Australian Crop Update – Week 48

Harvest and Weather Update

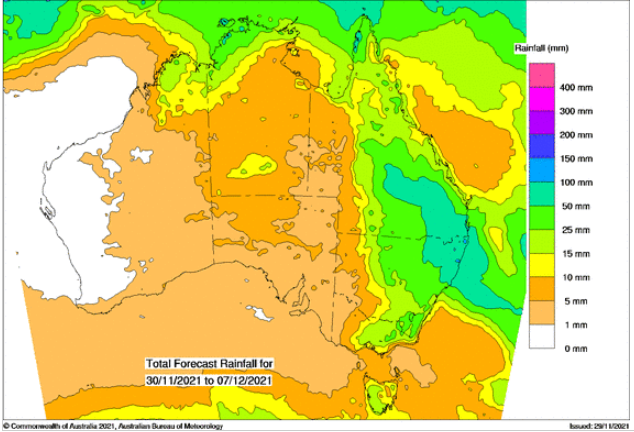

Heavy rains fell across much of New South Wales last week and into the weekend and this is certain to result in a further substantial downgrading to winter crops in the state. The cash markets in New South Wales jumped by $50/MT for the week, on the realisation at least half of the New South Wales wheat harvest will now be downgraded to general purpose wheat or lower. Prices in other states followed New South Wales higher as the trade scrambled to cover export and domestic sales made in expectation of a record against milling wheat sales. This number could increase if the wet weather conditions and more of the Southern New South Wales crop is downgraded. Yields will also suffer more broadly following the heavy rains with lower test weights.

Weather in Western Australia was generally favourable, South Australia less so. CBH had taken 6.3MMT at the start of the week. A dry forecast should have them above 9.0MMT in deliveries by early next week. Wheat proteins have been low in Western Australia, with about half the crop coming in ASW and ¾’s APW2 or lower.

What does this mean for the likely quality profile so far?

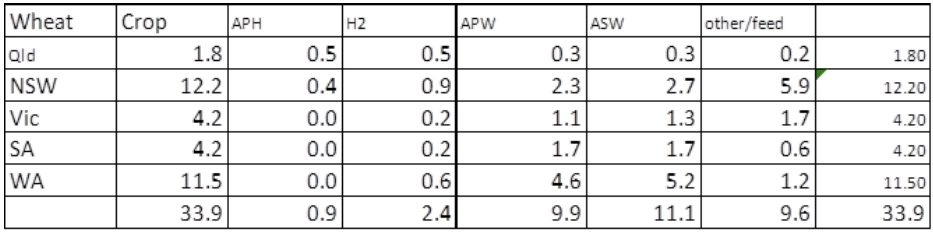

Our Analysts are expecting there will be about 10MMT of other/feed (downgraded), 11MMT ASW, 10MMT APW and 3.2MMT of H2/APH. Domestic milling wheat and seed reserves will move to capture 3.6MMT of the milling wheat before it moves into export channels leaving a high proportion of the export task weighted into the lower quality spectrum (ASW and GP or below).

Source: https://www.agscientia.com.au/

Importantly it’s likely that the volume of downgraded wheat increases from the above assumptions. 2/3’s of the New South Wales wheat crop is still to be harvested and there is more wet weather forecast.

Farmers will be rethinking sales plans now. They are working through existing sales commitments against likely quality downgrades. Further sales will stop until they harvest the rest of the crop and know what they have got. The exporters we have spoken to will be in a similar boat.

Australian Supply and Demand 21/22

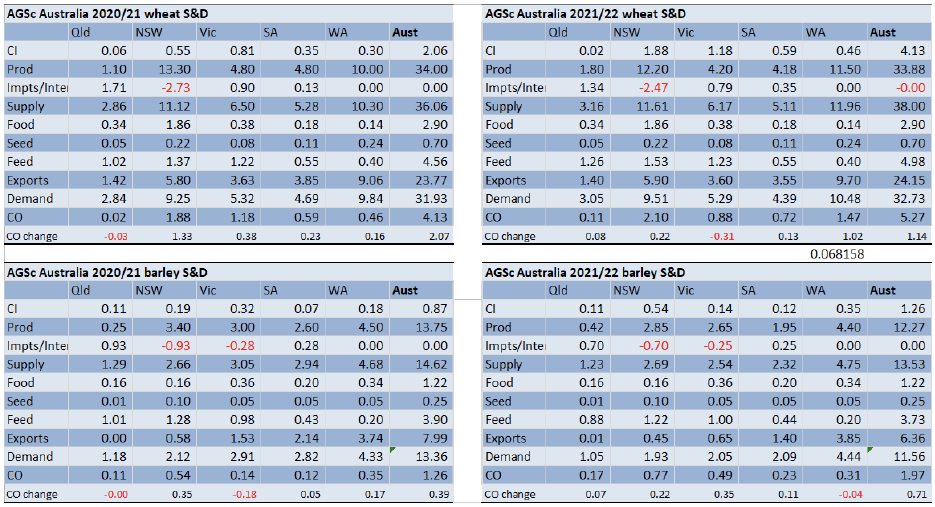

Our Analysts released an Australian Supply and Demand update during the week. National wheat production is up to 33.9MMT from 32.9MMT previously and ABARES 34.4MMT. National barley production is at 12.3MMT vs last year’s 13.7MMT. We are pegging canola production at 5.4MMT

We have wheat exports at 24.1MMT (23.8MMT last year) and barley at 6.4MMT (8.0MMT last year) but this is likely to reduce as the quality of the crop is going to impact on logistics and the export pace. This is still a work in progress, but one would imagine December and January shipments from the East Coast and perhaps South Australia will be heavily affected.

So, what does this all mean?

Global milling wheat supplies tighten further, particularly for mid and high-protein users, protein spreads widen, and in our view, prices for milling wheat in Q1 and Q2 just lost their last “supply” anchor. Debate will switch to what level pulls more Russian and US wheat into the export matrix, the prospects for the northern hemisphere new crop, including the cost of fertilisers(!!) and the level to which we see demand destruction at destination.

Ocean Freight

In contrast to the grain markets, ocean freight was relatively stable last week. The wider market still remains relatively subdued and lacking in fresh enquiry which has had the knock-on effect of creating a vacuum of information. In a general sense, the market has a more traditional look to it with a stronger Atlantic and weaker Pacific market generating discounted back haul opportunities. At the moment, it is hard to feel the shipping market will change significantly without a pick me up from China, so in the absence of that, we would have to feel the situation will remain flat, give or take, until February.

Currency – AUD

The Australian dollar fell to a low of 0.7112 on Friday on the back of risk-aversion caused by the new Omicron variant of COVID 19. From a technical perspective, the AUD/USD pair is currently trading at 0.7130. We continue to expect support to hold on to moves approaching 0.7106 while now any upward push will likely meet resistance around 0.7153.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 48 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.