Australian Crop Update – Week 49, 2024

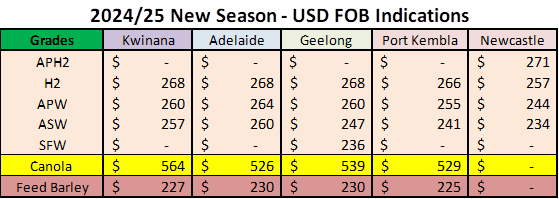

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Domestic markets softened over the past week with declines in global markets and as traders wait to see the impact of widespread rain on unharvested crops across eastern Australia. Globally, US wheat futures were 2% to 6% lower with KC futures the biggest loser. Corn was back 0.6% for the week while Canadian canola futures tumbled 3.5%. Matif rapeseed was only modestly lower for the week.

Locally, New South Wales (NSW) and Victoria (VIC) canola bids tumbled by around USD20 per metric tonne (/MT) or 3.5% while Western Australia (WA) Kwinana was only back USD3/MT or 0.6% for the week. Wheat and barley bids were up USD2-5/MT across most port zones as buyers scrambled for nearby supplies, particularly wheat. ASW was up USD6/MT as buyers are to better understand how much wheat was downgraded following the rain. There will be some, but we doubt it will be general across all areas. Weekly rainfall totals were lighter south with 17-25mm and heavier to the north with 50-80mm.

Australian Pulses Market Update:

Australia exported 109,622 metric tonnes (MT) of chickpeas and 29,887MT of lentils in October, according to the latest data from the Australian Bureau of Statistics. India on 82,418MT was the major destination for October-shipped chickpeas, followed by Pakistan on 14,384MT, and Bangladesh on 3948MT.

On lentils shipped in October, India was also the leading destination, taking 10,952MT, followed by Sri Lanka on 7,615MT and Bangladesh on 4,943MT.

In terms of overall production ABARES cranked up chickpea production to over 1.88MMT. They bumped fava beans to nearly 700KMT on the back of a large NSW crop and slashed lentils production back to 1.1MMT due to a poor harvest in SA.

Export Stem & Ocean Freight Market Update:

The Ocean Freight market has settled into this year’s Christmas Season relatively early. Rates have been drifting over past few weeks but for the most part have now stabilised. We are not anticipating any major movements (up or down) until 2025.

Panamaxes have been sluggish in both basins and while we did witness a brief mid-week push in the Atlantic it failed to materialise into anything of substance. The Pacific has struggled with little fresh cargo appearing in the market, but it does feel like a floor has finally been established with rates trending sideways for the most part.

The Supramax and Handysize sectors followed the same trend.

It’s been a relatively lean week for shipping stem additions. This included just 200KMT of wheat, 260KMT of barley, no canola and some chickpeas. Some wheat slots were switched to chickpeas. We will be watching for further possible changes in the weeks ahead.

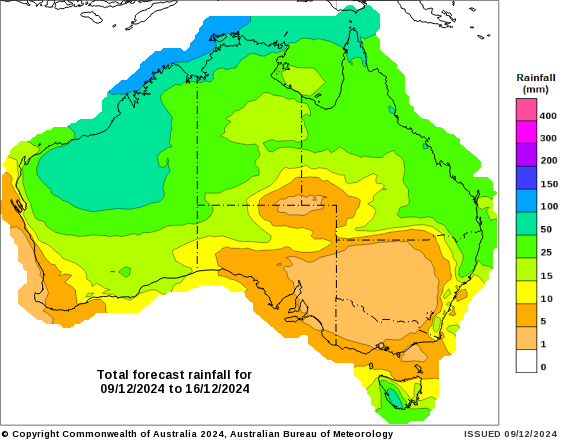

Australian Weather:

Over the next week there is little rain expected in the unharvested regions of the country, so farmers will focus on stripping the balance of the grain ahead of the Christmas period. Once the grain has been harvested, we will be in a better position to assess the overall damage of this rain event.

8 day forecast to 16th December 2024

http://www.bom.gov.au/

Weekly rainfall to 9 December 2024

http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to close the week when valued against the Greenback trading at 0.6372. The AUD/USD pair experienced significant weakness on Friday, sinking near its August lows after the release of the US Nonfarm Payrolls (NFP) report for November. On the data front last week, Australia's economy grew by 0.3 per cent in the September quarter, and 0.8 per cent over the year, according to the Australian Bureau of Statistics (ABS). Looking ahead this week and on Tuesday, the Reserve Bank of Australia (RBA) will have a monetary policy meeting. The central bank will announce its decision, and it is widely anticipated that interest rates will be kept on hold. The Official Cash Rate (OCR) has been steady at 4.35% since November 2023, when the RBA delivered its latest interest rate hike.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au