Australian Crop Update – Week 41, 2024

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Rain has slowed harvest activity across southern Queensland (QLD) which has offered some mild support to the nearby prices. Exporters are comfortable to wait for harvest to get well underway and are not chasing prices higher at the moment.

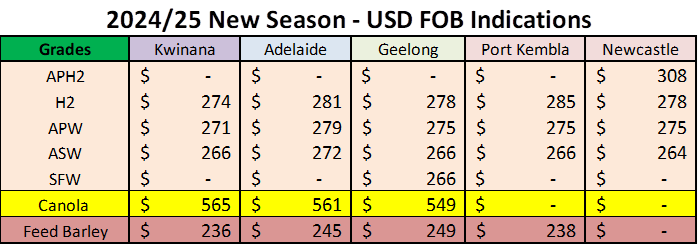

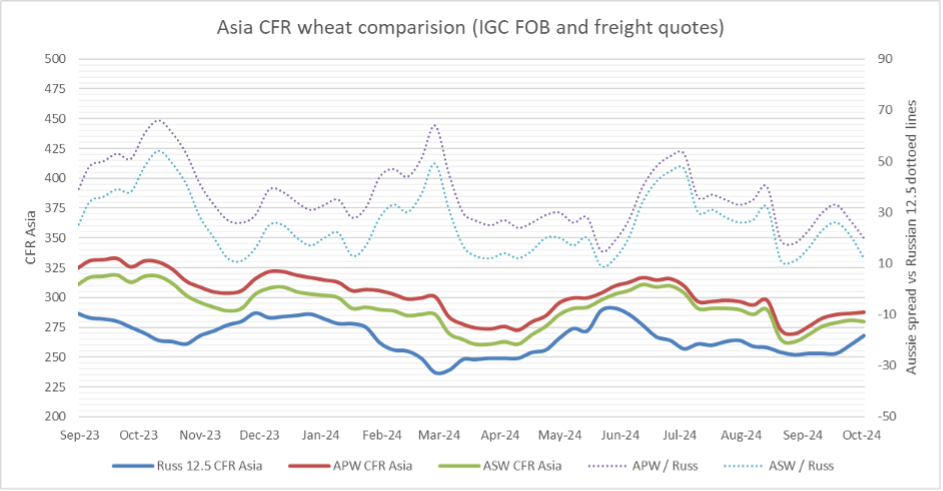

APW bids are generally around the $270-275 FOB equivalent which puts values around $295 CFR Asia. Australian wheat is now competitive with Black Sea and South American wheat into Asian markets.

There will be updates to production estimates next week (mid October). Production numbers will be reduced, however it is expected that the national wheat crop will hold slightly above 30 million metric tonne (MMT). Weather forecasts continue to offer widespread rain for QLD, New South Wales (NSW) and Victoria (VIC) next week, and possibly South Australia (SA). Rain is expected to start building in north east NSW on Tuesday and this will broaden in the later part of the week as it connects with a southerly front that comes through SA and VIC. Rain will still benefit most crops in NSW, VIC and some in SA.

Pulses Update

Australian chickpea prices declined 2% last week while lentils increased around 3% due to the recent frosts and dry weather in VIC and SA. Rising freight costs and increases in prices are making it challenging for exporters to be competitive for new season pulses into the subcontinent.

Export Stem & Ocean Freight Market Update:

There was 290 thousand metric tonne (KMT) of barley added to shipping stem in week 41 which makes it the largest weekly addition in 12 months. This included 240KMT in Western Australia (WA) (4 x 60KMT) as well as 50KMT in Geelong. The 60KMT vessels look like they could be heading to China. There was also 121KMT of canola put onto the stem with 61KMT in WA and 60KMT in Geelong, VIC. There was 128KMT of wheat put on the stem.

In the ocean freight market, the anticipated bounce-back after Chinese Golden Week celebrations failed to materialise for the Supramax and Handysize markets, however we did witness some positivity in Asia on Panamaxes. There was a notable uptick in demand from Australia, Indonesia and Nopac on Panamaxes which helped the overall index end the week in the green. The Supramax sector was generally flat and balanced throughout the week. Australia and Indonesia were fairly quiet throughout the week, while little fresh demand appeared from Nopac.

Australian Weather:

There was approximately 50mm of rainfall received in parts of the cropping regions in QLD over the past seven days while most of the rest of Australia remained dry. Rainfall is only required now for the southern growing areas while it needs to remain dry for harvest in the north. The Australian Bureau of Meteorology is forecasting a 50% chance for exceeding median rainfall across November and December which will affect harvest momentum but will be supportive of a summer cropping program.

8 day forecast to 22nd October 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 15th October 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to finish last week when valued against the USD closing at 0.6725. The Australian dollar recovered some ground against the Greenback on Friday after a measure of prices paid by producers reaffirmed that inflation is coming down, warranting further easing by the Federal Reserve. Inflation expectations have decreased to a three-year low of 4% in October, providing a somewhat positive signal.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.