Australian Crop Update – Week 50, 2023

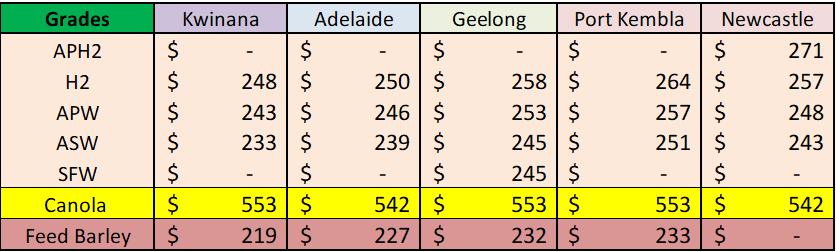

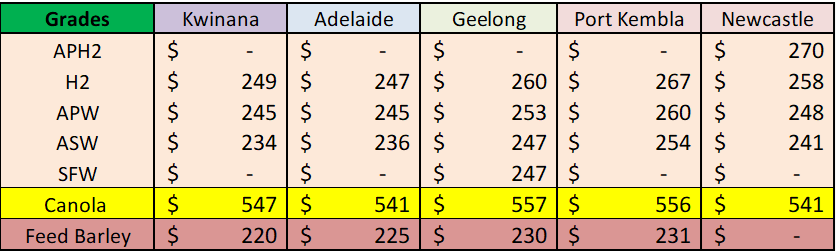

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

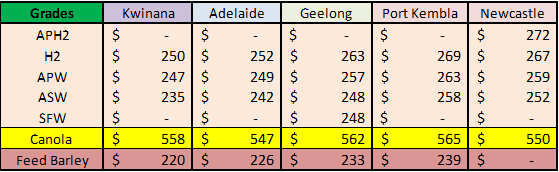

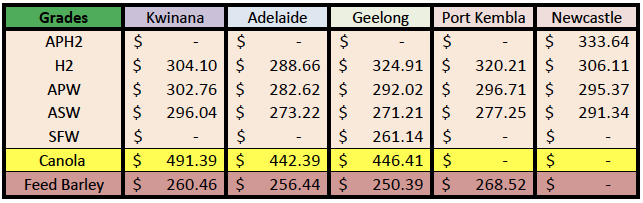

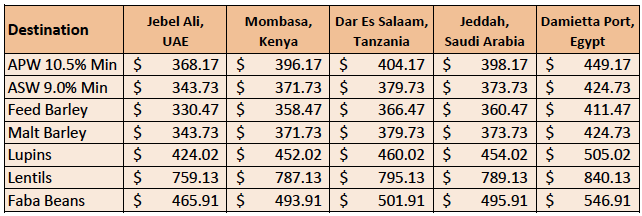

New Crop - CFR Container Indications PMT - LH January 24 Shipment

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

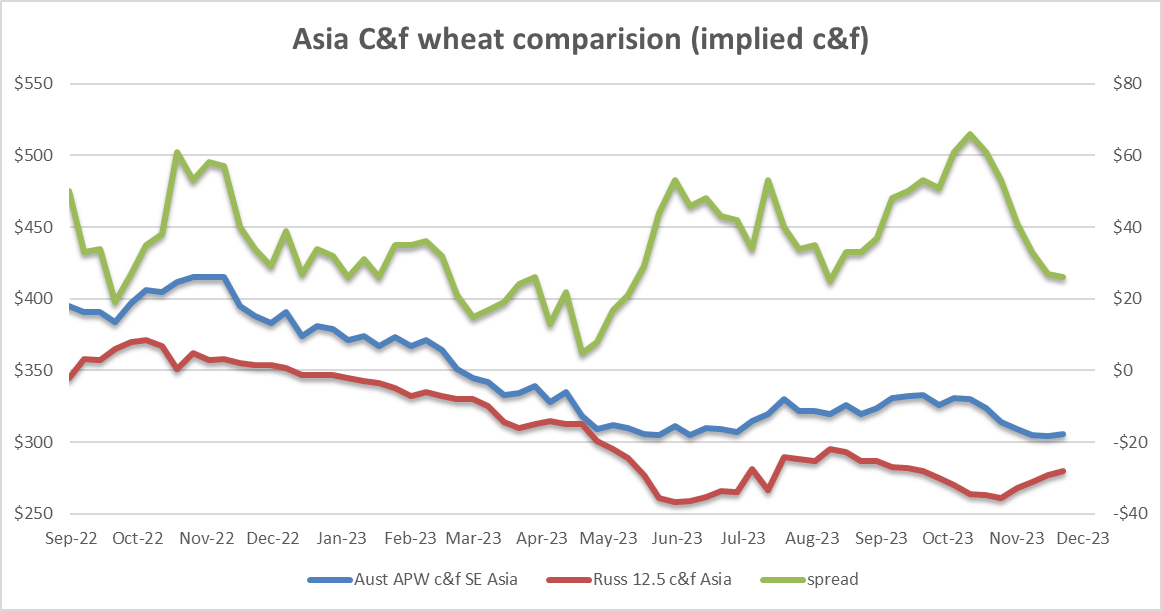

A stronger AUD increased Aussie wheat values at the FOB point at a time when, for a variety of reasons, global cash values seem to be strengthening slightly.

The 2023/24 S&D updates for the national wheat and barley production estimates are being updated following the harvest receival data and anecdotal feedback. Our analysts latest view will be published later this week.

The overall impact for national wheat and barley production is little changed where Australian wheat production for the season is at 25.1 million metric tonnes (MMT) and barley at 10.0MMT. Sizable carry in wheat and barley supplies in Western Australia (WA), South Australia (SA) and Victoria (VIC) will help with the export surplus for the 2023/24 season. The estimates show a national wheat carry in at 5.1MMT and barley at 2.9MMT.

The market is forecasting Australia’s 2023/24 wheat exports at 18.6MMT and barley at 6.4MMT. Exporters have already committed large volumes of wheat and barley to China, as well as other routine markets in Asia so we are not predicting too much will make its way to the Middle East this year. It is estimated that more than 70 percent of the 6.4MMT of barley exports are already sold or committed through long term arrangements. Wheat export commitments are expected to be less advanced than barley with most consumers still buying on a hand to mouth basis and the grower a reluctant seller.

Quality has in general held up well despite the late harvest rains in SA and WA, which has reversed the low protein trend of last year with significant amounts of Australian Hard and APW being delivered.

Australian Harvest Update:

Australian Pulses Update:

Rainfall in SA and VIC has caught the tail end of Australia’s faba bean, lentil, field pea and lupin harvest. The majority of crops were harvested ahead of the rain, with quality and yields generally good. Supply-side pressure from pulses sold directly after harvest has dwindled as growers wait to get a better quality picture after recent rain and storms which have caused some downgrading and yield losses. The upside of the recent rain is that it has bolstered planting and establishment prospects for mungbeans, Australia’s main summer pulse.

Chickpeas

- The chickpea harvest finished last month in the key growing regions of Queensland (QLD) and northern New South Wales (NSW). ABARES last week revised its estimate for the crop to 528,000MT, down 5000MT from its September estimate. Shipping stems indicate a maximum of three handymax cargoes will depart QLD ports by mid-January to arrive in South Asia ahead of the start of Ramadan on March 10. Container rates have fallen to levels where they are competing with bulk.

Faba beans

- ABARES last week revised its estimate for current-crop fabas to 484,000MT, up from the 447,229MT seen in September. SA and VIC grow the vast majority of Australia’s faba beans for export, and both states have had considerable rain in the last quarter or so of their crop to be harvested. Beans that are still in the field are unlikely to make export specs, and will go into the domestic stockfeed market. Growers with crop left to harvest are concentrating their efforts on cereals to minimise their risk of downgrading. Egyptian demand for fabas is steady, but near-term shipments from Australia are limited as other commodities book out loading slots. These delays, limited selling and steady demand have put good support under the faba market.

Lentils

- ABARES last week lifted its estimate for the current lentil crop to 1.39MMT from 1.23MMT previously, and less than one third is believed to have been sold by growers. India accounts for around 60pc of Australia’s exports, and this percentage is expected to lift as currency issues beset other South Asian destinations. Lentils prices are trading sideways for now with the quality generally good.

Ocean Freight & Shipment Stem Update:

There was 507 (KMT) of wheat, 115KMT of canola and 97KMT of barley added to the stem in the past week. The most notable feature is that wheat is now being added more readily in recent weeks.

Ocean freight is now being affected by disruption to the Suez and Panama Canal transit routes. This will generate significant additional tonne/mile demand at a time when other parts of the freight market are slowing down for the global holiday season (Christmas and then Chinese New Year). The Atlantic remains very firm compared to the Pacific even if the daily Baltic indices have shown a falling market on routes in that basin. Front-hauls are generating significant numbers at $25kpd (and USG origins significantly more than that) on Panamax and Supramax. Australia is heading into holiday mode with not much happening in the way of fresh cargoes.

Over the past weeks, we have seen further escalation of piracy in the Red Sea causing owners and container carriers to pull out of the trade lane. If the Yemen situation cannot be managed in the near term, we could see an anti-seasonal escalation in freight rates for this region and this does need to be borne in mind along with raised insurance rates for the Red Sea region.

Australian Weather:

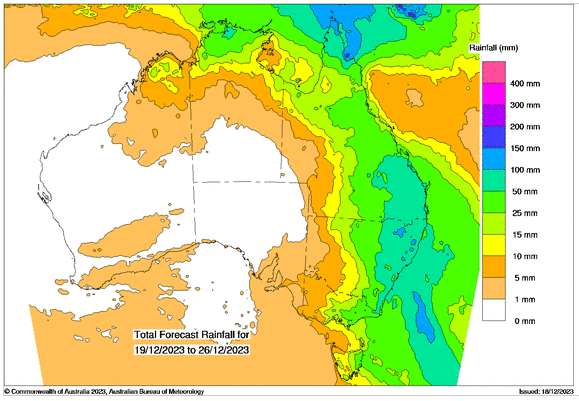

Some of the heaviest rain ever observed in Australia has hit Queensland’s North Tropical Coast during the last few days, resulting in widespread major flooding and landslips. Rainfall has been relentless over northeast Queensland ever since Tropical Cyclone Jasper made landfall on Wednesday, December 13. This 5-day spell of wet weather was exacerbated over the weekend by a slow-moving coastal trough being fed by a persistent stream of tropical moisture. Provisional data collected by Bureau of Meteorology rain gauges shows that two locations in Queensland may have just received the 3rd and 4th highest daily rainfall on record in Australia. There were also four locations that beat the previous national daily record for December. There has been more than 500 mm of rainfall over the weekend with some areas reporting up to 800 mm causing widespread flooding and damage.

Needless to say, all this rain stands in contrast to the Bureau of Meteorology forecast for a long, hot, dry summer but then who would be a weather forecaster anyway. For what it's worth, they are predicting warmer temperatures for January and February so watch this space.

8 day forecast to 26th December 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 18th December 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The AUD did not lift after the USD fell last week and that lack of response by AUD/USD suggests it is facing resistance near 0.6700 level. Predictions of the major banks have shifted to being more conservative for the forecast into 2024. Two of Australia’s major banks, NAB and CBA, have commented that the AUD is likely to remain rangebound over the next 3-6 months between .6500 to .6700 cents.

Merry Christmas and Happy New Year from the Basis Commodities team.

As we wrap up for 2023, we’d like to wish you, your families and loved ones a very Merry Christmas and Happy New Year. For those who celebrate at this time of year, we hope you all enjoy the festive period and have time to relax with family and friends. We look forward to working with you in the new year and beyond.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.