Australian Crop Update – Week 50, 2024

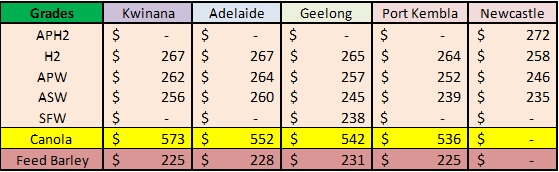

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

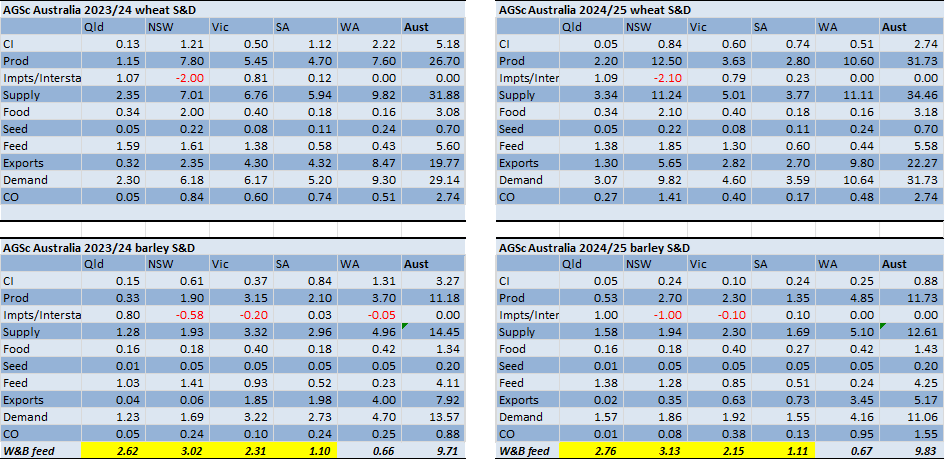

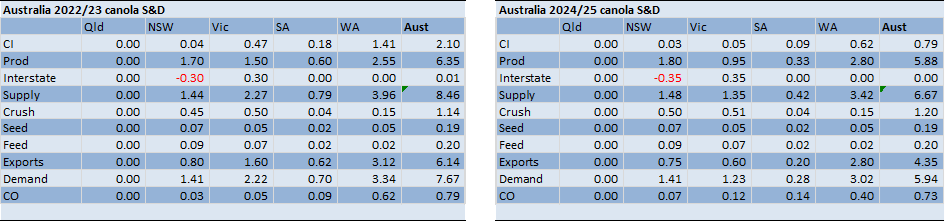

The harvest continues to roll on and seems to be confirming a larger crop. Most of this was due to higher-than-expected yields in Western Australia (WA) across barley, canola, and wheat although that will come at a cost in terms of wheat protein.

“There is no single factor influencing the incredible quantity of grain being harvested right across the state on very little rainfall,” GIWA said, adding that pre-harvest yield estimates for wheat, barley and canola have ended up being well below the actual results. “The total tonnage for the state will easily end up being the third-largest harvest on record.”

Export demand is generally sluggish with exporters cautious about how much Australian wheat and barley China will import. Other destinations are happy to maintain the hand-to-mouth buying purchasing strategies. Australian canola is the exception with strong demand from Europe.

In terms of quality, more reports are emerging of wheat crops that are still making milling grades following the rain and this seems to confirm our view that less than million metric tonnes (MMT) of wheat in New South Wales (NSW) and Victoria (VIC) will has been downgraded. Grower selling has picked up a little ahead of a large sorghum crop in the north and a little more in the south.

Our analysts updated their Australian supply and demand estimates last Friday. Harvest is advanced in all states and receival data has allowed some fine tuning of the production estimates. Overall, wheat production has been similar to the November forecast, but WA’s canola and barley has come in better than expected. The crop is larger, but wheat and barley exports are off to a slow start. Australian supplies are still relatively expensive vs Black Sea and Argentina although the gap is closing. Chinese demand is much softer than last year, and other buyers are happy to stick with the hand to mouth buying strategies and are arguing for cheaper prices. On the demand front, there are reports that Beijing has instructed importers to limit grain imports into China due to a large domestic crop. Some traders are saying that buyers have been instructed to limit Australian wheat, barley, and sorghum imports to 12.0MMT. Elsewhere, wheat demand feels sluggish.

Australian Pulses Market Update:

Australian growers remain willing sellers of chickpeas, faba beans, and lentils as pulses continue to populate the nearby shipping stems. Solid demand from South Asia for lentils is seeing plenty of business written for on-farm and accumulated parcels, but the arrival of Canadian and Russian yellow peas, as well as new-crop Australian cargoes, has dampened India’s demand for desi chickpeas.

A record, or near-record, volume of early-season faba beans has seen several cargoes shipped to Egypt from the northern ports of Newcastle and Brisbane in recent weeks, but prices are holding at levels high enough to keep growers selling. The quality of most pulses harvested has been high, but successive rain events caught some of the NSW chickpea crop in the field, and the same for faba beans in South Australia (SA) and VIC.

Export Stem & Ocean Freight Market Update:

It’s been a busier week for shipping stem additions with more than 1.2MMT of grain additions since last week’s update. This included 424 thousand metric tonne (KMT) of wheat, 355KMT of barley, 360KMT of canola as well as more pulses.

From an ocean freight perspective, the pre-holiday slump is continuing with fresh activity being limited and a general lack of urgency from charterers. Vessel hire rates are still facing gentle downward pressure, but the general consensus is the floor has been found, and we will trend sideways for the near term.

It was a similar story on the Panamax sector whereby both basins are struggling to generate fresh inquiry to combat the growing tonnage supply. Australia and Nopac have been quiet in the Pacific and while in the Altanitc there did appear to be a slight increase of trans-altanic trips in the North, it couldn't combat the general negative sentiment as we saw rates slide again.

The Supramaxes appeared to be more active ex ECSA and USG in the Altantic for trips within the basin and the indexes reflected a more optimistic feel. However, very limited fixing information leaked out into the market which could indicate it has been driving more from sentiment rather than anything of substance. By contrast, the Pacific was very subdued.

The Handysize followed the same path. Many market players are going on their leave at the end of this week so have decided to cover early so they only need to monitor over the next few weeks.

Australian Weather:

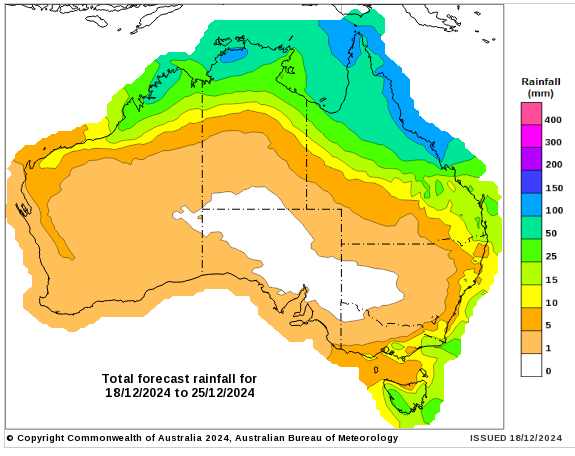

There is limited rain expected over the next week to ten days across the cropping regions of Australia as farmers look to finish harvest ahead of the Christmas holidays. There is no rain on the forecast for WA and SA with only coastal showers expected for VIC and NSW. Queensland (QLD) is forecast to see rainfall in land, however harvest is complete, so the rainfall will be welcomed with the imminent sowing for summer crops. Daytime temperatures are expected to soar in rural areas with heat waves crossing rural VIC, NSW and into the Northern Territory. Temperatures will peak between 41-45 degrees in these areas.

8 day forecast to 25th December 2024

http://www.bom.gov.au/

Weekly rainfall to 18 December 2024

http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to finish last week when valued against the Greenback closing at 0.6346 with the Chinese yuan remaining a key driver for AUD/USD weakness. AUD/USD runs the real risk of moving below 63c.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.