Australian Crop Update – Week 39, 2024

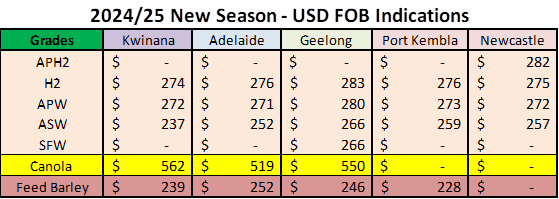

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Domestic grain markets were mostly steady over the past week. Early barley harvest has started in southern Queensland (QLD) which has pressured local markets for harvest deliveries as old and new crop prices merge. Australian wheat basis vs CBOT has come under pressure with the rally in CBOT. This isn’t making it any easier to sell Australian wheat, but it does ask the question of consumers who are sticking with hand to mouth purchases while missiles are flying in the Middle East and dry weather is threating the new crop Black Sea production outlooks through reduced planting.

Wheat harvest is still another one to two weeks away from starting. Early yields in southern QLD have been variable ranging from above average to well above average. It’s going to be a large crop in QLD and New South Wales (NSW) with a large export surplus. Exporters are showing no willingness to chase farmer purchases with Asian markets still reluctant buyers. In addition, farmer selling is very limited across the board and values won’t get tested until we get closer to harvest which is still a few weeks away in the main areas. Sentiment seems to suggest that the crop that does come out of South Australia (SA) will be higher protein. Western Australia (WA) is shaping up to be low protein crop, and there is still a lingering concern that the La Nina could lead to downgrades in NSW if the rains come at the wrong times.

There were a couple of other interesting developments during the week. Cargill agreed to sell GrainFlow sites at Maitland, Crystal Brook, Mallala, Pinnaroo and Dimboola in Victoria to Viterra. Cargill also sold its mobile ship loader at Port Adelaide to Viterra. Viterra said they would incorporate the facilities into its existing SA network. The Dimboola site will give Viterra significantly more exposure into Victoria. In addition, the government extended the Wheat Port Code for another two years. The government said the extension to the code would give the industry more time to come up with an alternative framework to replace the code.

Pulses Update

Lentils have jumped USD50 per metric tonne (/MT) in the past three weeks on expectations of significant frost damage particularly to the stressed SA crop. ABARES put the combined Victorian (VIC) and SA lentil output at 1.65 million metric tonne (MMT) in the September Crop Report, but it’s now expected to fall well short of this with losses of over 500,000MT being talked about.

We just spent some time travelling from Adelaide to Melbourne and can report that crops on the SA side of the border are struggling but central and southern western VIC seem to be in better shape from a pulse perspective.

Export Stem and Ocean Freight Update:

There was 121 thousand metric tonne (KMT) of wheat, 30KMT of barley and 13KMT of canola added to the shipping stem in the past week. Additions are for a late October to early November loading.

As expected, the shipping market was active at the start of the week with participants eager to be covered early before tapering off as the Chinese Golden Week neared.

In the Panamaxes we did start to see rates ease after a couple of weeks in the green in both basins as negative sentiment creeped in with the impending holidays. There was a lack of urgency from charterers to engage which caused owners to start revising their offer levels down in the hope of getting booked.

The Supramax sector in the Atlantic found support in the USG however the other regions struggled with little fresh cargo appearing to maintain the levels. The Pacific found support early in the week, especially in Southeast Asia, with a notable increase of Indonesian coal which caused rates to improve by 2-3kpd for rounds. But again, by weeks end, this activity slowed and we found rates retract to their initial levels.

The Handysize experienced moderate gains over the week with increased levels of fresh cargo appearing in both basins. With China being off this coming week we are expecting fixing activity to slow down for the remainder of the week.

Australian Weather:

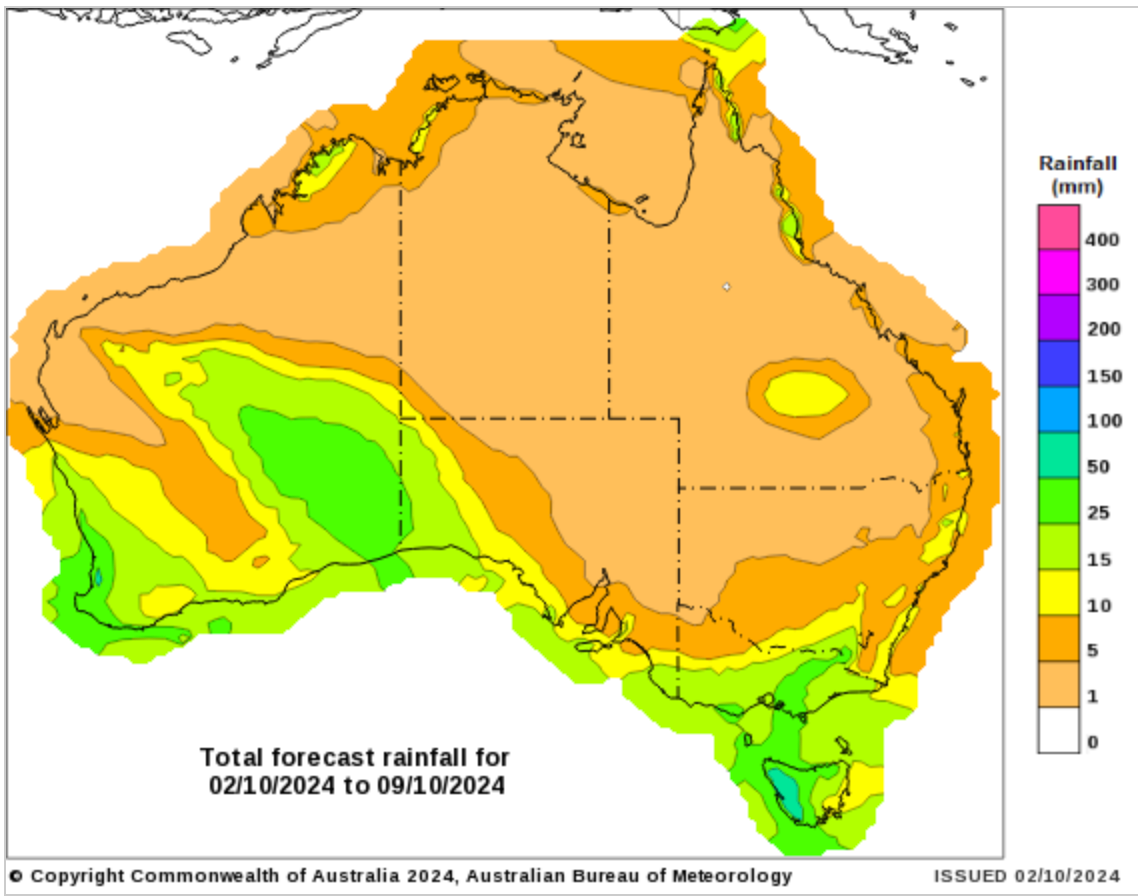

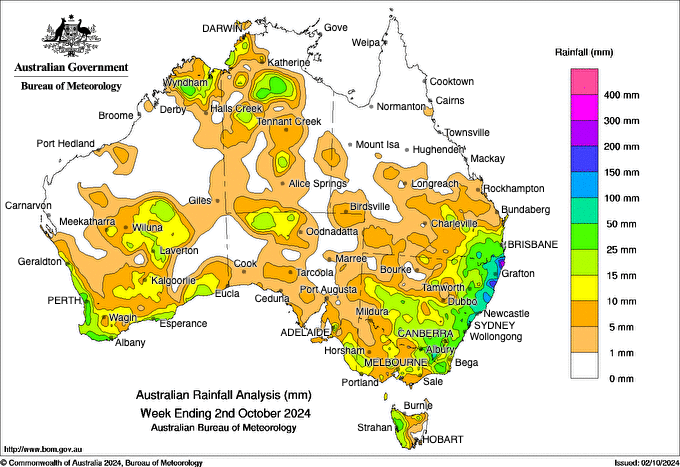

NSW received some rain last week recording 10-30mm. Southern QLD also received some light showers with most seeing 5-15mm. VIC cropping areas largely missed out apart from some light showers of 2-4mm. SA was much the same where most areas saw 2-5mm. The WA Great Southern and Esperance zones have received ~10-12mm of rain over the past week. Not as much as farmers wanted to see, but still beneficial for crops. Nonetheless, any rain is beneficial, and it will help fill crops which have been starved of moisture during September.

Veg index data showed a general improvement in NSW (week of 21-28 Sep). The northern half of the state is 13-15% better than average at the start of October and it saw rain last week. the southern half of the state isn’t as good, but the Murrumbidgee region received rain last week. This should lock in a big NSW crop. VIC veg index measures were steady last week but it’s not as bad as SA’s Murray Mallee, Yorke Peninsula (YP), Mid North (MN) and northern areas where some crops won’t get harvested and sheep are already in the paddocks. VIC will still benefit from October rain. SA conditions, apart from the Eyre Peninsula (EP), were sharply lower last week. The Mallee and YP/MN conditions declined sharply last week which reflects crops are running out of soil moisture. The EP veg indexes improved last week and most areas apart from west of Minnipa are better than average.

WA veg index ratings declined but are above average at the start of Oct. Geraldton, Kwinana and northern Great Southern (GS) zone are well above the average. Southern GS and Esperance are holding above average.

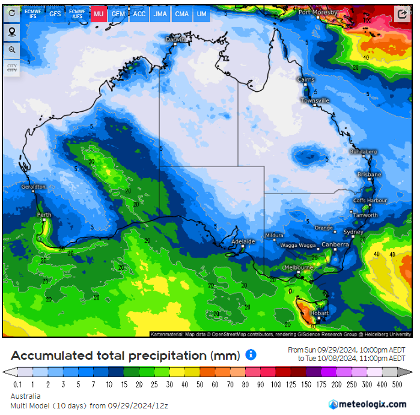

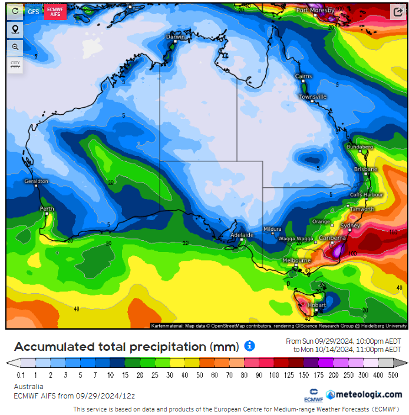

8 day forecast to 9th October 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 2nd October 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to finish last week when valued against the USD closing at 0.6898. The AUD/USD gained traction on Friday. Optimism surrounding China's stimulus measures, including monetary easing by the People's Bank of China (PBOC), provided support to the Australian dollar and boosting risk appetite among investors.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au