Australian Crop Update – Week 46, 2024

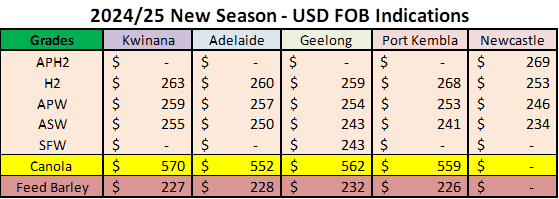

2024-25 New Season - USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Harvest progress across New South Wales (NSW) and Western Australia (WA) slowed last week due to unsettled weather. Harvest in Victoria (VIC) is now underway but was also slowed by showers last week. Harvest is still in its early stages in South Australia (SA) but the dry growing season has helped grain quality if not pricing. Early wheat deliveries have been more than 60% hard wheat and there has been a good volume of malting barley. Overall, the WA harvest is seen as nearly a quarter complete although canola and barley are more advanced.

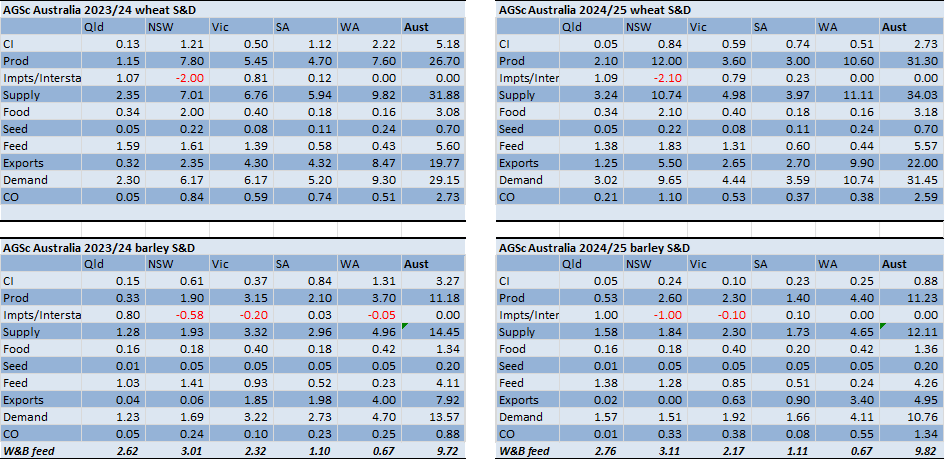

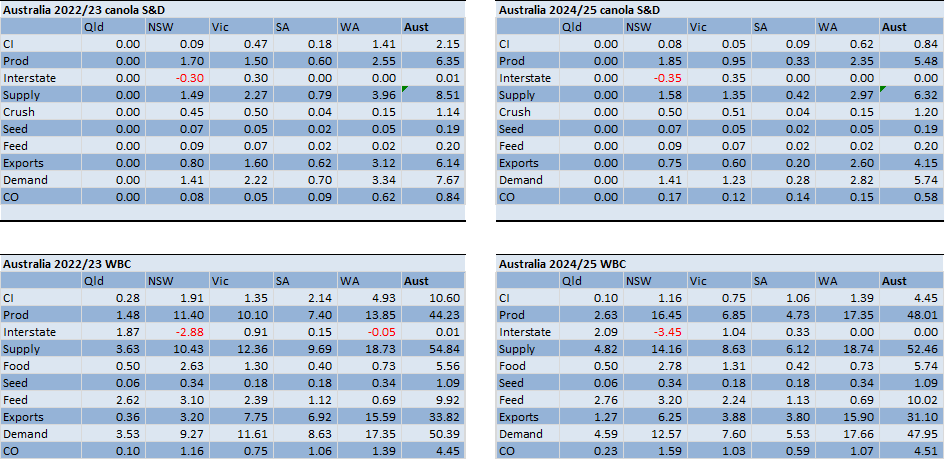

Our latest balance sheets see national wheat production to 31.3 million metric tonne (MMT) from 30.0MMT a month ago. National barley production is up to 11.2MMT and canola at 5.5MMT. Most of the production increase has been in NSW where farmers have been reporting better than expected yields across the northern half of the state and this is extending into the central west. Australia’s 2024/25 wheat exports have been raised to 22.0MMT. From a logistics perspective, it will be a slow start to the season as Queensland (QLD) and northern NSW are focussed on early pulse exports despite the large wheat crop. VIC and SA exports will be slow because of the supply restrictions.

On the domestic front the local markets were mixed last week with most zones drifting lower with the sharp declines in US wheat futures and a weaker AUD. However, in some zones exporters willingness to pay up for nearby supplies helped to support farmer bids for particular grades/port zones. Farmer wheat selling still appears to slow in NSW, and most areas for that case, but most appear to be selling canola as its harvested. WA wheat values edged higher as trades tussle for nearby supplies to load ships.

Australian Pulses Update:

Pulse markets were mixed into the close last week. Exporters are now nominating wheat vessels out of northern NSW due to the softer than expected chickpea demand from India. Faba beans continue to firm in both the north and the south as multiple exporters chase supplies for boats. There were signs the market was topping out late in the week with early harvest in the south coming in better than expected.

Export Stem & Ocean Freight Market Update:

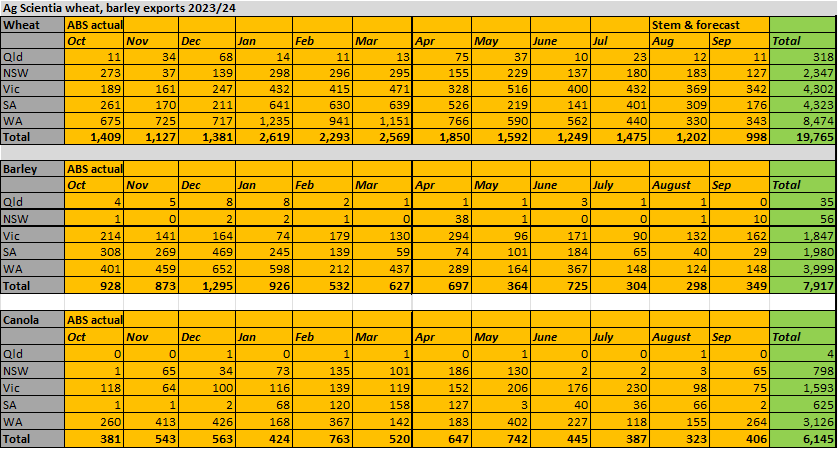

Australian exporters have reportedly made reasonable wheat sales and that is reflected in the stem. China is seen to have bought 500-600 thousand metric tonne (KMT) of Aussie wheat in recent weeks, as well as some barley. Other Asian wheat buyers have also been active with reports of sales to Indonesia, Philippines and South Korea. As a consequence, shipping stem nominations are gradually picking up. There was 693KMT of wheat added to the stem in the past week alone.

Australia exported 998KMT of wheat in September putting the 2023/24 national wheat exports at 19.8MMT. Indonesia was the largest destination with 161.5KMT followed by Philippines with 157.3KMT. Barley exports for Sep were 349KMT. This put the national 2023/24 Oct/Sep barley exports at 7.9 MMT. Sorghum exports were 340KMT. September canola exports were 406KMT. This puts the national Oct/Sep canola exports at 6.15MMT.

It was another challenging week for owners in the Supramax and Handysize sectors in both the Atlantic and Pacific. Generally speaking, we are experiencing a lack of fresh cargo appearing in the market to counteract growing tonnage lists. Charterers are holding the whip hand and bidding well below last done levels with owners having no other choice but to engage to find coverage. Since mid-October, the Supramax index in the Pacific has dropped roughly 30% while the Handysize has experienced an 11% contraction for a Pacific round. By contrast, the Panamax sector is starting to show signs of recovery. The Atlantic is seeing more cargo demand appear in traditional loading areas. It is slower in the Pacific however there has been a recent push on grain clean loaders ex NoPac which is helping to lift the overall sentiment.

Australian Weather:

Wet weather is likely to slow harvest activity next week in NSW. The rain is forecast to start on Monday in southern NSW and spread into the centre and north west through the week. Wheat harvesting in NSW is advancing quickly in the western areas but is only just getting started elsewhere in the Riverina. Overall, wheat yields are coming in as expected or slightly better in southern NSW so far.

Weekly Rainfall to 19th November 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker again to close last week when valued against the USD at 0.6453. The Australian dollar may face continued challenges due to recent weak domestic and Chinese economic data.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.