Australian Crop Update – Week 47, 2023

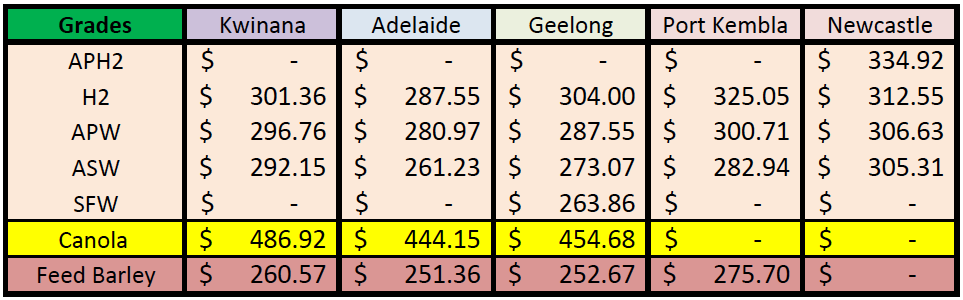

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT - LH Dec/Jan Shipment

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

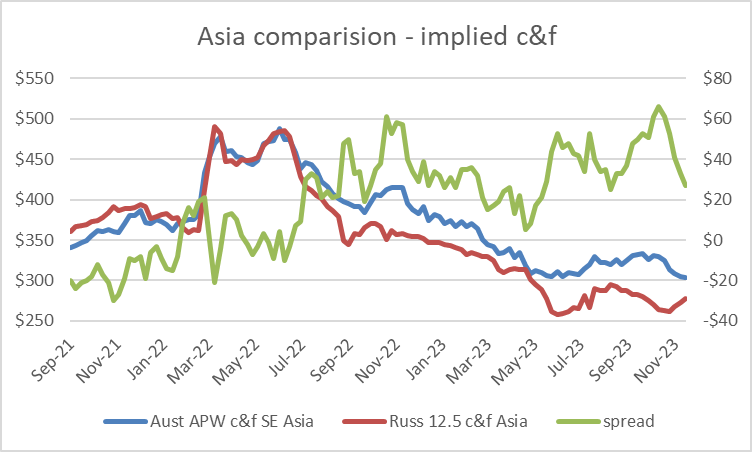

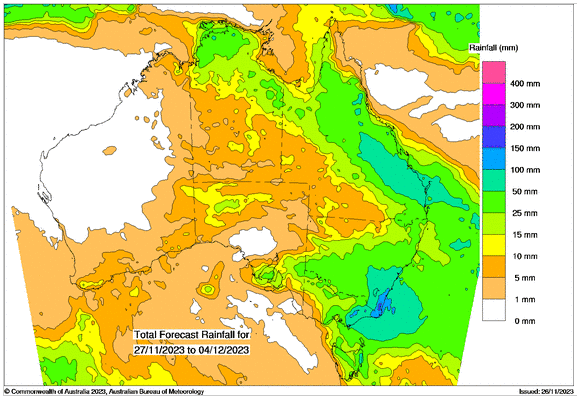

Australian grain prices were variable last week depending on the port zone. The East Coast focus was on the widespread rain stretching from Queensland (QLD) through New South Wales (NSW) and into Victoria (VIC). The market is settling into the impact the rain will have on pasture availability in the north and associated feed-grain demand, grain quality, farmer selling and trade shorts which are undoubtedly more comfortable now.

VIC is the only state that is still exposed on grain quality as harvest is not yet in full swing. VIC grain markets were generally softer last week with traders showing limited concern, although this may change this week with the additional rain. A lot of the barley and canola has already been harvested and quality was good, but they are only just starting wheat in the southern Mallee and Wimmera. Harvesting was interrupted by rain late last week and could be 10 or more days before farmers restart with the wet weather expected to continue this week. The market in general however on the east was down 2-3% for the week on the back of the solid rainfall.

To that end, farmers in Northern NSW have been actively planting sorghum in recent weeks. New crop sorghum values tumbled with the rain, and this also weighed on broader grain prices in the north. Cottonseed prices have also fallen in response to the rain on expectations the supplementary feeding of cattle will decline. The rain has seen a bottoming in livestock prices. Cattle prices have bounced with the rain on expectations of improved pasture reserves.

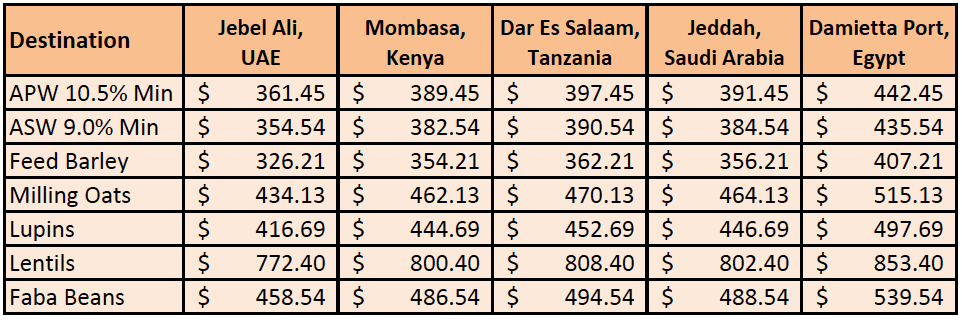

Western Australia (WA) wheat prices ended the week higher with most grades up USD4-6 per metric tonne (/MT) for the week on the back of, it seems a surge in Southeast Asian demand caused by the rain concerns in the east and storm damage, reduced logistics/higher prices out of the Black Sea.

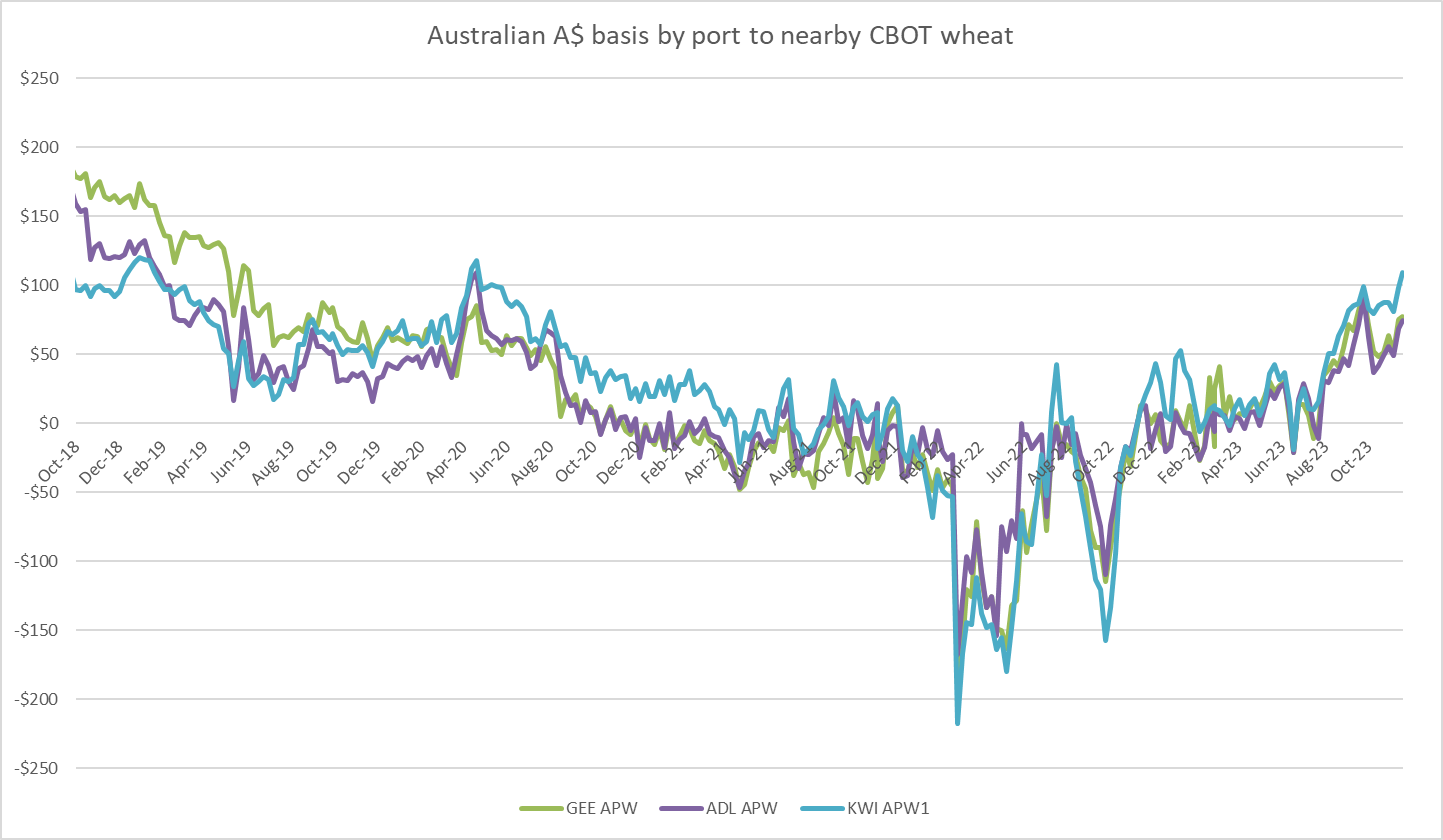

Australian wheat remains expensive against Black Sea supplies landed into Southeast Asian destinations, but the difference is smaller than it has been for months due to stronger freight and higher FOB prices in the Black Sea. WA barley and canola bids ended the week lower.

Interestingly much has been made of the dominance of China in the export program this year. In discussions with our analyst, it would seem to us that the Barley export program is extremely well advanced for this early in the year with perhaps as much as 4.5 million metric tonne (MMT) already sold, particularly when you include malt sales, out of a total likely program of 6.4MMT give or take.

Wheat – has a lot more work to do both in terms of grower selling and export pace. Patience will be a virtue with this crop.

Ocean Freight & Shipment Stem Update:

There was 951 thousand metric tonnes (KMT) of wheat, barley and canola added to the Australian shipping stem in the past week. Barley accounted for 409KMT followed by wheat with 387KMT and 155KMT of canola.

In terms of Ocean freight, we continue to see values firm driven by strong Atlantic demand and the Panama Canal problem. Only 31 vessels a day are now being let through….

In general, it looks like we are in for a strong finish to the year for ccean freight in general. Although Asia remains relatively quiet.

Australian Weather &

Harvest Update:

Last week, VIC received 50-70mm of rainfall with more falling yesterday and today. The rain impacted any opportunity for harvest and will also affect harvesting in Southern NSW. The rain is raising questions over the quality of the VIC wheat and pulses crop as well as concerns for export accumulation for logistics and farmer selling. A lot of the barley and canola has already been harvested with good quality but concerns have been voiced for the lentils and fava beans crop. The VIC barley harvest is advanced (>50%), but the wheat harvest is still less than 20% complete. VIC grain quality has been good so far with heavy test weights although wheat proteins are down. If the rainfall slows down the harvest until the start of December, the grain quality will likely lower.

Northern NSW also received soaking rain in the past week with 40-70mm across the region. This included the summer cropping regions central and north of the state. Southern QLD also received good falls for the week with 40-60mm. The national wheat harvest is over 50% complete now with VIC the only state exposed to any significant weather downgrading. The national barley and canola harvest is >75% complete.

8 day forecast to

4th December 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to

27th November 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar edged higher through trade to close last week pushing back above US$0.65 amid an improvement in the underlying risk narrative. US equities and risk assets advanced as market expectations for a retracement in US rate hikes through the second half of 2024 grow. Falling global bond yields and rising expectations for rate cuts have forced the USD to give up its highs against a basket of currencies won in October, opening the door for the AUD to rally back above US$0.65. The question now is, can the AUD recovery be sustained and extended while the global growth outlook remains unclear and China’s recovery uncertain. The market remains balanced in answering this question.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.