Australian Crop Update – Week 38, 2024

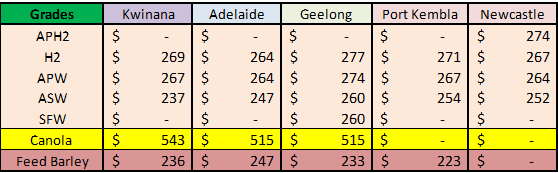

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian domestic markets are becoming more volatile in the past week following frost damage across New South Wales (NSW) and parts of Victoria (VIC) and South Australia (SA) plus ongoing dryness in the south. Old crop supplies are hard to buy which is creating a premium again for old crop values vs new crop and making it difficult to secure logistics before the end of November/December. New crop values were generally steady in Queensland (QLD), NSW and Western Australia (WA) but stronger in SA and VIC where production estimates have been hit hardest by the drought and frosts. An absence of farmer selling has also contributed to markets firming as well as the domestic market paying more attention to the recent frost damage in the east and concerns about a major rain system moving across the country. This rain system should impact eastern states from Thursday and could bring more than 25mm to cropping areas with amounts increasing toward the coast. This could be followed by more rain for eastern states around the 4th October. In short, after regaining a level of export competitiveness in late August, Australia has added the premium back in with a dry September and the spectre of rain at harvest and is once again well above Black Sea values into Asia and the Middle East. That said we cannot take our eyes off the fact that Australia is still making a large crop even if there have been some yields affected.

Pulses Update

According to reports, faba bean crops in southern NSW lost flowers to recent frosts while crops in central and northern NSW and southern QLD are generally looking at above-average yields. Most are at the flowering stage and because of their much greater biomass than lentils, anything less than a 20mm-plus rain would do little to rebuild yields following losses of flowers and setting pods. In early September ABARES revised up its forecast for new-crop lentils to 1.7 million metric tonnes (MMT), up around 100,000 metric tonnes (MT) from the previous estimate released in June. However, recent reports also suggest some yield has been lost due to frost and dry weather. That said, SA and VIC will still have plenty of lentils to load on to early shipments, with the Lower Eyre Peninsula in SA and Wimmera in VIC faring the best in terms of yield outlook.

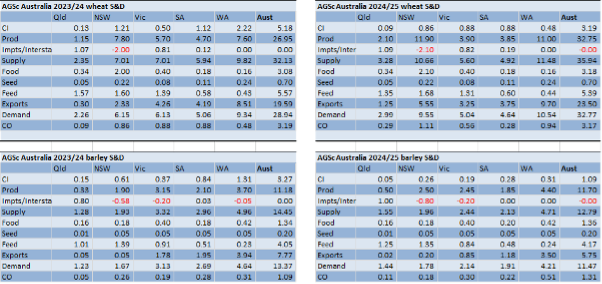

Australia Supply and Demand Update (AgScientia)

Our analysts made some significant changes to the 2024/25 wheat and barley production estimates this week trimming yields in most states. Reductions came from high levels in QLD and northern NSW where forecast yields remain well-above average. The southern parts of NSW didn’t enjoy the same amount of autumn and winter rain and conditions have dried out more quickly. Dry September weather has further lowered yield expectations in SA and VIC. SA has been the most adversely affected but yield expectations in VIC have also fallen in the past month. In WA, yields have lifted on the back of the high sub-soil moisture levels following the well-above average July and August rainfall. Conditions have started to fall in September however the above average yield forecasts in the northern cropping areas are still justified.

Recent frosts in southern NSW, parts of VIC and SA are also likely to reduce yields in these areas in recent days. We won’t know the full extent of the frost damage until harvest reports start to come through but the temperatures that have fallen to below -3 C will do yield damage to crops that were susceptible when they hit. Anecdotal reports from SA indicate that crop conditions have fallen away sharply in the past 10 days. We put this down to crops running out of soil moisture and starting to dry off. National wheat production is back under 33MMT from 33.3MMT in August.

National barley production is down 300 thousdand metric tonne (KMT) to 11.7MMT from 12.0MMT in August. Barley production will feel even smaller due to the smaller crops in SA and VIC which are normally important export states.

Exporters are under sold on wheat and barley heading into harvest and farmer selling is also well behind normal heading into harvest. This time last year China had already bought significant volumes of Australian wheat and barley, but exporters are saying they are showing limited appetite to secure volume ahead of harvest this year.

Domestic demand assumptions remain unchanged. Domestic demand will be strong driven by record high cattle on feed numbers, large poultry usage as well as normal demand from pigs and dairy. Food grain demand for wheat and barley will be steady. The smaller SA grain crop is likely to increase interstate flows as feeders chase interstate grain but also as Viterra looks to draw in supplies to keep assets busy.

Export Stem and Ocean Freight Update:

Despite regional holidays in Asia at the start of the week we found market activity to be higher than anticipated.

Panamaxes gained for the second week. The Atlantic was well supported by fresh fronthaul cargoes appearing in both the north and south which in turn helped trans-Atlantic rounds firm again, with owners having more options to look at. The Pacific was understandably quieter throughout the week but surprisingly the rates didn’t lose any ground as demand remained steady.

Supramaxes were busy in the Atlantic all week with plenty of fixing at last done levels. The Pacific came to life once participants came back to office on Thursday and we saw higher than last done levels on pacific rounds as demand ex Indonesia/Aussie/Nopac remained strong.

It was a mixed week for the handysize market. South Atlantic was quiet and lost ground while USG and Cont/Med was busy with moderate gains achieved. The Indian Ocean was quiet while in the Pacific has seen a clear out of prompt tonnage which has caught some charterers out who were hoping for a cheap deal around the holidays.

Looking forward, we are now on the doorstep of China's Golden Week holidays next week so we are expecting activity to remain high in the near term.

Weekly shipping stem additions remain quiet, which is to be expected for the time of year.

There was 84KMT of wheat added to the stem. This was made up of October loadings from Newcastle NAT (59KMT) and 25KMT of wheat for a late October loading from Albany.

There was 60KMT of canola put on the stem which was in two vessels for a late October loading from Kwinana and Esperance.

There was also 50KMT of sorghum put on the stem for Newcastle NAT (late Sep load).

Australian Weather:

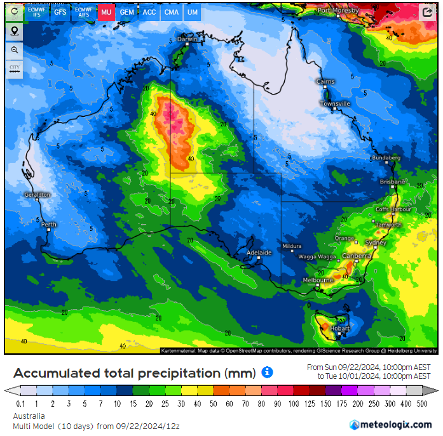

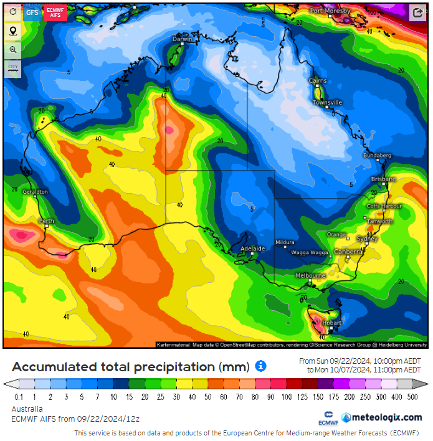

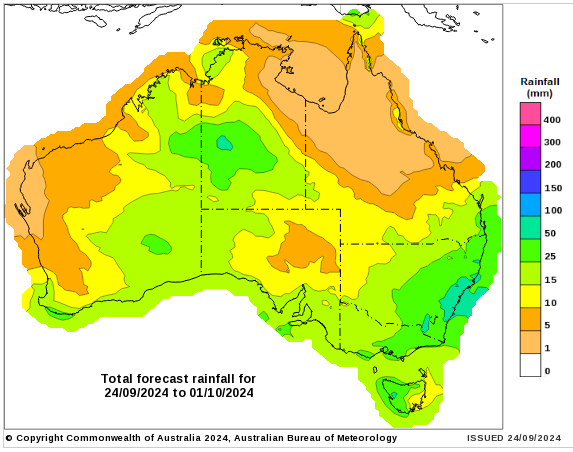

Unseasonally heavy rain is already falling in WA and is forecasted to develop into a deepening broad low-pressure trough through the week bringing widespread rain to central and eastern Australia in the next 10 days. Although forecasts are varying daily, they are consistently predicting heavy falls for most of SA, VIC and NSW cropping areas. They are less certain about how much rain WA’s cropping areas will see, if any.

The nearby models continued to bounce around on where the rain will fall. The trough is expected to start developing in central NSW by the middle of the week and then draw moisture from central Australia across the state and then expand across the eastern seaboard.

Forecast from 22/9/2024 to 1/10/2024

Forecast from 22/9/2024 to 7/10/2024

8 day forecast to 1st October 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 24th September 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was slightly weaker to finish last week when valued against the USD closing at 0.6789. Despite the mixed Australian economic outlook, the Reserve Bank of Australia's (RBA) hawkish stance on inflation has led to market expectations of a modest 25-basis-point rate cut in 2024.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.