Australian Crop Update – Week 43, 2023

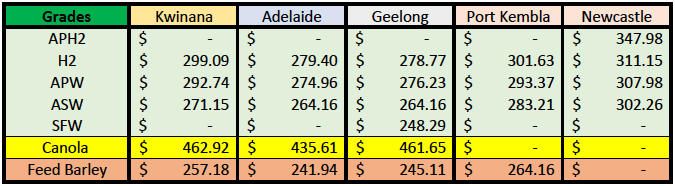

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

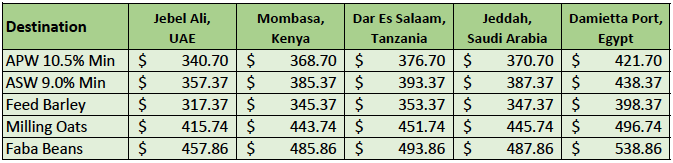

New Crop - CFR Container Indications PMT - LH Nov/Dec'23

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

The Australian wheat and barley market came under further pressure last week as harvest pace increased with exporters unwilling to chase supplies at current values. Wheat bids were 2-3% lower on the east coast and about 1% lower in Western Australia (WA). APH13% premiums eased in Queensland (QLD) and Northern New South Wales (NSW) with traders reporting a little more protein wheat as the harvest moves south. Farmer selling interest picked up in Victoria (VIC) with farmers wanting to clear storages ahead of harvest. WA barley bids crept up USD3 per metric tonne (MT) higher on the back of strong sales into China.

In terms of yield, the current harvest is a mixed bag with some areas over delivering and others underwhelming in production terms. Northern NSW and Southern QLD have not seen as much high protein wheat as was expected whereas WA and South Australia (SA) are seeing higher protein than they have seen for a couple of years with lots of APW and AH2 reported.

Australian Pulses Update

The Pulses harvest has also commenced with the northern growing regions seeing most of the activity in chickpeas. In some isolated areas in the south, harvest for lentils, faba beans and lupins has also started. However, we are still approximately three to four weeks away from seeing significant volumes. At this stage, the estimate for the Australian faba bean production is approximately 1.6 million metric tonne (MMT) which is down from last year. This is mostly due to the dry finish. In addition, lentils are also expected to be lower at around 1.2MMT.

Grower price expectation is considered to be above export parity. However,

the market has reported some northern faba beans trade into Saudi Arabia in containers. The northern beans usually trade at a USD20-30/MT discount to southern beans due to the variety performance and size differences. More information and activity will come to market over the coming weeks as the crop profile during harvest is further understood for the 2023/24 season.

Ocean Freight Market Update

With the amount of red ink visible across the freight Indices at the moment, you would think the market should be in free fall, but it isn't. There are some notable market players saying they think this is a temporary dip and the underlying tone remains firmer than today's expectation, but for the time being, the bears have control. From our perspective, it feels like the cargo side is very quiet and that combined with more vessels arriving from the Atlantic is keeping the market under pressure.

There was 284 thousand metric tonne (KMT) of wheat added to the stem in the past week, 185KMT of canola and 180KMT of barley. WA dominated the additions accounting for 2/3rd of the weekly wheat additions and all of the barley and canola. There was 70KMT of wheat added into VIC which is expected to be old crop wheat coming to market as farmers clear on farm storages ahead of harvest. NSW and QLD remain void of new additions which is expected to be a familiar theme for the 2023/24 season, although there was 27KMT of wheat added in Central QLD as well as a sorghum vessel.

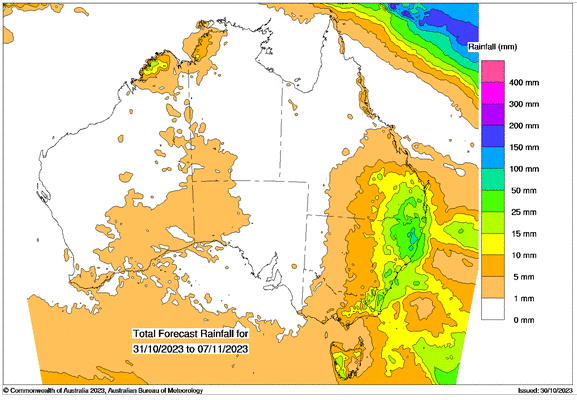

Australian Weather

There have been few harvest delays over the last week due to rainfall and the same is expected for the next 7 to 10 days. Showers are forecast for coastal cities on the east coast with only 10-15mm expected for the next few weeks. The greater focus will be on what happens after harvest with the need for good summer rains to provide sub-soil moisture for the 2024/25 winter crop.

8 day forecast to

7th November 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to

31st October 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian Dollar offered little to excite investors through trade last week tracking within what has become a familiar range as market attention drifted to what promises to be a week loaded with headline data events. Having edged toward US$0.6350 leading into last week's close, the AUD has given up 20 points to open the week as markets respond to an escalation in the conflict between Israel and Hamas at the weekend. The risk off mood is unlikely to send the AUD spiralling back below US$0.63 but should be enough to cap gain ahead of key headline events this week. The current AUD support levels are at US$0.6270/80. If it trades through this, it will have further downside to low US$0.6200’s quickly.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.