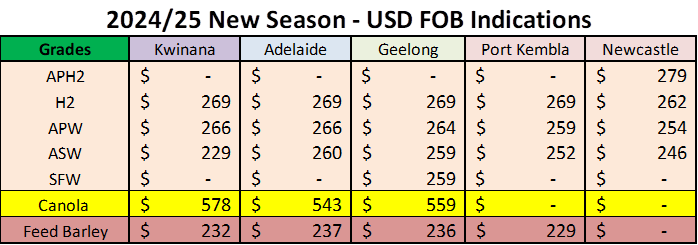

Australian Crop Update – Week 43, 2024

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian harvest progress pressured Australian cash markets last week. It was a dry week which is allowing more farmers to start harvest. In addition, USD values for Australian grain were helped by a softer AUD.

Wheat and chickpea values were softer with harvest pressure in Queensland (QLD) and northern New South Wales (NSW) which is showing better than expected yields. There are plenty of reports of wheat yields in the north above 4t/ha and even larger barley yields. Early reports from southern QLD and northern NSW have also showed good amounts of APH13 and AH12 which is pressurising protein premiums. However, it is still early days in terms of the wheat harvest with QLD progressing well, NSW 10 percent done, and Victoria (VIC), South Australia (SA) and Western Australia (WA) just getting started. It is certainly too early to make a call on likely grade splits but the yields being seen in the north make us more confident that the wheat crop will come in well over 30 million metric tonne (MMT) despite smaller crops in the south.

Pulses Update

Australia’s prices for chickpeas delivered to QLD sites have fallen by up to USD150 per metric tonne (/MT) in response to harvest pressure, and India’s continued absence from the market. This is despite it removing its tariff on chickpeas, which was expected to prompt a fast and furious shipping program bookended by the start of the QLD harvest and the closure of the tariff-free period on 31 March 2025. Trade sources say Pakistan has emerged as the destination for the first two new-crop cargoes shipped this month from QLD, and that prices have now fallen to a level expected to attract buying interest from India and Bangladesh, as well as Pakistan. Trade sources say the price drop has occurred in response to volume selling from growers at higher rates. With around one third of the Australian crop forecast at 1.5-1.7MMT now harvested, the trade is now confident that volume to supply prompt shipment cargoes is available.

Elsewhere, the northern fava bean crop is being bid up by some export shorts and the southern crop is getting some early support by some who are concerned about a smaller crop however rain last week was helpful to the VIC crop at least.

Export Stem & Ocean Freight Market Update:

It was a tough week for owners in the Pacific and Indian Ocean last week. Tonnage lists began to grow from Monday and with little fresh cargo hitting the market, it didn't take long for the sentiment to turn negative and rates to start contracting especially for Handysize where many owners had to start entertaining lower than last done levels to get covered. Southeast Asia and F East were noticeably quiet as rates dropped $1-$2kpd across the board for Handies and Supra/Ultra. The Panamax sector followed a similar trend in both basins – subdued seemed to some up the market nicely.

More new crop wheat, barley and canola was added to the shipping stem in the past week, but it was all in WA. This comprised of 240 thousand metric tonne (KMT) of barley, 170KMT of wheat and 55KMT of canola. The increased wheat volume suggests exporters are connecting with Asian buyers at current values particularly in the lower protein grades. However, the softness in the cash markets indicates volumes are modest which makes this commentator think talk of Chinese import interest is mainly focused around barley. There was also 30KMT of chickpeas added in central QLD.

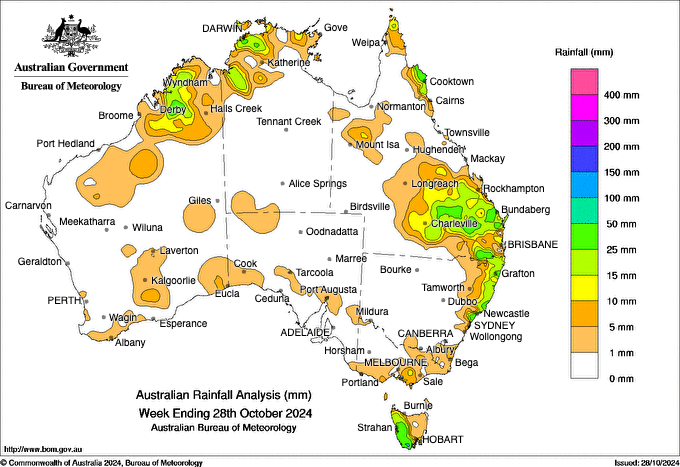

Australian Weather:

Harvest was in full swing last week as the country remained dry with no rainfall of significance reported. This week looks somewhat similar.

8 day forecast to 5th November 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 28th October 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

All major currencies were weaker against the US dollar in European and US trade. The AUD in particular fell for a fourth week in a row and closed beneath its 200-day SMA on Friday. Election speculation around Trump rising in the polls and higher US yields appear to be behind the ‘risk-off’ moves for AUD/USD. In Australia we have the CPI read this week although commentators doubt it will make a material impact on the RBA who are still mulling over whether a cut or hike is more likely, if or when it happens at all.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au