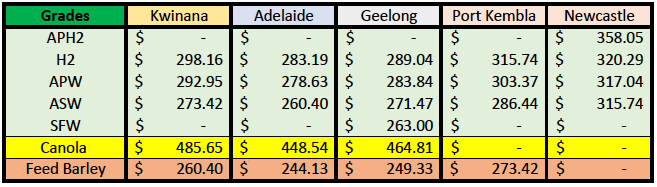

Australian Crop Update – Week 44, 2023

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT - LH Nov/Dec'23

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Australian cash prices finished the week lower.

Wheat was USD7 per metric tonne (MT) lower at (-3%) reflecting a strengthening AUD on the back of weaker US data. Barley prices were off USD3/MT as buyers continued to lower bids on harvest selling. The stronger AUD is impacting all values, but barley seems to have underlying demand from China which is keeping a bid under the market.

Export barley values are also being based off the US$250 FOB values that work back into China. Famer selling seems to have picked up in the past couple of weeks ahead of the southern harvest, but the strong dollar means the traders are lowering their buying expectations to remain competitive in the export market.

Wheat prices are holding on as China continues to buy a minimum 500-700 thousand metric tonne (KMT) of wheat per month from Australia. The question is when does the music stop?

Australian Harvest Update:

In the east of the country, harvest activity in Central Queensland (QLD) is nearly complete with receivals now focussed on the south of the state. New South Wales (NSW) is now well into harvest.

Harvest deliveries are also advancing quickly in South Australia (SA). Most of the activity has been wheat and the rest barley, canola and pulses. Wheat proteins were high with more than half of the wheat deliveries reportedly making H2 11.0% so far in SA.

In the west, CBH received more than 1 million metric tonne (MMT) of grain deliveries in the past week, lifting the total harvest receivals to 1.7MMT. Harvest is advancing across all of Western Australia’s (WA) port zones now. Canola and barley have been the major grain deliveries so far. The canola harvest is well-advanced. Wheat proteins are reportedly well-up from last year’s low-protein season.

Australian Pulses Update:

Australia exported 675,516 metric tonnes (MT) of chickpeas and a record 1,745,433MT of lentils in the year to September, according to the latest data from the Australian Bureau of Statistics. Pakistan received 372,858MT totalling 55 percent (pc) of the annual shipments, indicating its transition from a containerised to a bulk market. Bangladesh received 128,833MT as the second-biggest market for 2022-23 chickpea shipments, followed by the United Arab Emirates on 63,230MT. India was the largest market for lentils with 47% of 2022-23 shipments, followed by Bangladesh on 261,259MT, and the United Arab Emirates on 178,199MT.

Ocean Freight Market Update

The shipping market continues to lack any confidence and as a result, the rates have continued to ease further across all sizes. Interestingly however, owners are yet to discount as severely for longer duration trips or legs/period as compared to quick Pacific rounds trips, which suggests that owners still have faith in the market recovering for the "usual" pre-Christmas fixing rush. In the Atlantic, rates have also eased over the past week. On a positive note, for the owners, bunkers have remained fairly stable over the past few weeks which is helping the voyage rates to ease gently rather than drop quickly. The market’s point of view hasn’t changed dramatically and is still generally lacking cargo to help reverse the current trend with only another 4/5 weeks left before the shipping market starts to shut for the Christmas holidays.

Barley remains the largest grain moving for exporters according to the shipping stem. A further 514KMT of barley was added to the stem in the past week. SA accounted for 287KMT, WA with 175KMT and Victoria (VIC) with 52KMT. There

was 300KMT of wheat and 55KMT of canola put on the stem in the past week with most of this in WA. Recent wheat sales to China should start appearing on the stem as these were reportedly for a December shipment onwards.

In other notable news - Australia exported 1.49MMT of wheat in September lifting the Oct22 to Sep23 marketing year exports to 31.7MMT of wheat exports – a record.

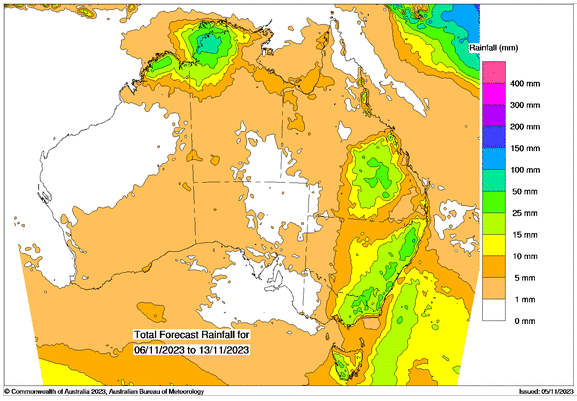

Australian Weather

There was some patchy rain across southern QLD and north eastern NSW last week ranging from 10-20mm. This will help with the pasture supplies across the region which are scarce, but more rain is needed. Some farmers have seeded sorghum on storm rains over the past couple of weeks but they will be awaiting more rain in the coming weeks to boost the dry subsoils.

8 day forecast to

13th November 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to

6th November 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is stronger to start the week against the USD after it rallied to a nine-week high capitalising on USD weakness following a weaker than expected Nonfarm Payrolls reading and risk-on market sentiment. Cooling US data is helping to confirm that the Federal Reserve is done with rate hikes, and investors are now turning forward to start anticipating a future rate cut cycle from the US central bank. The upbeat Australian economic data and risk-on environment have boosted the Australian Dollar (AUD). Looking ahead this week on Tuesday, the Reserve Bank of Australia (RBA) will decide if they are to raise the cash rate by a further 25 basis points.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.