Australian Crop Update – Week 46

FOB replacement values using Australian track bid/offer (AUD) – not an indication

Harvest and Weather Update

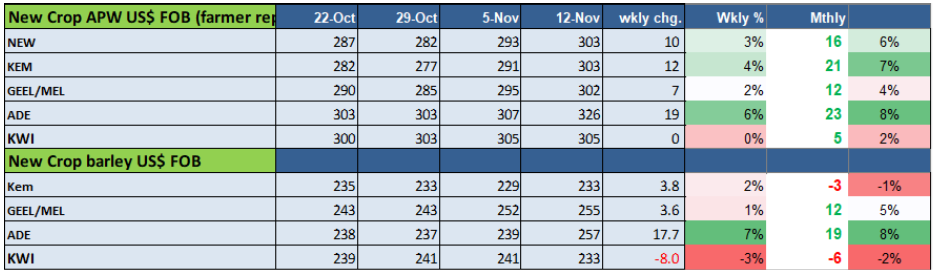

Local markets were sharply higher with the strength in US futures (hitting nine-year highs yesterday) but also due to wet weather delays with wheat harvest and growing uncertainty over wheat quality, squeezing out early new crop shorts.

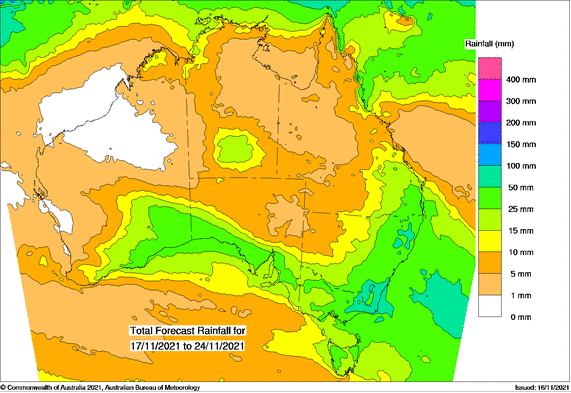

Widespread rain fell across most of Australia including Queensland, New South Wales and parts of South Australia last week. The rain further delayed an already later than normal harvest. At this stage, we anticipate this has seen around 1-1.25MMT of the crop downgraded, but this will easily be absorbed into the domestic market without the need to find export homes. Crops in the south remain green and are not vulnerable to downgrading at this stage. High protein wheat bids are rising while downgraded bids are slipping as traders wait to see what the quality is like when harvest resumes in the coming days.

In the west, CBH is receiving much more ASW than anticipated. Close to half of the wheat deliveries so far have been ASW or below while less than a third has been APW1/hard wheat.

Forecasts are showing another rain front hitting New South Wales and South Australia this weekend and this will keep the market supported.

Ocean Freight

Another incredible week in a volatile year for shipping. The market has continued to ease across the board in all sizes. It is hard to put the finger on specific causes, but to take a broad approach, it would be hard to look beyond the absence of China related business as the underlying reason. The tap has been turned off. Levels remain unpredictable, however, our feeling is the markets are close to bottoming – especially in the Handymax size.

Currency – AUD

The Australian dollar started last week advancing against its US counterpart, trading around 0.7440. However, employment and inflation data fuelled investors’ concerns and the Aussie dollar ended the week around the 0.73 level and has struggled to move away from here so far this week.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 46 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.