Australian Crop Update – Week 47, 2024

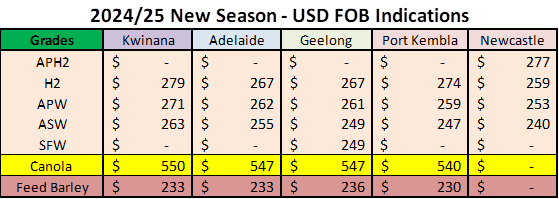

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Domestic markets finished the week mixed, with buyers focused on the harvest and available supplies to meet nearby requirements. Western Australia (WA) APW wheat bounced higher USD10-15 per metric tonne (/MT) through the week on exporter short covering as the harvest slowed with rain and the lower protein profile of harvest receivals to date. East Coast feed wheat values continue to strengthen on limited supplies of ASW in the north and Victorian (VIC) wheat and barley also edged higher ahead of forecast rain in the week ahead. Global inputs for wheat were mildly supportive. US wheat futures were 1.5-2.5% higher but this was partially offset by a 0.7% increase in the value of the AUD. Canadian canola and EU rapeseed were sharply lower last week as investors slashed long positions in canola and vege-oil markets which look overheated compared to other ag commodities. The sharp declines in canola and rapeseed resulted in sharp declines in the local Australian markets.

Overall, the crop is coming in as expected which has buyers comfortable on the total crop size of around 31 million metric tonne (MMT) for wheat, but slow farmer selling, and the weather delayed harvest is keeping values supported. This was evident in WA, when APW bids jumped USD10-15/MT last week. It appears that exporters have sold some reasonable volumes of wheat and barley for shipment over Dec/Jan/Feb with most of the wheat and barley expected to go to China. However, other destinations have also been buying. Overall sales volumes into China are sharply lower than this time last year but still sizable. Global markets remain very competitive with Argentinean wheat now the cheapest milling wheat in the world at around $220 FOB. Stiff competition means that exporter prices must be sharp to make sales into Asia and other markets.

Australian Pulses Update:

Chickpea markets were weaker for most of the week with nearby vessel accumulations in Brisbane and Newcastle being well covered. The rainfall during the week slowed harvest across New South Wales (NSW) with northern NSW having approximately 15% remaining to be harvested and Central West NSW 50%. There was a pickup in market activity on Friday as further bulk demand started flowing through to the interior. The strong demand has meant that there is now a vessel being accumulated for out of Melbourne due to the tightness of shipping capacity in NSW and Queensland (QLD) prior to Christmas and the larger than usual production in northern Port Kembla zone that can be trucked/railed to Melbourne. This provided a strong bid in Central NSW which growers are selling while the opportunity presents. It feels further business may have been done out of Newcastle and Brisbane as bids reappeared late in the week. The faba bean market continues to rally strongly with Southern NSW harvest underway. Quality is mixed with reports of bug damage, but yields are good. Bids for bulk accumulations were $30AUD higher on the week with one accumulator finishing their coverage while another steps up to the plate. Lentil harvest is underway in VIC and South Australia (SA) with yields coming in better than expected albeit from low expectations to being with.

2024/2025 Harvest Update:

Grain harvest is progressing, although wet weather slowed progress in some areas. NSW grain harvest is about 60% complete. Grain harvest in northern NSW slowed last week but is now moving ahead quickly in the state’s Central West and southern NSW. Unsettled weather and high winds also slowed progress in some areas. Harvest is wrapping up in QLD. Harvest activity picked up in VIC and SA however progress was slowed by unsettled weather. Grain harvest activity ramped up last week in WA ahead of forecast rain this week with growers making the most of ideal harvesting conditions ahead of the forecast rain. It is estimated that WA overall grain harvest is approximately 40% complete. However, canola is about 80%, barley 60% and wheat around 25% through. Barley quality is improving as the southern harvest picks up with more malting barley deliveries.

Export Stem & Ocean Freight Market Update:

It has been another steady week for shipping stem additions for the new season. There were steady additions for wheat, barley canola and pulses, but it’s clear that exporters are having to work hard for sales to keep the grain pipelines moving. There has been 419 thousand metric tonne (KMT) of wheat put onto the stem in the past week, 164KMT of barley, 75KMT of canola as well as more chickpeas.

Another subdued start to the week as we saw rates continue to drift in the Pacific. However, by Friday the sentiment began to shift with signs the market has stabilised and possibly ready to push. Aussie looks busy on handies for first half December laycans which is having a positive flow-on effect into Southeast Asia where owners are starting to ask better than last done levels. Large/nice spec handies are back aiming in the $14k's and charterers are willing in the $13k's for Aussie/Pac rounds. Far East is still lagging for handies however large units can still achieve $13/14kpd if willing India/PG direction, otherwise will have to settle in the $12k's for short jogs or southbound trips. Supra/Ultra has followed a similar trend. The S2 route index (Pacific round) was green for the first time in a few weeks and has coincided with a change in owners sentiment. We are yet to see any meaningful change in TC rates as Ultra in Southeast Asia are still fixing $13/14k for rounds while in far east, rates have settled around $11/12k for same but we are expecting an upwards shift over the next week or so. By contrast, rates in the Atlantic felt the pressure all week on all sectors. ECSA and Cont/Med has been quiet with a lack of fresh cargo appearing. USG was the outlier in terms of being active with a few fresh orders appearing, however due to growing tonnage supply, the rates weren’t able to hold ground and eased. There is pessimistic outlook in the Atlantic currently, so we are not expecting any uptick in rates for the next week or so.

Australian Weather:

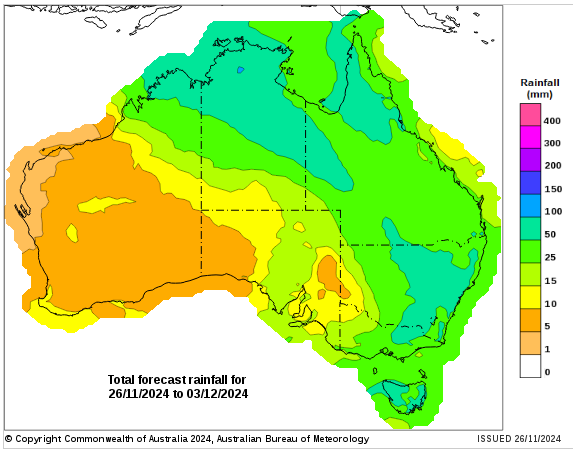

Wet weather in Australia slowed harvest across all zones last week. Warmer temperatures assisted to burn off moisture to ensure delays were not too concerning or downgrading of the crops. Over the next week, the eastern states of Australia are expected to see between 25-50mm of total rainfall from Thursday onwards so growers will be focussing on a huge week of harvest to ensure they get the crops off ahead of another series of delays. Both SA and WA should have a relatively delay free week with minimal rainfall forecast for the next 7-10 days.

8 day forecast to 3rd December 20024

http://www.bom.gov.au/

Weekly rainfall to 25 November 2024

http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar finished the week firmer when valued against the USD at 0.6520. The AUD/USD pair recovered more than half of its intraday losses throughout Friday after the RBA held interest rates to close out the year finalising the current cash rate of 4.35%. The peak rate of 4.35% is lower than in many other economies in part because the RBA determined that borrowers would be feeling the rate pain more quickly than elsewhere given the prominence of variable-rate mortgages.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.