Australian Crop Update – Week 48, 2023

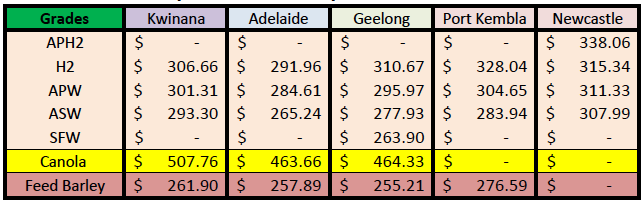

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

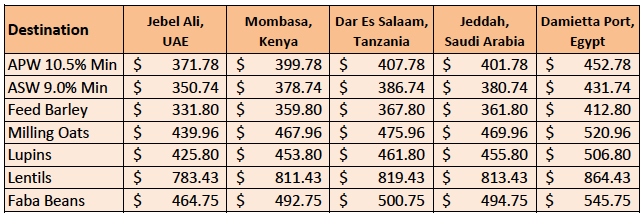

New Crop - CFR Container Indications PMT - LH January 24 Shipment

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Australian domestic markets remained quiet last week as rain interrupted the grain harvest across Victoria (VIC) and New South Wales (NSW). The rain has paralysed markets in southeastern Australia with farmers and buyers waiting to see how the grain quality has been affected. Recent rain in the north is helping to keep the northern markets softer as farmers work on planting a summer crop.

Local cash markets have remained at similar levels for several weeks with exporters having already committed large wheat and barley sales to China. Exporters will be reluctant to make additional sales without improved farmer selling which is not forthcoming at the moment.. The offshore market appears to show an uptick in buying interest from Southeast Asian destinations as northern hemisphere logistics problems grow. Traders are reporting that China is still seeking more Australian barley offers at current values but there is a stand-off with growers who know the export trade is relatively short.

Australian Harvest Update:

It is estimated that the national harvest is approximately 80% complete. VIC is the only state that is behind the harvest pace after a generally favourable season and rain over the past seven days. It is expected that harvest in South Australia (SA) and Western Australia (WA) will finish within the next 7-10 days. Overall, the crop has largely come in as expected however forecasters expect that the national wheat harvest will finish at around 25 million metric tonnes (MMT).

In terms of quality concerns caused by the rain interruptions in the last week, our sense is they are limited. Maybe some test weight issues but nothing major at this stage that will materially affect the overall availability of milling wheat this year.

ABARES Agricultural Outlook:

ABARES released their last quarterly outlook of the year and forecast wheat production to fall by 37% to 25.5MMT, 4% below the 10-year average. This is an upward revision from the September forecast. Barley production is forecast to fall by 24% to 10.8MMT, 4% below the 10-year average. This is an upward revision from the September forecast. Canola production is forecast to fall by 33% to 5.5MMT but remains well above the 10-year average on account of area planted estimated to be the second highest on record. This is an upward revision from the September forecast.

To set in context, the total winter crop production is forecast to be 46.1MMT, which is the fifth largest in history!

Australia's five major winter pulse crops

are forecast to produce 3.17MMT. The figure for the crops now being harvested is up 7% from the 2.96MMT forecast in the previous quarterly report released in September. The current crop however is forecast to be 26% smaller than last year’s, with smaller lupin and lentil crops accounting for much of the difference.

Australia’s chickpea, lupin and field pea harvests are pretty much over. Unfortunately, the lentil and faba bean harvests are closer to halfway through and are being affected by the recent rain events. Roughly one-third of faba bean and lentil crops in SA and VIC remain unharvested, and patchy rain, storms and some hail will impact yield and quality in paddocks that were soaked.

Ocean Freight & Shipment Stem Update:

The ocean freight market awoke from its dull and boring mood with global ocean fright rates moving sharply higher in the past two weeks with the Baltic Dry Index 25% reaching an 18-month high. The Atlantic basin is leading the way with the Pacific slightly less impressive, but still firm. The culprits are clear. Strong demand from East Coast South America (ECSA) grain ports and consequent congestion, strong imports of coal to China the ongoing restrictions at the Panama Canal are all reducing the amount of dwt available to be fixed. It's the major bulk commodities that are transported in larger ultramax/panamax and cape tonnage which are the biggest movers and shakers - hence the larger ships are the ones where the effect is most keenly felt. Handies have not taken off to the same extent though. In the Atlantic, they are starting to see substitution demand as larger stems get split/downsized. Tonnage is being drawn from the Middle East and India into the Atlantic basin. The big question is how long this is going to last. Are we seeing the pre-seasonal holidays rush or does this have more solid foundations? Forward paper suggests we have a little way more to go in December, but we are still getting the "shelf" effect for January where numbers tumble.

There was 932 thousdan metric tonne (KMT) of wheat, barley and canola put on the stem in the past week which was similar to the previous week. This included 610KMT of wheat which is the largest in three months. WA accounted for more than half of the weekly wheat additions. It is expected that a lot of the wheat on the stem will be heading to China. There was also 100KMT added in NSW which included 50KMT of durum wheat. There was 205KMT of canola put on the stem in the past week and 117KMT of barley.

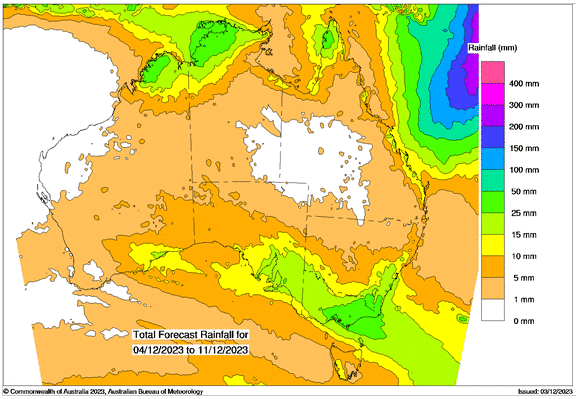

Australian Weather:

8 day forecast to 11th December 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 4th December 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar (AUD) was slightly stronger to open the week when valued against USD. In Friday's trading session, the AUD found demand against its US counterpart, with the AUD/USD pair making gains and trading at around 0.6650 before falling back yesterday when the Reserve Bank of Australia (RBA) kept interest rates on hold into the New Year on the back of easing inflation data.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.