Australian Crop Update – Week 48, 2024

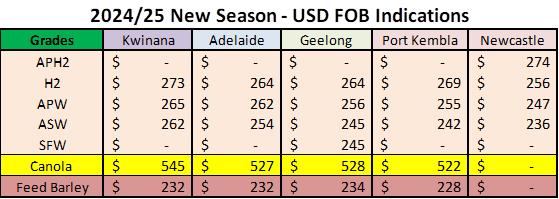

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Domestic markets softened over the past week with declines in global markets and as traders wait to see the impact of widespread rain on unharvested crops across eastern Australia. Globally, US wheat futures were 2% to 6% lower with KC futures the biggest loser. Corn was back 0.6% for the week while Canadian canola futures tumbled 3.5%. Matif rapeseed was only modestly lower for the week.

Locally, New South Wales (NSW) and Victoria (VIC) canola bids tumbled by around USD20 per metric tonne (/MT) or 3.5% while Western Australia (WA) Kwinana was only back USD3/MT or 0.6% for the week. Wheat and barley bids were up USD2-5/MT across most port zones as buyers scrambled for nearby supplies, particularly wheat. ASW was up USD6/MT as buyers are to better understand how much wheat was downgraded following the rain. There will be some, but we doubt it will be general across all areas. Weekly rainfall totals were lighter south with 17-25mm and heavier to the north with 50-80mm.

2024/2025 Harvest Update:

It is thought that greater than 80% of the NSW wheat crop has been harvested and around 40% of the VIC wheat crop. This means NSW has harvested >9.6 million metric tonne (MMT) of its forecast 12.0MMT wheat crop while VIC is around 1.5MMT harvested of its 3.6MMT crop. Therefore, NSW has about 2.0 to 2.5MMT of wheat exposed with downgrading and VIC still has about 2MMT yet to harvest. South Australia’s (SA) grain harvest is estimated to be 50% complete although it is thought that the crop could come in smaller than expected. WAs CBH total harvest deliveries is at 8.9MMT which is above 50% complete. It is estimated the WA wheat harvest is about 1/3 done, barley is around 2/3’s and canola are more than 90% complete. The WA wheat harvest has been mostly ASW.

Export Stem & Ocean Freight Market Update:

Meaningful additions to the shipping stem were seen last week with more than 1.1MMT of wheat, barley, canola and pulse nominations seen. This included 440 thousand metric tonne (KMT) of wheat (mostly WA), 300KMT plus of barley and 300KMT of canola. The canola stem is gathering pace with the stem additions climbing to 8 pts w/w to 36% of the export forecast. NSW is the most advanced of the canola exports at 52% of the forecast 600KMT. The 304KMT of barley additions was all WA. This saw the cumulative Oct/Sep stem additions increase to 28% (24% LW) of the forecast 5.5MMT. WA is 1.3MMT which is 38% of the forecast 3.4MMT. National wheat steam additions of 443KMT in the past week lifted the cumulative wheat stem additions to 3.4MMT which is 19% (+3% w/w) of the forecast 22.0MMT.

The ocean freight market began this week with positive sentiment off the back of the momentum at the end of last week. Many thought the pre-Christmas rush was going to eventuate, however by Tuesday it was clear this was incorrect. Momentum and optimism stalled and instead of the anticipated push, rates for Handies and Supra were stabilising. Demand was steady which helped activity levels remain healthy throughout the week, but the tonnage supply kept pace which put a ceiling on rates.

Handies on the Australian coast are fixing in the high teens for outbound trips for 37/38kdwt types and 2-3kpd less for smaller units. In Southeast Asia, pac rounds for large handies were concluding around 12500-13500 depending on cargo and redelivery while 28kdwt's have settled at around 10,000 for same. For non-Aussie traders there is a 1-2kpd discount for rounds. Fareast was under pressure again with a lack of fresh cargoes. Nopac rounds for 38kdwt types are fixing 11500/11750 sub spec/dely (abt $500-750 less than last week) while even steel runs to PG/WCI have reduced close to 12000 now.

Supras in the Fareast have settled to around 10000-11000 for nopac/pac rounds while in Southeast Asia they could achieve 11000-12000 for Indo or Aussie rounds. The MEG/India region continues to be under pressure with the amount of ships entering the region to discharge. In the Atlantic, we found the market to be active from USG and ESCA prior to the Thanksgiving holiday but ended on a quiet note as expected.

The Cont/Med markets struggled on all sizes as a distinct lack of fresh cargo appearing in the market to help stop the downward pressure on rates. Looking forward for the rest of 2024, the general sense is that the market will settle in both basins and likely trend sideways in Christmas.

Australian Weather:

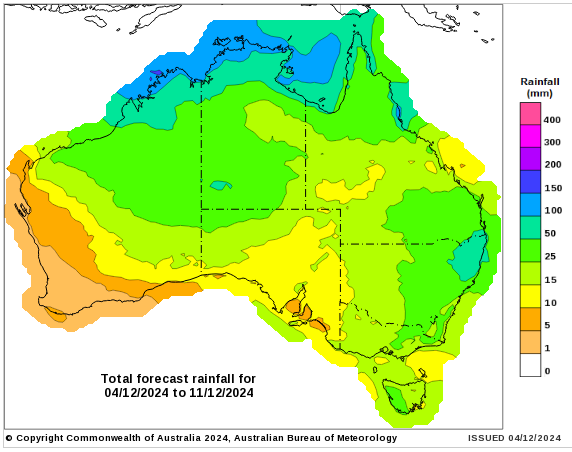

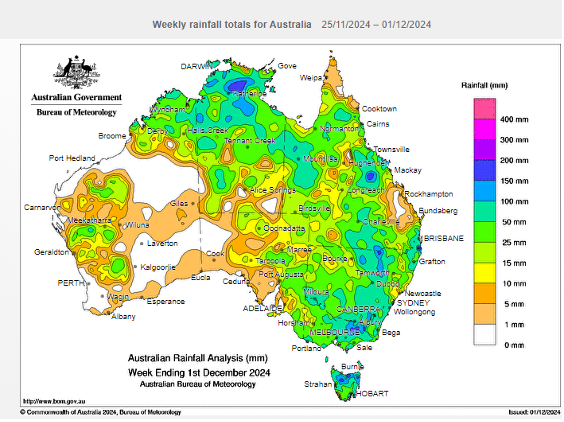

Widespread rain stalled grain harvest across NSW and VIC last week. NSW harvest is advanced with only about 20% of the crop or around 2MMT still to be cut with is mostly in the eastern cropping areas in the northern, central and southern slopes. These areas received 50-100mm last week which is expected to see a lot of the crop downgraded from milling quality. VIC also received general rain last week, but the wheat crop is still less than 50% harvested (about 2MMT unharvested). More stormy and unsettled weather is forecast for NSW and VIC this week. Most of the NSW cropping areas will see 10-20mm on Tuesday. VIC sees showers later in the week and showers are forecast to return to NSW on the weekend.

8 day forecast to 11th December 2024

http://www.bom.gov.au/

Weekly rainfall to 1 December 2024

http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar finished stronger last week when valued against the USD at 0.6504. The AUD/USD pair extended gains for the third straight day on Friday, although it has trimmed a portion of its intraday gains and holds above the 0.6500 psychological threshold. The pair recently reached a multi-day high before retracing some of its intraday gains. The positive momentum in the pair is influenced mainly by broad-based US dollar weakness.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au