demand seen from Asian wheat importers. The same is said for barley which had previously been supported by the large China sales and the advanced export pace.

USDA Report:

The recent USDA report from Thursday last week was mixed, but a generally bearish report as any cuts made were less than the market expected. Wheat saw more production (with Australia unchanged) which was matched with a similar increase in consumption, leading to a marginal decrease in stocks. USDA did cut internal US food consumption, so the report was more bearish for the US traders than the global traders.

On the surface, corn was bullish with less production and less stocks than last month. However, the market took the report as bearish since USDA only cut the Brazilian crop by a mere 3 million metric tonne (MMT) which is much less than local analysts there believe. Once again, the US saw a more bearish picture than global traders as domestic US stocks were up.

Beans were a subdued and bearish affair too, even if Brazilian production was cut by another 1MMT, we still saw an increase in ending stocks of 1.4MMT. We did see USDA increase local US crush to record levels which is of interest.

Ocean Freight & Shipment Stem Update:

There was 710 thousand metric tonne (KMT) of wheat put onto the stem in the past week. This included 255KMT in Western Australia (WA) and 240KMT in Victoria (VIC). There was also 140KMT added in South Australia (SA) and a further 75KMT in New South Wales (NSW).

There was 135KMT of barley added to the stem in the past week and 96KMT of canola, which was all in Pt Kembla, NSW. Barley exports on the stem are close to 70% of the expected exports for the season of 6.6MMT. It would be 88% of the USDA forecast of 5.7MMT which they raised by 500KMT in the Feb WASDE.

Barley shipping is the most advanced, followed by canola and then wheat.

Pressure remains throughout the Red Sea as disruptions to the corridor persist with conflict and the absence of insurance underwriters willing to reinstate the coverage for vessels. There has been an increase in airstrikes within Gaza by Israel and in Iraq by the US which only inflates the conflict within the region. Peace and cease-fire talks appear to be a long way off for Israel and Hamas which will continue to keep freight rates firm and route transits affected to avoid any concerns for transits.

Australian Weather:

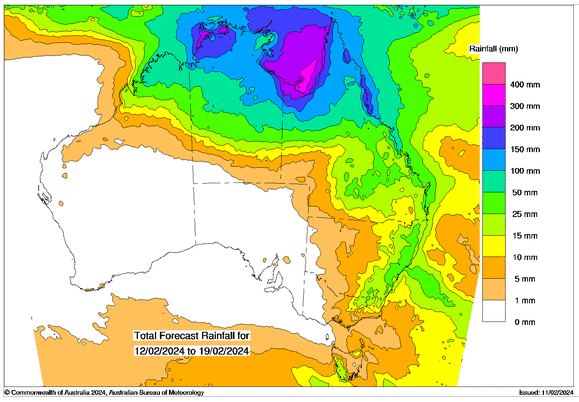

The Australian Bureau of Meteorology (BOM) is forecasting the El Niño-Southern Oscillation (ENSO) drivers to return to a neutral phase. However, the BOM's ACCESS model only projects forward to Apr/May/Jun’24. Some of the models they forecast into Australia's spring are saying it will move into La Nina again. The seasonal outlook is pointing to normal to slightly above normal precipitation across Australia's cropping areas through the autumn, winter and spring. All of this is positive for Australia’s 2024 winter crop production prospects.

Minimal rainfall was recorded last week across Australia’s west and east coast cropping regions. Temperatures in parts of WA cropping regions topped 40° over the past week. According to the BOM, the week ahead will see more rainfall in Queensland (QLD) and parts of NSW, and limited to no rainfall in VIC, SA and WA.

8 day forecast to 19th February 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 12th February 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to end last week when valued against the USD. The AUD continued to trade around the psychological level of 0.6500 retracing the losses registered in the previous two days. The Australian dollar may have found some support as the Reserve Bank of Australia reaffirmed the commitment to managing inflation, noting encouraging signs in inflation data. Last week the Reserve Bank left its interest rate unchanged for a second meeting in a row with the cash rate at 4.35%.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.