Australian Crop Update – Week 42, 2023

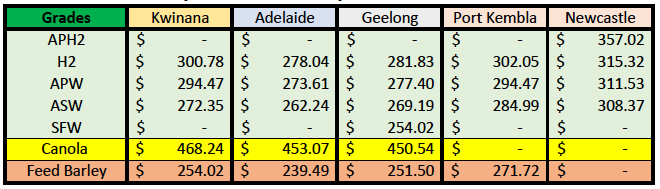

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT - LH Nov/Dec'23

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Australian high protein wheat premiums were firmer last week but the east coast feed grain bids were soft as buyers adjusted their bids lower with harvest well underway. APH13.0% premiums in the north remain strong at USD$30-35 per metric tonne (MT) above APW10.5% with the smaller than expected volumes being harvested so far. Barley remains the softest leg in the south which seems to be a function of old crop selling and the lack of willingness for exporters to chase the new crop at levels that won’t work into China. Northern markets ended the week slightly lower as buyers pulled the bids on harvest pressure but there is a scarcity of trade sellers.

Western Australia (WA) and South Australia (SA) wheat bids were 2-3% higher for the week. H2 11.0%, APW10.5% were up USD$6/MT, while ASW was USD$9/MT higher. Adelaide H2 11.0% and APW10.5% was also USD$6-8/MT higher. Buyers are more willing to step up in WA and SA as harvest is underway and exporters have sales positions they need to cover. The shipping slots are well sold for the first half of 2024 with traders having reportedly already committed 2-3 million metric tonne (MMT) of new crop wheat into China as well as additional sales into other markets.

China has managed to snap up as much old and new-crop Australian wheat as it could over the past couple of months and was active again last week. However, with prices increasing on the back of the El Niño and building drought conditions across much of the country, competitiveness has decreased, particularly in the east. One would imagine their focus will shift to cheaper originations as well as sellers becoming reluctant to go shorter to the grower.

China’s demand for Australian wheat also had to compete for late-season elevation capacity renewed demand for Australian barley after the anti-dumping tariffs and countervailing duties imposed in May 2020 were axed back in August. China resumed barley purchases almost immediately and it could be said that China has truly come to the rescue in terms of providing strong early season demand in an otherwise subdued international market that is buying on a hand to mouth basis.

Australian Harvest Update:

Over 20% of Australia’s total winter-cropping area has now been harvested. Wheat harvesting in Central Queensland (QLD) is close to finished and is progressing in WA's Geraldton zone, where yields have been below average because of limited in-crop rain.

Favourable weather saw harvest pace accelerate last week in southern QLD and northern and outer central New South Wales (NSW), where yields have generally been average or below.

Rain earlier this month in SA, Victoria (VIC) and southern NSW has either consolidated yields or improved them, particularly in VIC and southern NSW and our supply and demand update below reflects that.

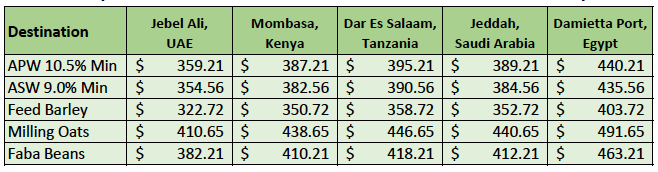

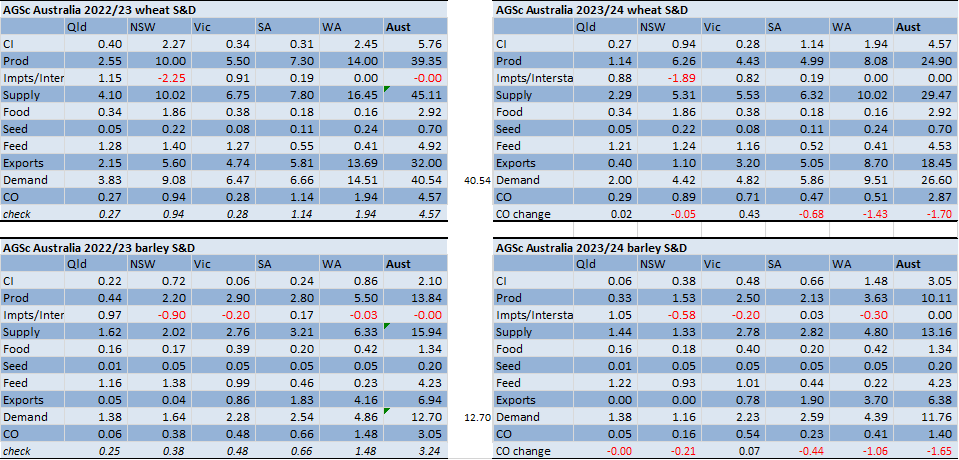

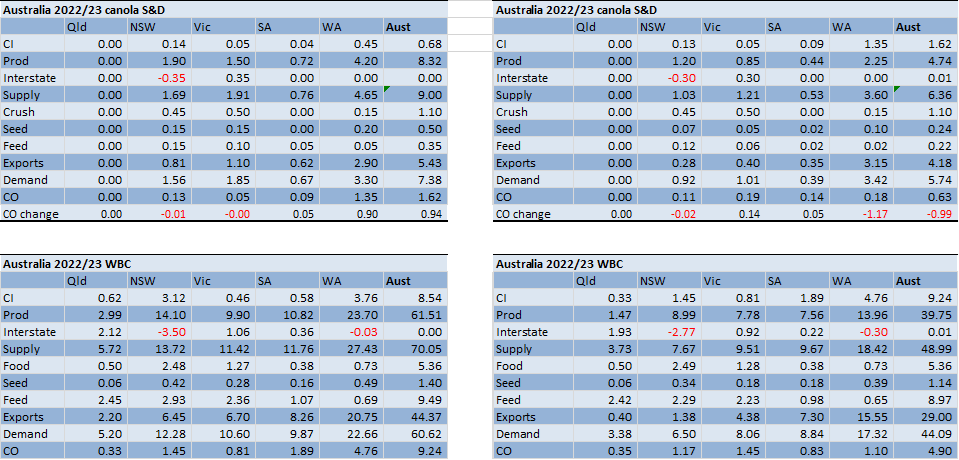

Australian Supply and Demand Update:

We have raised the Australia’s 23-24 wheat production to 24.9MMT, which is 1MMT higher than the last update. Barley has been lifted to 10.1MMT. Most of the increase is in VIC and southern NSW, but other regions have also been edged higher. After some patchy hot weather in September, temperatures moderated for most of VIC and southern NSW which allowed for a gradual crop maturation, making the most of the available moisture. VIC NDVI’s are below last year but remain historically relativly high. This should allow for well above average yields. The GIAV is reporting on its recent crop tour across VIC and southern NSW which we expected to see average to above average yields for wheat, barley and canola.

The finish for SA and WA hasn’t been as kind as seen in Vic and southern NSW. October temperatures have been warmer than seen across southeast Australia and they didn’t benefit as much from the rain event in the first week in October. This is evident in the NDVI’s for SA and WA which have fallen away sharply in recent weeks.

The larger wheat crop will allow for more exports. We have raised Australia’s 23-24 wheat exports to 18.4MMT. Wheat stocks through QLD and NSW will remain tight but more comfortable in VIC, SA and WA. Even so, we are reluctant to push the exports any higher given national stocks are down below 3.0MMT. Barley exports are >6MMT with the bulk of this expected to head to China. We have canola exports at 4.2MMT.

Domestic demand assumptions are unchanged. Feedlots in southern QLD and northern NSW are set to remain full. Barley continues to enjoy a significant proportion of the feed grain diets in all states.

Ocean Freight and Export Stem

Last week was a really dull week with rates falling off their recent highs. Given how little fresh business reached the market last week we had expected the market to fall away quickly, but it has managed to remain relatively stable. We are not yet in a definably "weak" market but if the quiet spell continues rates must inevitably come under pressure. Most of the Baltic indices are a tale of two oceans and are reflective of what we are seeing at the coal face. In simple terms, the Atlantic is firm, the Med & Indian going sideways and the Pacific is weaker. Australia itself has been uninspiring. There aren't many ships open on the coast now but likewise, there isn't a great deal of demand.

There was approximately 300KMT of wheat and 100KMT of barley added to the stem in the past week. Exporters aren’t seeing significant demand at this stage of harvest, however, the new crop demand has started to emerge in recent weeks. More demand will with both the CBH and Viterra stems are close to fully booked through to May. WA and SA accounted for all the weekly stem additions with nothing added on the east coast ports. Several Panamax vessels were added to the stem in both WA and SA which are expected to be against the recent barley sales into China.

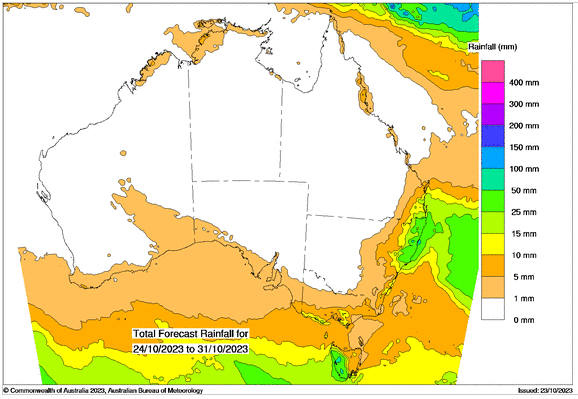

Australian Weather

8 day forecast to

31st October 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to

23rd October 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar was slightly weaker to close last week when valued against the USD. Risk-aversion amidst heightened tension in the Middle East weighs on the AUD/USD, which trades at 0.6318, down 0.17. In other news, the Australian share market plunged on Friday to finish the week 2.1 per cent lower as traders worry about the ongoing conflict.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.