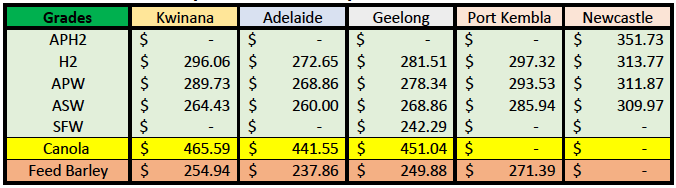

Australian Crop Update – Week 41, 2023

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

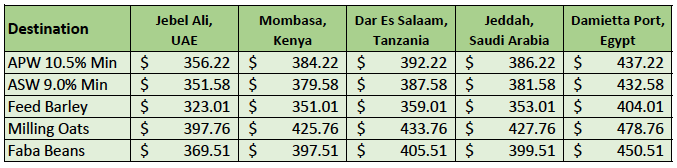

New Crop - CFR Container Indications PMT - LH Nov/Dec'23

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Australian domestic values were softer last week after the recent rains across Southeast Australia solidified production forecasts. Domestic markets were extremely quiet with buyers pulling bids following the recent rain. Buyers are running hand to mouth as they wait for farmer selling to advance as harvest approaches the southern cropping belts. However, with the prospect of El Nino in the background it feels like grower selling is muted and is behind where it normally is for this time of year. On the demand side, there was talk of up to 700 thousand metric tonne (KMT) wheat purchases from China but none of this could be confirmed.

In terms of harvest progress, northern areas are progressing well, mostly barley and canola, but recent rains across the southern half of the country and cooler temperatures have slowed harvest timings by one to two weeks. That said, it will still be a relatively early harvest with southern New South Wales (NSW) and Victoria (VIC) likely to start late October or early November.

Harvest is underway in Western Australia (WA), but it is very early days. Early yields have been variable, with some growers reporting crops have come in slightly better than expected. Farmers in WA’s southern cropping regions remain optimistic that they are on track for above-average yields.

In terms of exports, Australia exported 359,392 metric tonnes (MT) of canola in August, down 15 percent (pc) from the 424,153MT shipped in July, according to the latest data from the Australian Bureau of Statistics. Japan on 130,411MT followed by France on 124,324MT and the United Arab Emirates on 61,375MT were the three largest markets for August-shipped canola.

Ocean Freight and Export Stem

The stagnant atmosphere from the close of last week has pushed into this week and activity feels subdued. We are seeing a little more tonnage hit the market, although the level of cargo enquiry seems about the same. Monday to Wednesday last week had a very strong feel with cargo interests chasing tonnage and rates pushing quickly, but as of Wednesday afternoon, the activity died away and has not returned. It feels like levels have dropped back to what they were 10 days ago. The Atlantic looks steady - enough enquiry balanced with the tonnage supply - but rates on Panamax have been at slightly lower levels. Stepping back for a moment, it feels like the market is searching for a direction. Notable is the number of stems being quoted from Black Sea ports - more than we have seen for a considerable period of time. The Pacific was very quiet at the back-end of last week and even though coal stems are still being talked up, it feels like everyone is taking a breather.

There was a little more traction and balance to the shipping stem additions in the past week as more new crop wheat and canola vessels appeared. There was 444KMT of wheat added to the stem with 354KMT coming from WA. Most of the WA wheat additions were new crop. First half November loadings started being put on the stem last week along with 200KMT of canola. More than half of this was WA but there were also cargoes from VIC and NSW. Barley additions slowed to 85KMT in the past week down from an average of 240KMT over the previous three weeks.

WASDE

report summary

USDA raised US wheat production by 2.1 million metric tonne (MMT) to 49 MMT on the back of the changes already reported in the Small Grains report about 10 days ago. US stocks were increased by 1.5MMT to 18.2MMT. Exports were unchanged at 19.1MMT while feeding was increased. World highlights included Russian production unchanged at 85 while exports were raised 1MMT to 50MMT. Australia was down 1.5MMT to 24.50MMT with exports cut by the same amount to 17.50MMT. Canada 31MMT, Argentina 16.5MMT, and Ukraine 22.50MMT were all unchanged and Kazakhstan production was down 2MMT mil to 13MMT. Lastly, Chinese imports were unchanged at 11MMT.

Corn saw yield and crop reductions in the US offset by higher production globally, due to increases in EU and Argentina. Here we did see demand go up marginally for once (even though US demand went down). The net result was a tighter stocks situation and tighter stocks to use. US corn yields were cut by 0.8 bpa to 173.0 bpa. This was below market expectations with some privates expecting there could have been a slight increase. The US carry in stocks were cut by 90 mill bu. This was partially offset by a 25 mill drop in 23/24 feeding and a 50 mill bu drop in exports. US corn ending stocks were cut by 2.11 bill bu from the 2.22 bill in Sept. US corn exports still look a stretch with the sluggish demand for US supplies. Improved US corn exports are likely to hinge on a weather problem in South America. South American 23/24 crop assumptions were edged higher. Brazil’s corn crop is forecast at 129MMT which is down 8MMT on LY with Argentina up 1.0MMT at 55MMT which is 21MMT more than LY. Global 23/24 corn was unchanged at 187MMT, up 12.8MMT on 22/23.

World barley production was close to unchanged. Australian production was lowered by 0.3MMT to 9.7MMT. Kazakhstan was also cut by 0.3MMT to 2.7MMT. EU production was edged higher. World trade was raised by 0.8MMT to 27.2MMT which is still down 3.1MMT on LY. Russia’s barley exports were raised by 1.1MMT to 5.8MMT which is 1.3MMT more than LY. Australia’s barley exports were down 0.3MMT to 5.2MMT. Saudi imports unchanged at 4.1MMT and China imports unchanged at 7.5MMT.

Beans were bullish with less production (and US solid yield reductions), higher demand and lower stocks as well as significantly lower stocks to use ratios. US soybean yields were cut by 0.5 bpa from the September report to 49.6 bpa and below the average estimate of by 0.3 bpa. The US crush was raised slightly on the back of the biodiesel demand. At the product level, USDA increased the amount of soyoil used for biofuels 2%. US exports were lowered by 35 mill bu and ending stocks were unchanged at 220 mill bu. The average farmer price was unchanged at $4.90/bu. Globally, Chinese imports were unchanged at 100MMT. South America’s production forecasts were unchanged. Brazil’s 23/24 soybean crop is forecast at a record large 163MMT, up 7MMT from LY. Argentina’s 23/24 crop is forecast at 48MMT, 23MMT more than LY’s drought crop.

Canadian canola production was reduced by 0.4MMT to 17.8MMT. This resulted in a 0.4MMT reduction in exports to 7.5MMT which the crush was unchanged at 10.1MMT. Australia’s canola crop was unchanged at 5.1MMT with exports steady at 5.2MMT. EU production was raised by 0.3MMT to 20MMT with imports down 0.2MMT to 5.1MMT, down 1.6MMT or 23% from LY’s 6.8MMT. World trade was lowered by 0.45MMT to 17.0MMT, down 3.2MMT or 16% from LY. Ukraine’s crop was unchanged at 4.3MMT vs LY’s 3.5MMT. Ukraine’s exports were unchanged at 3.8MMT up from 3.4MMT LY. Global stocks edged higher.

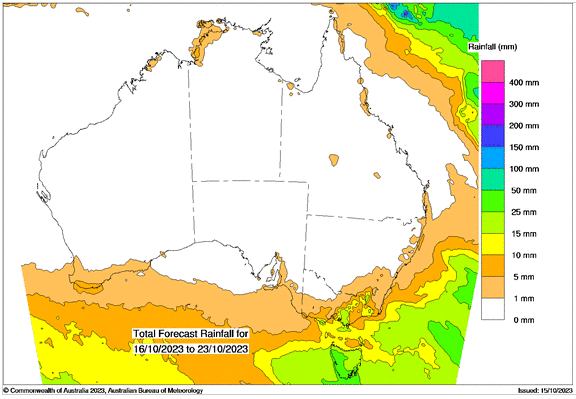

Australian Weather

Cooler temps through October will help crops maximise yield potential instead of having the crop prematurely shut down by extreme heat. This should help the southern cropping zones in particular, which are still green and where most areas had a reasonably favourable growing season.

8 day forecast to 23rd October 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 16th October 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Aussie Dollar touched a weekly low of 0.6289 courtesy of a risk-off sentiment even after the release of negative data from the United States. Australia witnessed a rebound in inflation in August, largely driven by elevated oil prices. This resurgence raises the probability of another interest rate hike by the Reserve Bank of Australia (RBA). The ongoing geopolitical tensions in the Middle East would continue to favour flows toward safe-haven assets, to the detriment of risk-perceived currencies, like the Aussie Dollar. The AUD/USD pair is currently trading around 63 US cents.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.