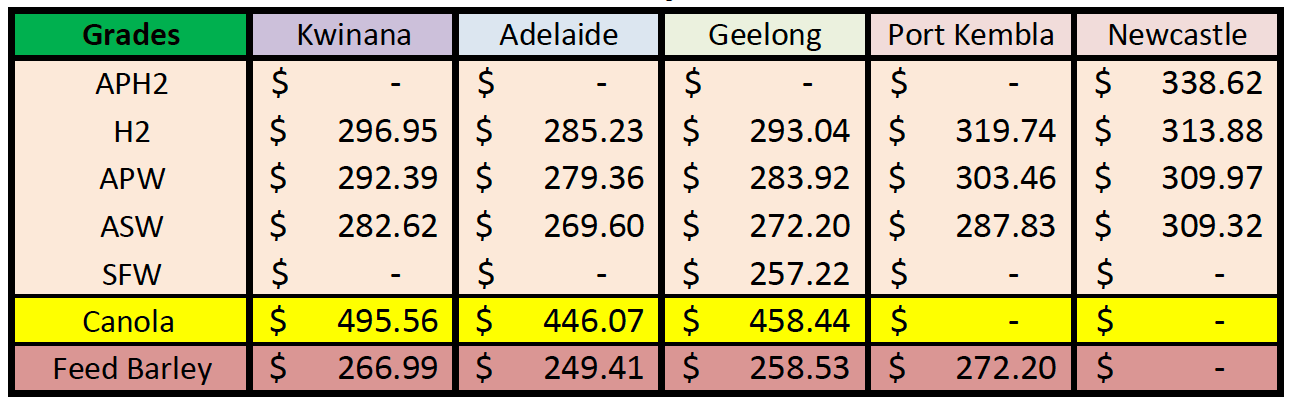

Australian Crop Update – Week 46, 2023

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

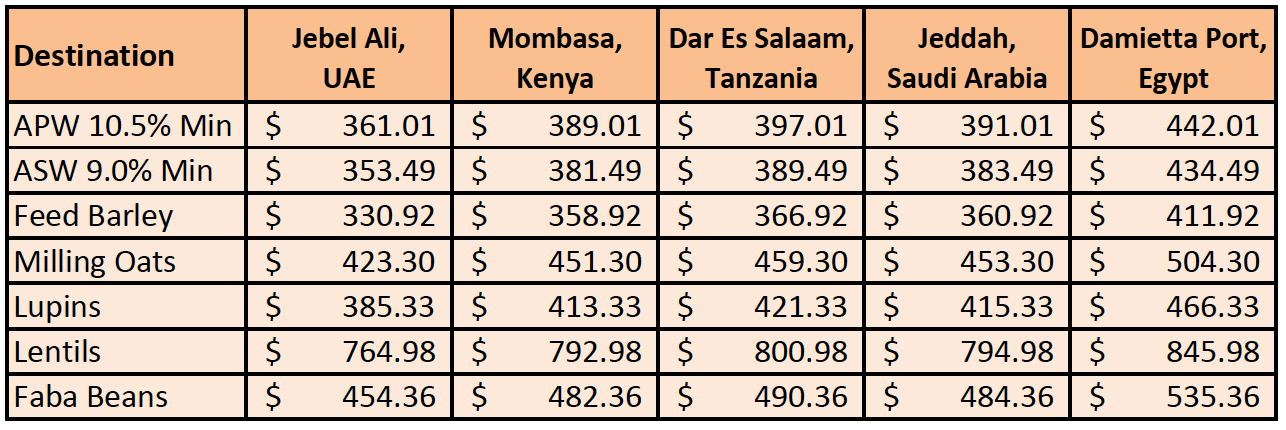

New Crop - CFR Container Indications PMT - LH Nov/Dec'23

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Australian domestic cash prices remained steady over the last week but implied US$ FOB prices were higher as the AUD rebounded back on further expected interest rate rises at a time when the US seems through the worst. Having just come back from a trip to the middle east it seems this AUD strength is making the export task even more difficult. Australian wheat remains comparatively expensive against Russian / Black Sea values landed into Southeast Asia and if it were not for the strong China sales program, I think we would be beginning to see prices pressure lower.

Barley bids were slightly higher in WA and SA which can be attributed to the underlying China bid at around USD 250 FOB. Queensland (QLD) bids were softer with domestic consumers comfortably covered for their nearby positions and widespread rain in Southern QLD and Northern New South Wales (NSW) has encouraged widespread planting of a summer sorghum crop.

According to industry sources, grower sales of wheat and barley have picked up in the southern market this week, while domestic demand in the north has shrunk as buyers saw the forecast rain depress offer prices.

Traders are confident growers will be pricing more new-crop tonnage to generate near-term cashflow in the coming weeks, with barley likely to be the grain they hold if they deem the bids too low.

From a quality perspective and given the mostly dry growing season which normally translates to high protein, the relatively low proportion of H1 and APH1 grain delivered has come as a surprise. That said, more may be held on farm and according to early milling reports the quality does seem to be exceptional.

While domestic flour millers are covered on high-quality new-crop grain, exporters are yet to see the volume they need to start offering higher-protein wheat to the export market comfortably.

Australian Harvest Update:

In terms of progress, the national harvest will have moved above 50% in the past week with most areas expected to be wrapped up by Christmas.

The harvest in QLD is mostly complete with some deliveries still coming into the bulk handling system. Activity in Northern NSW has also slowed into the key sites around the central part of the state. Rainfall in the later part of the week slowed harvest activity around the north and parts of the Central West, but deliveries picked up again over the weekend. Harvest deliveries are building in Victoria (VIC), Deliveries into the South Australia (SA) network increased during the week with growers delivering over 1MMT, taking total receivals for the season to almost 2.5MMT. SA’s grain deliveries are coming in very quickly, as can be seen in industry reports. Wheat made up just over half of total commodities received. In Western Australia (WA) harvest is slowing in the northern zone but is going strongly in other zones. WA’s grain harvest is set to be all but finished by the end of December, marking one of the earliest end dates in recent years on the back of low yields, an early start and high-capacity machinery in use after two record crops according to GIWAs November crop report.

Australian Pulses Update:

The harvesting of pulses is now fully underway in Australia, with the majority of activity now in Southern NSW, VIC, and SA. The bulk handling sites are now receiving lentils, faba beans, and lupins with significant volumes expected to be seen over the next two to three weeks. Initial estimates indicate a reduction in Australian faba bean production to around 1.6MMT, primarily attributed to a dry finish, resulting in smaller bean sizes. Likewise, lentil production is projected to be lower at approximately 1.2MMT. Grower price expectations remain above export parity however, despite the lack of trading into the sub-continent and the Middle East over the past few weeks.

Ocean Freight & Shipment Stem Update:

Coal shipments into China finally sparked the freight market into life last week. China seems to be stockpiling ahead of the winter and this combined with congestion at grain ports in East Coast South America and delays at the Panama Canal are reducing the amount of tonnage available to the market. Fronthaul panamax/supramax rates climbed steeply from the Atlantic. The Atlantic/Pacific market split has a very traditional look to it with big premiums in the former and Asia/Feast firmly discounted. There are some exceptions to the positivity with the Middle East Gulf being very quiet as is the Australian coast for handy/supramax.

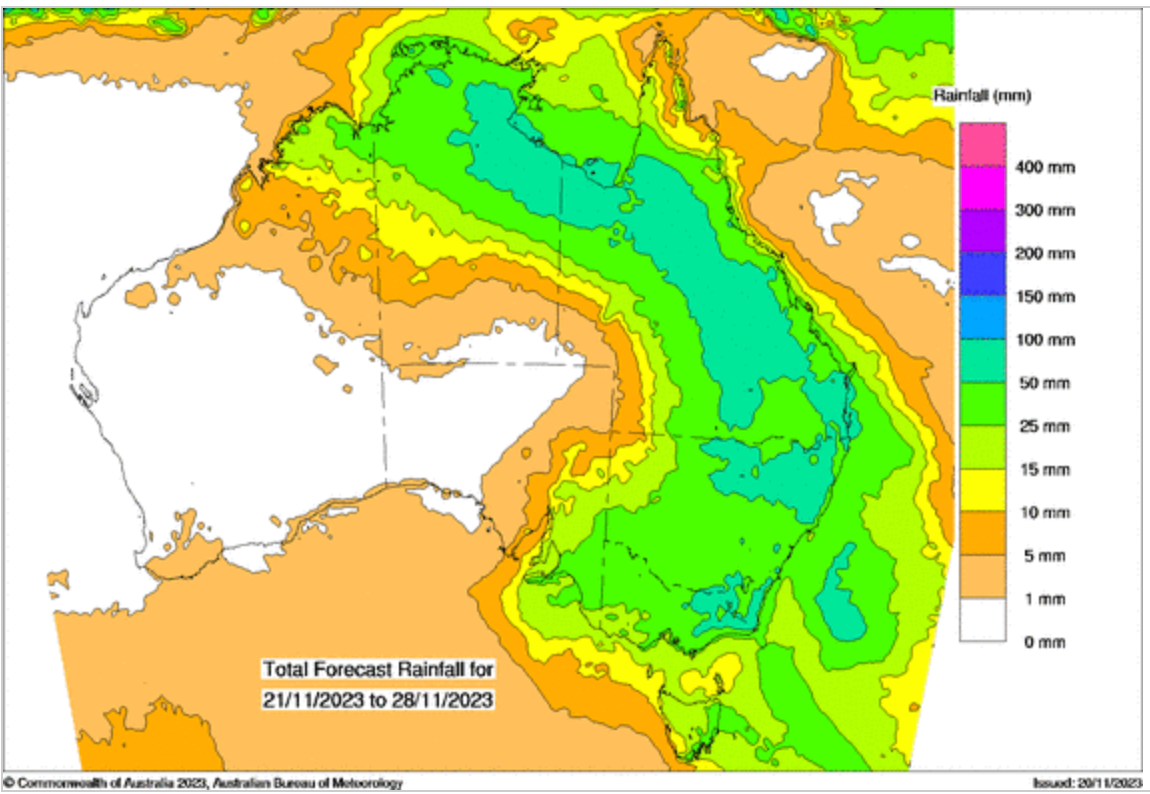

Australian Weather

We saw good soaking rains for Southern QLD and parts of Northern NSW for this weekend but otherwise the weather has been kind for harvesting.

8 day forecast to

28th November 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to

20th November 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar edged higher through trade to close last week pushing back above US$0.65 amid an improvement in the underlying risk narrative. US equities and risk assets advanced as market expectations for a retracement in US rate hikes through the second half of 2024 grow. Falling global bond yields and rising expectations for rate cuts have forced the USD to give up its highs against a basket of currencies won in October, opening the door for the AUD to rally back above US$0.65. The question now is, can the AUD recovery be sustained and extended while the global growth outlook remains unclear and China’s recovery uncertain. The market remains balanced in answering this question.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.