Australian Crop Update – Week 40, 2023

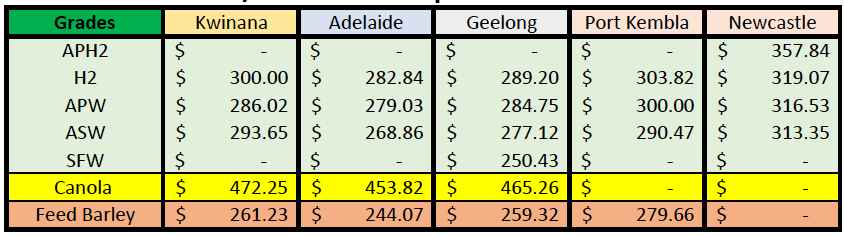

2023/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

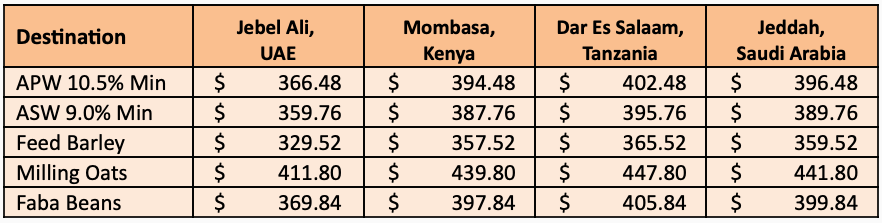

New Crop - CFR Container Indications PMT - LH Nov/Dec'23

THE BELOW PRICES ARE INDICATIONS TO THE MAIN CONTAINER DESTINATION, NOT FIRM OFFERS. TO OBTAIN SPECIFIC PRICING FOR SPEICIFIC GRADES AND QUALITIES, PLEASE CONTACT STEVEN FOOTE ON STEVEN@BASISCOMMODITIES.COM.

Australian Grains Market Update

Rain across most of Victoria (VIC) and Southern New South Wales (NSW) in the past week has helped sure up yields in these areas and for the time being at least, put pressure on domestic grain prices. Rainfalls were steady and beneficial. NSW received light rain in the north (10-20mm) which was too late for winter crops with farmers already into harvest although it did cause some delays. Farmers in these areas are looking for more substantial rains to plant summer crops.

South Australia (SA) received some patchy rain. This included light showers across the Eyre Peninsula, the Lower North and Adelaide Plains as well as heavier rains of 15-25mm in the Upper North. Cooler temperatures and showers across SA still offer some modest yield assistance. Western Australia's (WA) Great Southern and the coastal areas of the Esperance zone also got some light showers although this was limited to 5-10mm.

On the cash side of things, some Asian wheat millers were looking for cover with the post rain sell off and China continues to be active across all grades which is supporting the market. Barley prices were also softer against ample suppliers of black sea barley into the Middle East and softening CFR China bids as local traders there assessed prices against domestic corn prices as the harvest came online. Canola markets remain under pressure from the weakness in vegetable oil markets and ample oilseed supplies in the EU. Europe appears to be swimming in oilseed supplies with the Ukraine sunflower seed harvest coming in much larger than expected.

Finally – We saw this ASX Basis chart last week and thought it would be interesting to our readership. White is Chicago Dec 23 and Orange ASX Jan 24. What’s interesting is basis has not been this wide since the last drought and it again reinforces the importance of timing in procurement.

Australian Export Statistics Update

Australian wheat exports dipped below 2.2 million metric tonne (MMT) in August down from 2.68MMT in July and 2.56MMT in June. WA wheat exports remain strong at 1.38MMT, but other states are declining, and this is being led by NSW and Queensland (QLD). The August exports have lifted Australia’s Oct22 to Aug23 exports to 30.3MMT with a month remaining in the 22/23 marketing year. Indonesia was the largest destination with 767 thousand metric tonne (KMT) in August. China was the next largest destination with 340KMT. This lifts China’s Oct/Aug shipments to 7.36MMT up from 5.85MMT for the same period last year. Vietnam was the next largest with 230KMT.

Australia exported 350KMT of barley in August down from 365KMT in July. The most notable feature was the 55.7KMT of malting barley shipped to China. It was the first shipment to China since November 2020. Mexico also took a further 33KMT of malting barley in August. Japan was the largest barley destination with 166.4KMT.

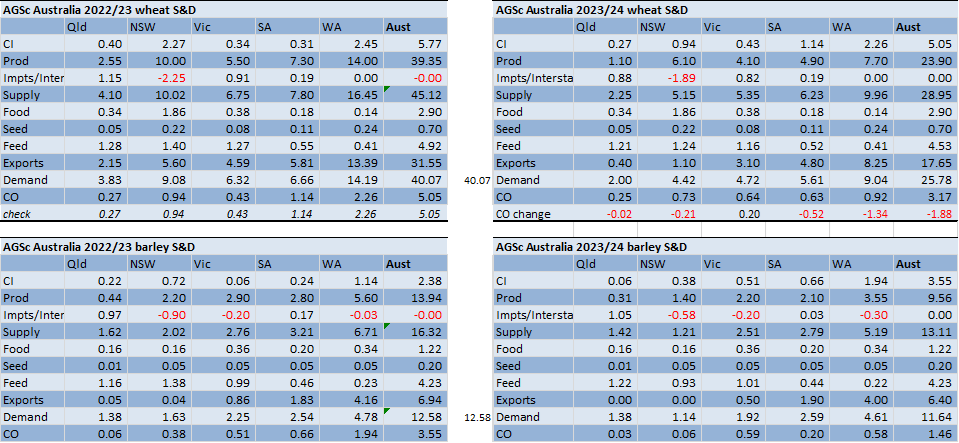

Australian Supply and Demand update

The rain created more certainty about crop size which had been sliding with the dry weather over the proceeding 45-60 days and consequently, we have included an Australian balance sheet update. We put the national wheat crop at 23.9MMT and barley at 9.5MMT

Ocean Freight and Stem Update

It's probably too early to be making definitive calls on the freight market post Golden Week, but the early signs suggest more of the same freight rate wise. Ostensibly there isn't much going on - we haven’t seen an avalanche of enquiry nor ships pushed into the market, but the underlying tone is positive. The smaller classes in Southeast Asia look very tight on tonnage and charterers are quietly trying to fix without stirring up the market. Early worries about fuel prices also figure strongly from cargo interests who shorted the market in anticipation of weaker rates post Golden Week only to see oil prices up heavily due to the fighting in and around Gaza. On the derivative (FFA) market there is a touch more positivity to come for October and November, with some relief likely in December.

Probably more important to the wider market is a firm Atlantic basin - especially long-haul cargoes to Asia and India from ECSA and USG. As long as these two areas keep drawing in tonnage the ocean freight market is likely to remain firm.

Last week’s shipping stem additions saw 494KMT of grain added to the stem in the past week. Barley made up the bulk of this with 303KMT. Most of this was in WA but SA and VIC saw additions also. There was also 181KMT of canola put on the stem in the past week with most of this in WA. Wheat was at the other end of the spectrum with just 10KMT added last week!

Pulses

Prices for chickpeas have hit a high not seen since early 2020 with harvest underway in Central Queensland (CQ). CQ will this year be the origin for most of Australia’s 2023-24 chickpeas, as dry conditions limit production in southern QLD and northern NSW. While ABARES on Sep 5 forecast Australia’s 2023-24 (Oct-Sep) chickpea crop at 533,000 metric tonne (MT), down from 544,000MT forecast in June, traders are now expecting a crop of less than 500,000MT or even smaller.

Faba beans are beginning to be harvested in the north but most will end up in the domestic feed market which will leave the southern faba beans to meet export demand when it comes. With Egypt still battling foreign exchange issues this demand is not necessarily assured, for bulk at least. ABARES’ forecast for new-crop faba beans at 447,229MT looks realistic at this stage.

Finally, lentils harvesting is underway in the south with the quality supposedly exceptional although there does seem to be a stand-off between grower and consumer for the time being after the early rally saw prices of over 1000 AUD a tonne delivered to port on the back of Indian import changes. The conventional wisdom is that with a reduced Canadian crop the grower has a better hand this year and ABARE’s estimate of 2023-24 lentil crop at 1.2MMT is in line with trade estimates.

Australian Weather

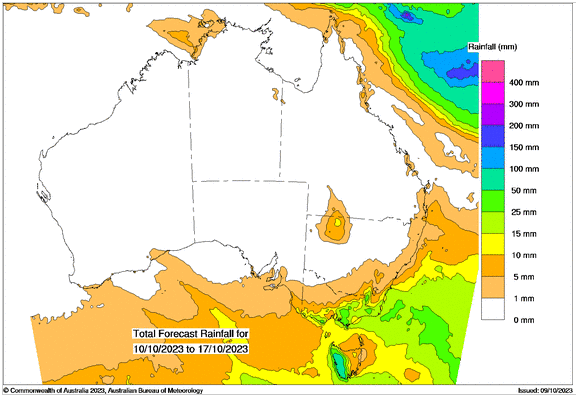

There was 15-40mm of rain across NSW with the heaviest of the rain in the central parts of the state. This will stop the yield decline in these areas and even boost yields towards the east of the state. There has been some permanent yield loss in the south with farmers saying wheat potential is down 25-33% since the start of Sept, although that’s from well above average yields. Rainfall totals in VIC were scattered with heavy rains in the central and northern areas. SA received some patchy rain. WA also got some light showers although this was limited to 5-10mm.

8 day forecast to 17th October 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 3rd October 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar was slightly weaker to close off the week on Friday valued against the USD. The Aussie dollar on Friday traded higher around the 64 US cent level after catching a bid that sent the US Dollar (USD) lower across the FX market as risk appetite flipped to close out the trading week. The AUD/USD pair had faced an intense sell-off to near 63 US cents after the better-than-projected Nonfarm Payrolls (NFP) report. The market sentiment shifted into a bearish trajectory as the expectations of one more interest-rate hike from the Federal Reserve (Fed) have accelerated. The AUD/USD pair is currently trading at 0.6351.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.