Australian Crop Update – Week 44, 2024

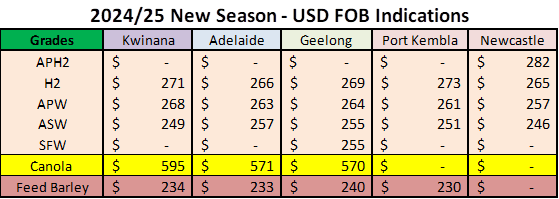

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australia’s winter crop harvest started to advance quickly last week. Barley and canola harvest is well underway in all states, but the wheat harvest is yet to start in earnest in Victoria (VIC) or South Australia (SA). Queensland (QLD) harvest is more than 50% complete while the New South Wales (NSW) harvest is around 10% complete and in Western Australia (WA) the harvest started slower than previous years due to the late rain.

Despite some bullish cuts to the crop, notably by the USDA and Rabobank last week, we and our analysts AgScientia have been impressed by the wheat yields seen so far. Wheat yields of 4-5 t/ha have been common thus far for wheat and across much of the growing regions with barley yields even higher. Chickpea crops have also performed well with many crops in the 2-3 t/ha range. As a result, our collective inclination is to call the crop above 31 million metric tonne (MMT). That is before we have adjusted WA numbers, which will have benefited from the late rain, so we could move towards 32MMT again in the coming weeks. We are also hearing that VIC is marginally better than expected and certainly a crop tour we carried out a few weeks ago suggested wheat was being relatively resilient, and that canola was most effected by frosts.

From a quality perspective it is too early to call any definitive grade spreads, but higher yields suggest a lower protein crop and there is certainly a fair amount of ASW hitting the bin, although AH2 is the dominant crop in NSW at the moment. There is some higher protein wheat, but one trader described receivals as “skinny” at the moment. From a barley perspective, reports are coming in of higher screenings and this might push the feed/malt equation in favour of feed this year. Time will tell.

In general, on the cash side we are seeing nothing bullish, and we are starting to see some pressure come into this market as global prices, particularly Russian, turn lower and new domestic supplies come in. However as always with the Australian market it pays to pay attention to logistics. We are seeing, and the market is reporting, that the early stem is filling up with pulse demand from the Indian Subcontinent and Egypt, and canola from Europe. There are also reports China did a sizeable clip of ASW for Feb/March 2024 so logistics for the harvest slots are starting to fill up. Remember, it is not just about wheat in Oz – it is about elevation margins, and so far, wheat is a distant third in that race with pulses and canola in first and second place, on the east coast at least.

Regarding pulses, it would seem ABARE have underestimated the NSW fava bean crop with three boats confirmed on the stem and two more talked about. Beans have filled gaps caused by subdued chickpea demand as the Indian Subcontinent looks for better value offers.

Export Stem & Ocean Freight Market Update:

The Pacific market again lacked inspiration this week. The Smax and Handy sectors faced another challenging week which was further disrupted by the mid-week holidays in Singapore. Few new orders meant owners were competing for business and therefore putting pressure on spot rates.

Handy vessels continue to ballast from India which has put further strain on the Pacific & Aussie market as owners resort to Aussie business to get their ships back to Asia. It was a similar story in the Atlantic whereby market fundamentals eased which in turn saw rates soften in the Cont/Med/USG.

Shipping stem additions are gradually increasing for the new season. In the past week there was 262 thousand metric tonne (KMT) of wheat was added to the stem, 127KMT of barley, 110KMT of canola, 100KMT of chickpeas and 30KMT of faba beans.

The wheat consisted of 176KMT in WA, as well as 56KMT at Pt Kembla and 30KMT at Melbourne. Most of the WA wheat was Geraldton for a late Nov loading.

The barley was also WA dominated with VIC adding 15KMT.

The canola was split between Pt Kembla and Geelong.

There was 100KMT of chickpea vessels nominated last week split between central QLD, Brisbane and Newcastle.

Another 30KMT of faba beans was added to the Newcastle NAT stem.

The monthly breakdown of the stem by ETD shows there is 558KMT of wheat scheduled to be shipped in November (1.1MMT last year), 614KMT of barley (873KMT last year) and 706KMT of canola (543KMT last year). There is also 150KMT of chickpeas scheduled to sail in November.

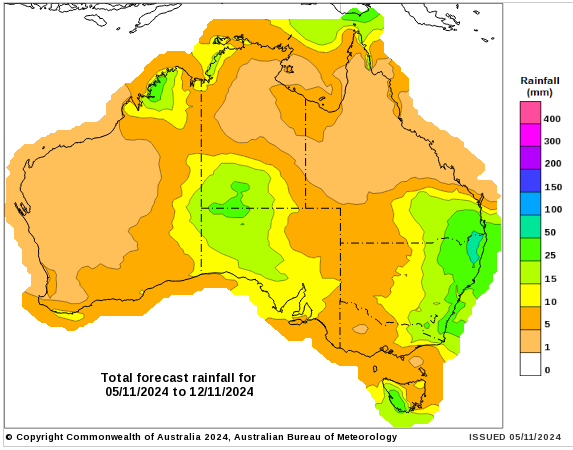

Australian Weather:

The warm, dry weather should see WA ramp up their harvest reasonably quickly from about 1MMT a week to 2-3MMT a week towards the end of Nov. Similarly, warm weather will allow the NSW harvest to advance quickly as well. We expect it will be a relatively quick harvest, weather permitting, because of the smaller crops in VIC and SA. They are usually representing some of the latest crops harvested in Australia, but these areas will come in more quickly this year.

8 day forecast to 12th November 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 5th November 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to close last week when valued against the USD at 0.6574 as traders responded to polling suggesting the “Trump Trade” was a possibility along with stronger USD and continued scepticism surrounding China's economic stimulus initiatives. Weak manufacturing data from China has weighed on the Australian dollar, which is heavily influenced by China's economic health.

Obviously, the US election is the elephant in the room and recent polling suggests swing voters maybe breaking for Harris but all other things aside 0.6500 is the next level of support for bulls to defend and bears’ target.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au