Australian Crop Update – Week 49, 2023

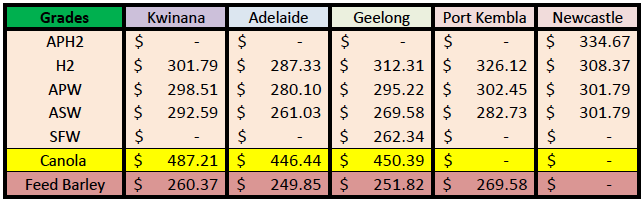

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

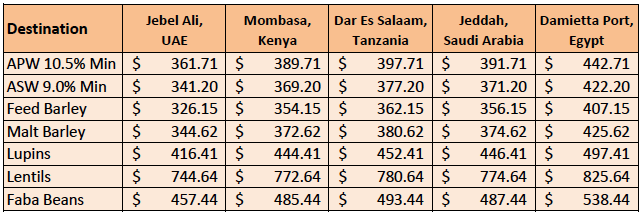

New Crop - CFR Container Indications PMT - LH January 24 Shipment

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

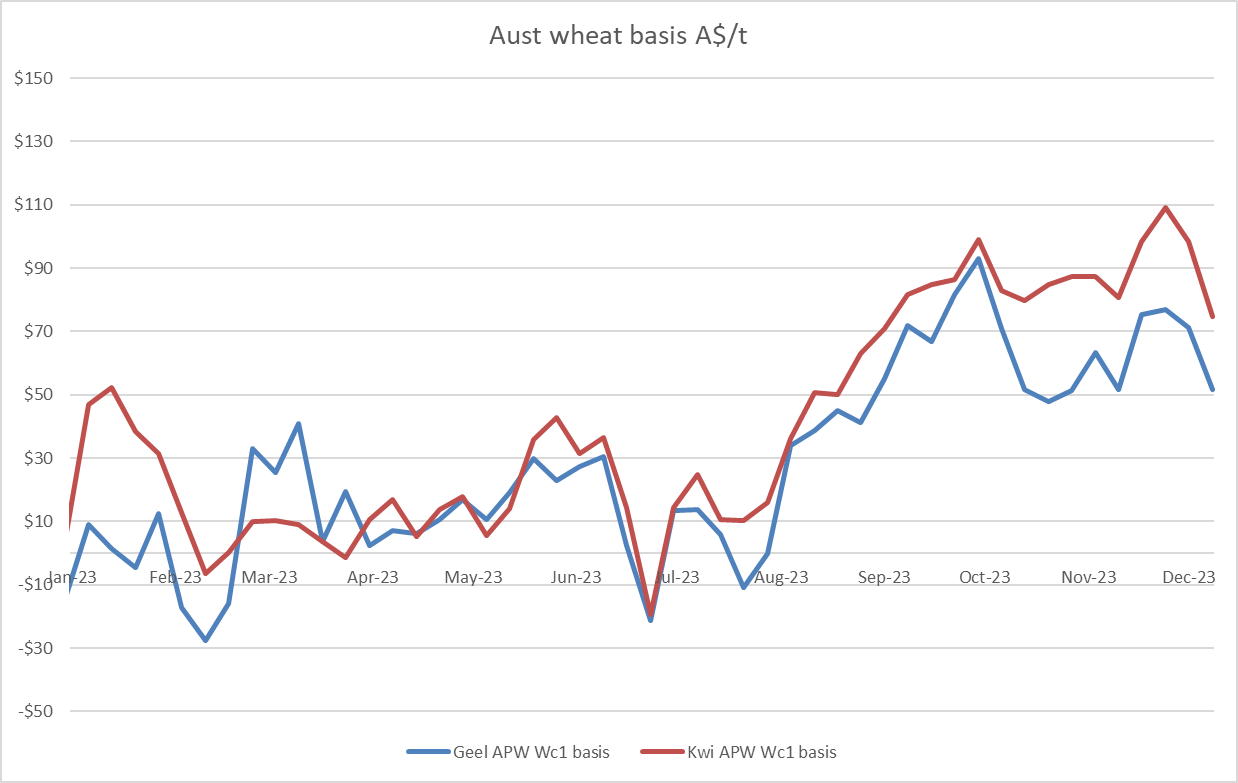

The Australian cash market remained relatively steady over the last week as traders and growers alike digested the impact of harvest rains. It is a pattern that we have flagged earlier in the season, i.e. value is being added / lost through cash basis with exporters reluctant to chase rallies in Chicago futures while they continue to struggle to connect with key Southeast Asian destinations.

Barley was steady with the softening on the AUD and Chinese demand still present for more Australian supplies, we hear at between 275 and 280 CFR China.

Canola bids were $15-20 per metric tonne (/MT) lower in line with further losses in Canadian futures.

Australia exported 1.42 million metric tonne (MMT) of wheat in October. China was the largest destination for the wheat exports in Oct with 270 thousand metric tonne (KMT) followed by Philippines with 161KMT, Indonesia with 153KMT and then Vietnam with 145KMT.

Australia exported 930KMT of barley in October which comprised of 713KMT of feed and 222KMT of malt barley. China took 668KMT with 128KMT sent as malting barley and the rest as feed.

There was 385KMT of canola exported in Oct. WA accounted for 260KMT and Vic accounted for 122KMT. France took 98KMT with Japan and Mexico the next largest with around 82KMT each.

Pulse exports are moving quickly with 103KMT of lentils shipped in Oct and 83KMT of chickpeas. India took 60% of the lentils. Pakistan was the main chickpea destination with 42KMT followed by the UAE with 20KMT.

Australian Harvest Update:

Australia’s 2023 winter crop harvest deliveries slowed significantly last week with rain across the eastern seaboard. There appears to be limited downgrades following last week’s rain with most traders reporting wheat is still making to milling grade. However, there was more rain received across the south in the last few days so it is likely we will see more downgrades and we are hearing some grain may have test weight issues. It’s been of little market consequence so far but has reinforced the bearish tonne in the north where feedlots and feeders are covered in the nearby positions and there are still some feed grains looking for domestic homes. We have also heard that some feed sales have been made into export markets.

In South Australia (SA) and Western Australia (WA) harvest will largely be wrapping up this week. There have been some delays in the Eyre Peninsula in SA due to rain and we will need to see if there are some downgrades in this zone.

Australian Pulses Update:

Chickpeas

- Queensland (QLD) is forecast to produce 320,000MT of chickpeas this year. This is an increase on both area and production from last year’s crop of 292,000MT. In New South Wales (NSW), a very dry pre-plant and growing season in the state’s north means a reduced area of 150,000ha has just been harvested to yield 165,000MT, with both figures below last year’s flood-affected crop of 160,000ha which yielded 192,000MT.

Faba beans

- A much drier growing season in SA has the state forecast to harvest 190,000MT down from a record 300,000MT. Victoria’s faba bean crop is forecast at 175,000MT. The harvest of faba beans in both states is well advanced, and is over in QLD, NSW and WA. Unharvested fabas which suffered significant rain damage are likely to go into the domestic feed market, as they did during last year’s wet harvest.

Lentils

- Lentil production in SA is predicted at 715,000MT. This will not get close to challenging last year’s record production of 900,. Victoria’s lentil crop is estimated at 650,000MT. The lentil harvest is well advanced in both states, but unharvested lentils in Victoria particularly have suffered some downgrading after last week’s rain.

Lupins

– WA is forecast to produce 380,000MT down from 925,000MT.

Ocean Freight & Shipment Stem Update:

There has been more volatile activity this week especially in the Atlantic basin. It feels like the freight market has peaked for panamax / supramax. As we commented last week, the inefficiencies of the present Panama Canal situation are generating ton-mile demand but also preventing a quick re-balancing of the oceans.

Shipping stem additions are starting to move along at a reasonable pace following a sluggish start. There was 460KMT of wheat, 327KMT of barley and 120KMT of canola added to the stem in the past week. The additions show that sales are moving along well but it also flags supplies could quickly tighten against shipping positions, particularly if farmer selling remains sluggish. Barley appears to have the greatest risk given Chinese demand is reportedly still there at around $275 c&f levels.

Australian Weather:

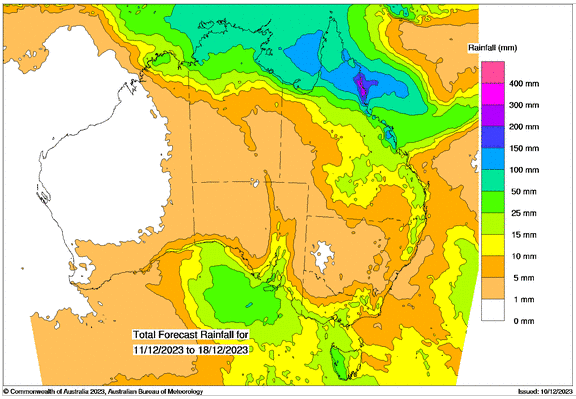

There is little rain in the forecast over the next 7-10 days with the harvest reaching its final stages in the south. Harvest will conclude earlier than normal this year with an earlier plant, smaller crop and quicker harvesting machinery. There is a tropical cyclone in the north east of Australia that has been downgraded to a category 1 cyclone. This will not affect harvest but promote more rainfall for the summer crop which is off to a good start.

8 day forecast to 18th December 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 11th December 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The AUD was slightly weaker to open the week when valued against the USD. The downward movement can primarily be attributed to robust American labor market data, coupled with escalating U.S. yields, which drove demand for the USD against other currencies. From a technical perspective, support for the Aussie dollar remains at 0.6590. Last week the Australian borrowers were spared a pre-Christmas interest rate rise with the Reserve Bank remaining on hold at its final board meeting of 2023. The RBA left its cash rate at 4.35%, a move widely expected by financial markets and economists after the inflation rate resumed its slowdown in October to 4.9% and the jobless rate ticked higher.

WASDE Summary:

The final WASDE report for the year was released on Friday. Global production was increased by an additional 1MMT to 783.01MMT, with Australia accounting for the bulk of this increase.The oilseed production outlook for 2023/24 is projected at 661.0 MMT, down 0.5MMT from last month. Lower soybean and sunflower seed production are partly offset by higher rapeseed production. Global coarse grain production for 2023/24 is forecast 2.7MMT higher. The 2023/24 foreign coarse grain outlook is for larger production, increased trade, and higher ending stocks relative to last month.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au