Australian Crop Update – Week 39, 2023

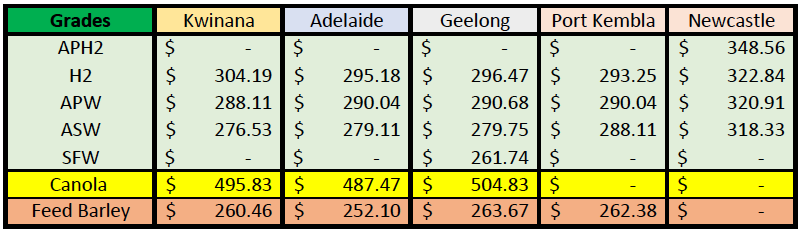

202/2024 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

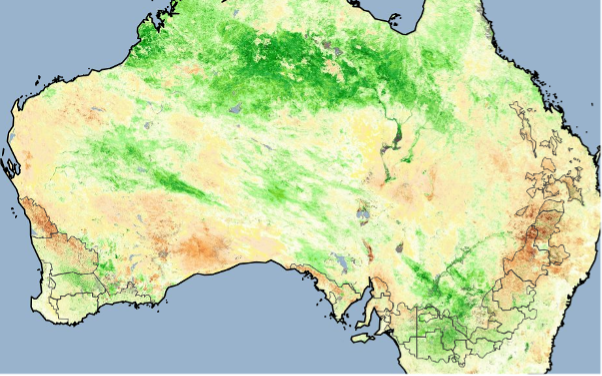

The Australian normalized difference vegetation index (NDVI) crop conditions continued to slide as drier weather intensifies. Central New South Wales (NSW), some parts of Victoria (VIC) as well as parts of the northern regions of Western Australia (WA) all posted 10-14% weekly declines in the NDVI measure. Anecdotal evidence on the ground shows that crops in these areas are poor and many crops are unlikely to be harvested.

With that said, we currently have a useful rain band moving across much of VIC and NSW which will deliver much-needed finishing rain. In terms of cash values WA bids to the farmer from the trade were broadly softer. APW10.5% was down 2.2% for the week which we expect was a reaction to the forecast rain in Southeast Australia and thin export demand for wheat at current values. Barley fell 6.7% back US$16 to US$254 WA. There are likely to be a few things contributing to this with barley and canola crops handling the dry finish better than wheat and proportional production losses will be smaller because of this. We expect the other factor is that China has little appetite for feed barley at upwards of $290 Cost and Freight (c&f) China. China has started harvesting its own corn crop which offers fresh feed grain supplies to the local market. China also reportedly bought 0.5-1.0 million metric tonne (MMT) of corn from Ukraine for an Oct/Dec shipment in the past couple of weeks at values expected to be considerably cheaper than Australian feed barley. Ukraine corn is the cheapest corn in the world but it’s unclear at what value China has bought it at. Brazilian corn is currently around $280 c&f China.

Australian Pulse Market

Ocean Freight Market Update

Regional holidays in Australia and Golden Week in Asia have produced a very quiet week so far. All indices (excepting Capes) are lower as the physical markets respond to China’s lack of activity. In general, daily hire rates for all sizes are off US$1-2k per day. It is likely the market will remain listless for the remainder of the week, and we'll only know the underlying strength/weakness of the market mid-next week.

There were 365 thousand metric tonnes (KMT) of wheat, 152KMT of barley and 20KMT of canola placed on the shipping stem in the past week. The wheat was primarily in WA with single cargoes added in South Australia

(SA) and VIC. Nothing was added in Queensland (QLD) or NSW.

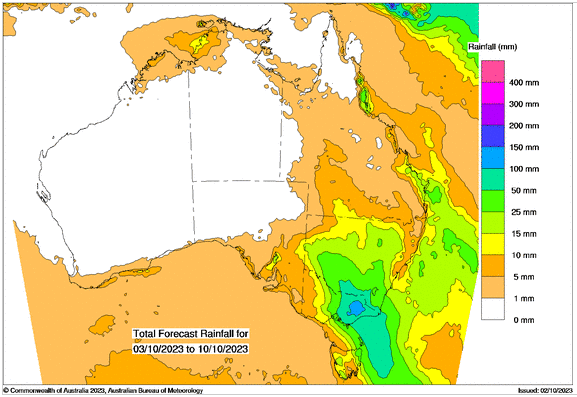

Australian Weather

Australia posted its driest September on record with the onset of El Niño expected to bring more warm weather ahead. The nation’s total rainfall was 70.8% below the average for September, according to Australia’s Bureau of Meteorology

The forecast rain will help crops arrest the decline in crop conditions in the southern cropping areas. Southern crop vegetation anomaly ratings are still 2-6% ahead of average.

8 day forecast to 10th October 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 3rd October 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

An eventful quarter concluded following the end of Friday's sessions for the AUD. One of the major storylines from the September quarter was the US dollar's utter dominance, catapulted from mid-July lows amidst a sustained run of superior macro data flow, emblematic of sustained outperformance for the world's largest economy. The final two trading days of the month and quarter have seen the US dollar give back some of its gains, in turn enabling the Australian dollar to rebound from year-to-date lows in the 0.6330’s to peek through 65 US cents heading into Friday's US session.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.