Australian Crop Update – Week 45, 2023

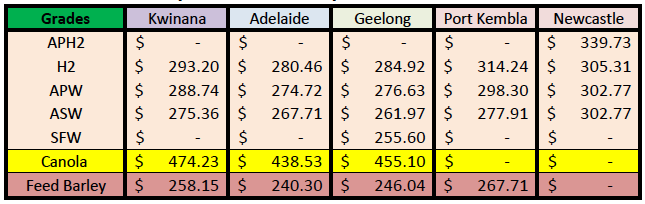

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

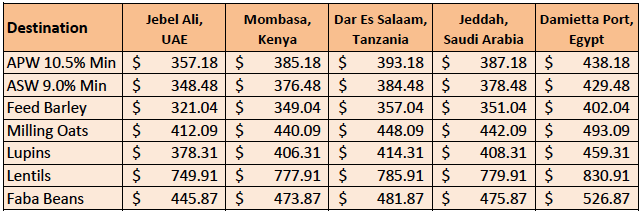

New Crop - CFR Container Indications PMT - LH Nov/Dec'23

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Australian grain values were variable last week with the domestic consumption market remaining firm at lower values while the grain bids in Victoria (VIC), South Australia (SA) and Western Australia (WA) strengthened on exporter short covering showing signs buyers were becoming more anxious to garner improved farmer selling. The 2.4% decline in the value of the AUD against the USD was supportive of local grain bids where there is an exportable surplus.

Northern east coast Australia trader buying ideas were USD7-12 per metric tonne (/MT) lower as harvest is mostly finished and grower selling remains underwhelming. It is expected that the exporter bids lowered in an attempt to shake out some improved farmer sales from those with length and protein suitable for Indonesia and the Middle East. There has been more ASW 9.0% protein wheat delivered to silos that will help ease the northern feed grain deficit as it helps lower the wheat price in the north. ASW discounts to APW remain modest and it is reported that 30-40% of the wheat through the central parts of New South Wales (NSW) is ASW 9.0%.

Grain prices in VIC, SA and WA had a firmer tone later in the week as buyers become more anxious to get some improved coverage while farmers are harvesting. The national wheat harvest is about a third complete with barley even more advanced but farmer selling remains reserved where it’s not easy to cover volumes. Exporters may be struggling to connect to South East Asian wheat markets, but they have sold large volumes of wheat and barley into China, and they are anxious to get some coverage from farmers through the harvest window.

Barley bids by the trade firmed USD7-10/MT last week as buyers stepped up efforts to get some coverage. Farmer selling remains slow with growers happy to harvest the crop first before meeting contract commitments. Farmers are opting to store as much as they can with silo bags proving a popular option again in Victoria. There was also a broader sense in the market that exporters were more interested in covering against nearby sales with the firmer tone bids seen last week.

Australian Harvest Update:

The Queensland (QLD) grain harvest is nearing completion with receivals slowing in the southern bulk handling sites in the state. GrainCorp staff and equipment are beginning to move south to help with harvest activity in NSW and VIC. It is estimated that the QLD harvest is two thirds complete.

Harvest activity is well underway in NSW with good quality wheat receivals across the regions. Early canola is also starting to come into the most southern NSW sites. GrainCorp has reported 575 thousand metric tonnes (KMT) delivered last week lifting total harvest deliveries to just over 1 million metric tonne (MMT). The NSW harvest is about one quarter completed. Protein wheat premiums remain strong in NSW where the APH 13.0% bids are up to USD60/MT above APW 10.5%.

Harvest activity is ramping up in VIC, with sites in the northern regions now underway. Activity in the central regions of VIC is beginning to build, with some barley and canola receivals. There was 110KMT delivered into the VIC sites in the past week taking the harvest delivers past 120KMT.

In WA, CBH reported a big week of grain deliveries through to Monday following favourable harvest weather. Total deliveries reached 3.3MMT following last week’s receivals of 1.6MMT. Harvest is moving along quickly. This year’s harvest is reported as the earliest to receive 2MMT into the CBH system.

It’s a similar situation in SA where Viterra’s harvest deliveries are moving quickly. It is reported that farmers delivered more than 760KMT in the past week, lifting the total harvest total to 1.489MMT. Central region deliveries ramped up last week with 335KMT received. Viterra General Manager of Operations, Gavin Cavanagh says we broke a receivals record in October. “We’ve just had our biggest October ever with growers delivering over 925,000 tonnes to Viterra sites during the month. Wheat quality has been very good with a lot of H2. More than 70% of the wheat delivered has been H2 11.0%.”

Ocean Freight & Shipment Stem Update:

It’s been another solid week for shipping stem additions with 838KMT of wheat, barley and canola. This included 477KMT of wheat, making it the biggest week for the 23/24 season so far. It also included 274KMT of barley following last week’s 514KMT. Canola additions were modest at 87KMT. WA accounted for most of the additions with 228KMT of wheat, 216KMT of barley and all of the canola. What was interesting was the 129KMT of wheat added to the stem for NSW. This included a couple of handy size vessels from Newcastle NAT as well as 60KMT for Port Kembla for a December shipment.

The last week has seen the Pacific freight market going sideways without much impetus either way. The underlying tone remains solid with a general perception the market may still have some life left prior to seasonal holidays next month. Capes were busy last week and now there may also be some flow-over of sentiment from the Atlantic where tighter tonnage availability is edging rates up on pmx/smx (rather than cargo driven). Asia is harder to call because of the regional long-weekend but a lack of fixtures and market talk suggests everyone is watching everyone else for the next move. The Persian Gulf / India area is weak and nearby ships are being fixed at cheap numbers. One interesting point to note is that forward cargoes are being fixed extremely cheaply on handy and supramax around $5-6kpd Singapore on 38kdwt types.

Australian Weather

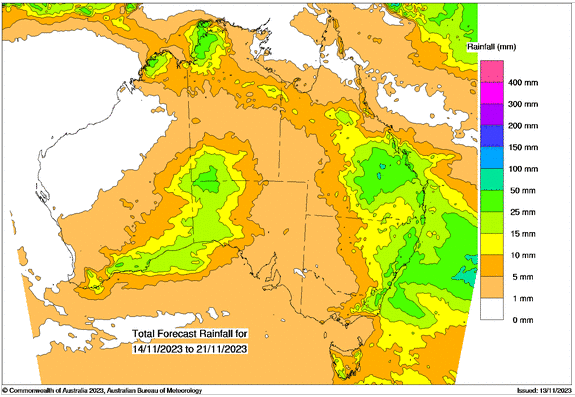

Rain has been received last week in NSW in the north softening grain price bids. The rain will see more sorghum planted as well as help recently planted crops.

8 day forecast to

21st November 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to

14th November 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is weaker to start the week after a strong showing last week valued against the USD. The AUD fell 0.12% on Friday and extended its substantial losses during the week, which has witnessed the AUD/USD pair traveling from a weekly high above 0.6520 toward a low of 0.6327. Last week the AUD failed to gain strength despite an interest rate increase from the Reserve Bank of Australia (RBA) on Tuesday. The RBA raised its Official Cash Rate (OCR) by 25 basis points (bps) to 4.35%. RBA Governor Michele Bullock kept hopes of further rate-tightening alive, citing that the progress in inflation declining to 2% has slowed and risks of persistent consumer inflation have escalated.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.