Australian Crop Update – Week 47

Harvest and Weather Update

ASX wheat futures rocketed up to AUD $425 on Tuesday as traders scramble to cover nearby milling wheat shorts amid the threat that a significant proportion of the NSW wheat harvest could be downgraded. East coast ASX wheat futures are now up nearly AUD $100 since late October as wet weather stalls east coast harvest activity and jeopardises grain quality. The situation is starting to look reminiscent of 2010/11 when a large proportion of the east coast wheat harvest was downgraded to feed quality following a wet harvest.

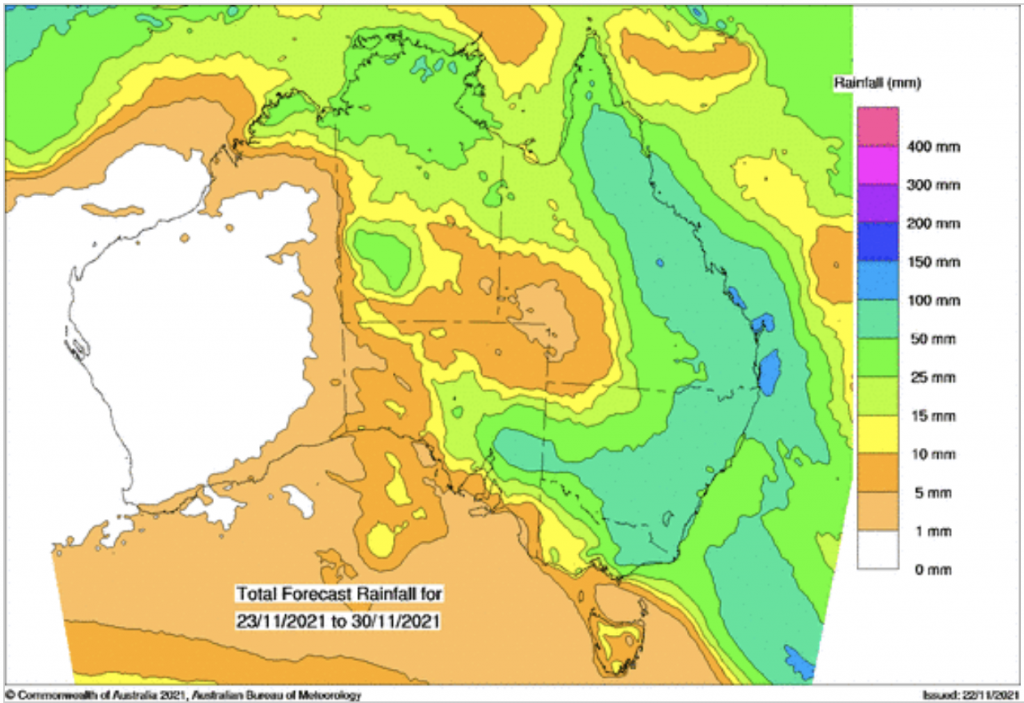

New South Wales grain harvest is still less than a third complete. At this stage our analysts feel 1-2MMT of the New South Wales wheat crop is already downgraded and the 30-60mm of rain forecast for the remainder of the week could more than double this. For the moment, Victoria, South Australia and Western Australia are avoiding the excessive rain.

In Western Australia, barley and canola are still making up the bulk of the WA deliveries but wheat deliveries are starting to climb as harvest picks up. Wheat proteins remain lower than normal which is likely to push more export sales into feed markets like the Philippines as well as making it difficult to meet the specs needed for milling wheat destinations, which require higher protein.

On the cash markets, quality milling wheat premiums have rocketed, while low quality bids have tumbled in the absence of mid protein wheat which typically makes up the bulk of exports heading into overseas markets. The abundance of low protein wheat adds further complexity to the global market which is already extremely short mid protein wheat supplies.

The latest run of the weather models has 20-60mm for Mon/Fri for Northern New South Wales and 30-80mm for Southern New South Wales. South Australia and Victoria should see lighter falls.

Ocean Freight

The freight market continued its negative path with Chinese demand almost completely absent from the market, which is really underpinning the present freight market malaise. Our feeling is the market is getting temporary support here, but Chinese demand will continue to be muted until after Beijing Winter Olympics which is set for February.

Currency – AUD

Last week the Australian dollar was hampered by a flight to risk aversion and a stronger greenback, closing a full cent lower from where it began the week. The greenback remained bullish, supported by a more hawkish Federal Reserve. This was led by expectations that two interest rate hikes are now expected in 2022. The Australian federal reserve was more dovish, suggesting they didn’t see interest rates needing to rise until 2024.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below

The post Australian Crop Update – Week 47 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.