Australian Crop Update – Week 51, 2024

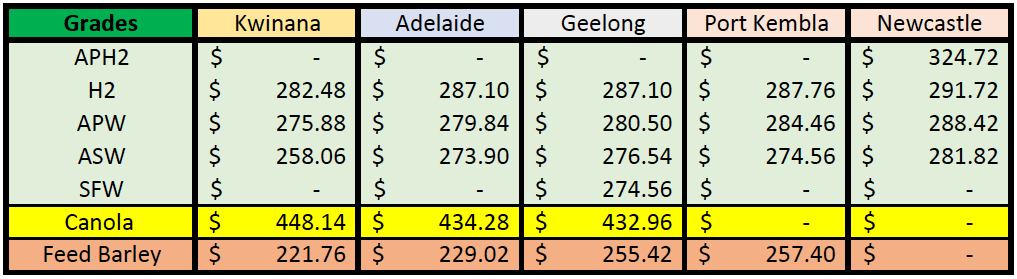

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

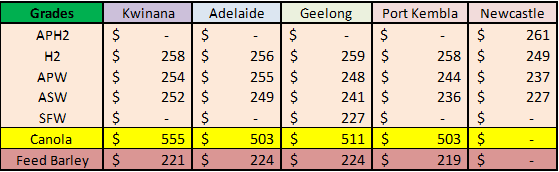

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian cash markets were softer in all zones and positions last week in the wind down to the Christmas and New Year break. Local markets progressively quietened through the week as traders exit the offices for the holiday period. Wheat was generally weaker across the east coast with exporters unwilling to chase supplies from the farmer given the difficulty of making overseas sales. East coast values are back to export competitive levels, particularly with AUD weakness, but farmer selling remains slow, so exporters are cautious. Australian wheat is competitive into Southeast Asia at these values. Overall, farmers are well sold on canola and pulses but undersold on wheat.

On the production front, late harvest grain deliveries in Western Australia (WA) have exceeded all expectations and warrant further crop increases. As of late in the week, WA deliveries were 19.3 million metric tonne (MMT) including >10.6 MMT of wheat, 5.1MMT of barley and 2.7MMT of canola. Australia’s winter crop production continues to climb, and a big crop is getting bigger.

Export Stem & Ocean Freight Market Update:

There was around 540 thousand metric tonne (KMT) of wheat added to the shipping stem in the past week, lifting the two-week tally to close to 1MMT. South Australia (SA) contributed more than 300KMT to last week’s wheat additions with around 230KMT in WA. Nothing was added in New South Wales (NSW) which further consolidates the slow start to the NSW wheat export program, despite the massive wheat harvest. Barley additions are moving ahead reasonably quickly with the Oct/Jan exports and stem already up to 2.3MMT.

As the freight market settles into the holiday period, activity levels have noticeably dried up in both the Atlantic and Pacific as expected.

Panamaxes in the Pacific experienced another tough week with rates continuing to slide. The underlying factor remains the imbalance between fresh demand hitting the market compared to the growing tonnage lists. With the low spot levels, it’s not surprising the lack of period fixing being concluded with owners not prepared to lock in any low rates for an extended time. In somewhat of a surprise, the Atlantic did witness a slight improvement in TransAtlantic levels off the back of more minerals demand appearing in the market. However, despite this uptick, we did not see any push on fronthaul trips which instead remained flat throughout the week.

The Supramax and Handysize markets have been following a similar path recently which is not expected to change in the short term. There has been no change in the fundamentals, and rates continue to gently ease. Looking forward, it is hard to see any genuine change in market conditions for the foreseeable future as many charterers and owners are taking the opportunity for a well-earned rest before getting ready to tackle 2025.

Australian Weather:

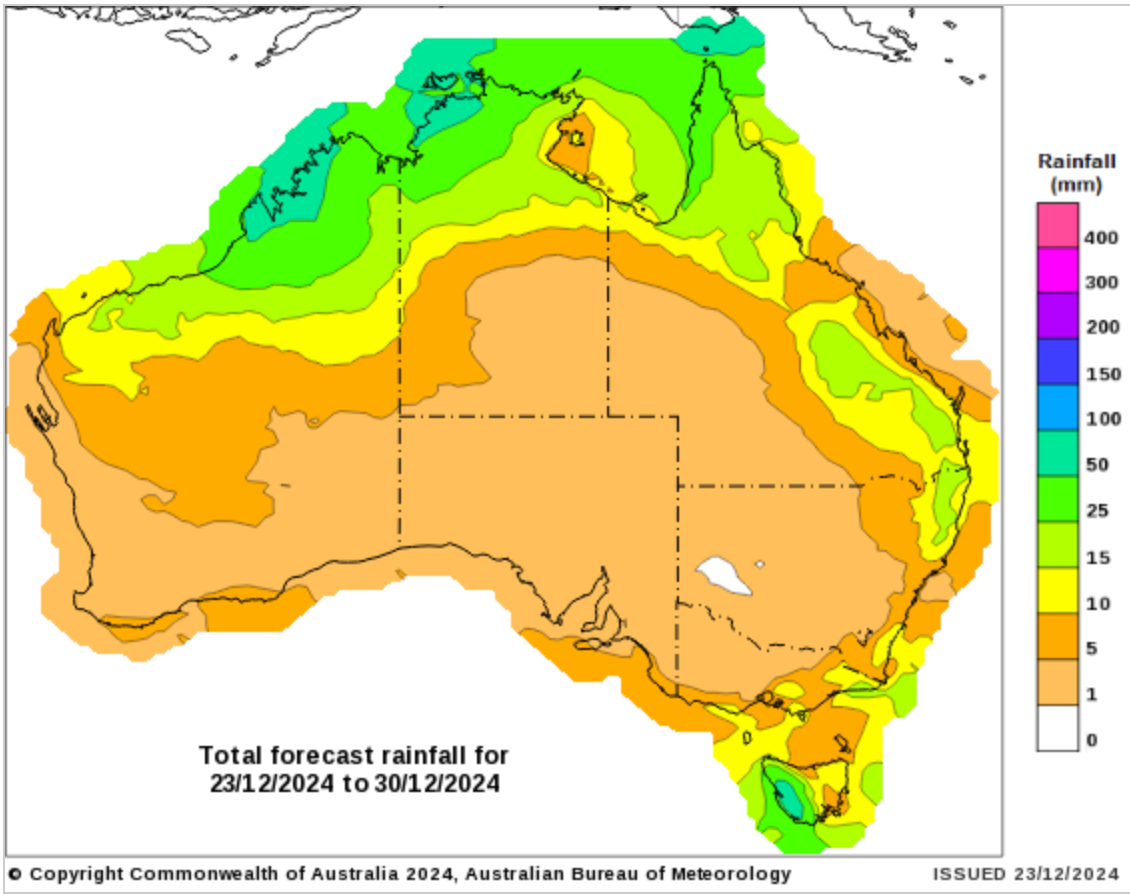

Limited rainfall is expected over the next week to ten days in Australia. Harvest pace has been maintained as many programs come to an end and the industry closes down for the Christmas break. Daytime temperatures in central and north Australia will remain extreme with temperatures reaching 41 to 45 degree in WA, Northern Territory and central Queensland.

8 day forecast to 30th December 2024

http://www.bom.gov.au/

Weekly rainfall to 23 December 2024

http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker again to finish last week when valued against the Greenback closing at 0.6250. The AUD continued its bearish outlook to close out 2024 with USD strength and uncertainty with the viability of the China economy. Expectations for the nearby are that the AUD will continue to be under pressure with resistance levels broken, impending Trump inauguration and the ramifications of tariffs and geopolitical pressures.

And that’s about it for 2024. We are going to take a break next week.

We wish those of you who are celebrating a very happy Christmas and New Year. May 2025 bring peace, health and prosperity to you all.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.