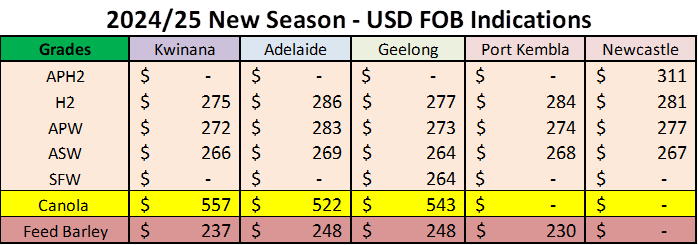

Australian Crop Update – Week 40, 2024

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Harvesters have just started rolling in the western regions of New South Wales (NSW) and Queensland (QLD) with early crop barley the first to come off. This is slightly earlier than expected but the past week of warm weather and limited rain has brought the crop in early. As expected, initial yields in these areas are good and quality so far has held up even with the dry finish. Chickpeas in southern QLD and northern NSW are two to three weeks away from harvest starting and the market is keeping a keen eye on the weather forecast as a cold change is due late this week with associated rain

Domestic markets were firmer last week across all states. ASX wheat was only modestly higher for the week. Track markets were firmer in all states. In general, domestic trade has been slow to engage with both grower and domestic trade, are keen to see what quality profile eventuates before extending coverage.

We will update our balance sheets in mid October, but we still expect the crop to be modestly higher than 30 million metric tonne (MMT). We expect the dry finish and frosts has probably taken about 1MMT off the NSW crop in the past month from our 11.9MMT forecast in mid September.

Light showers last week are helping the slow decline in veg index levels across southern QLD and NSW. Yield potential has declined in the recent weeks but remains high. Showers in the Murrumbidgee (5-10mm) steadied veg indexes and they were increased in central Victoria (VIC) (5-10mm LW). The big issue for NSW is how much crop has been lost to frost. We’re expecting there could have been ~0.5MMT of wheat production lost (15% Murrumbidgee, 5% Murray and 5% Central West). Anecdotally, canola and barley losses are worse than wheat. VIC veg index ratings were steady in the Mallee/Wimmera and slightly better through central VIC. Overall VIC measures are slightly better than average. Drive by reports from VIC support the average outlook. Observers have reported significant variability amongst the crops within regions just depending on where the showers have fallen. South Australia (SA) NDVI measures continued to tumble last week (29 Sep to 6 Oct). Murray Mallee and YP/Lower North are -8% below average while the northern area is -15%. 2018 looks to be the analogue season where the Mallee and northern will be doing well to average 1.0t/ha. Large areas won’t be harvested. On the Eyre Peninsula (EP), crop conditions declined on the upper EP, but the lower EP benefited from showers. Overall, the EP veg index ratings are slightly above average. A reasonable EP should help the total SA wheat output hold above 3.0MMT. Western Australia (WA) veg index measures were also close to unchanged last week except for Esperance which fell. The Great Southern was 2% higher following last week’s showers. Geraldton, Midlands and upper Great Southern are all 7% above average which is good for the first week in Oct. The mild finish has helped crops in WA. The dry finish has trimmed yield potential, but we are still expecting above average yields across most of the state.

Australia’s export competitiveness into Asia is improving based on Black Sea wheat values firming rather than the local basis tumbling and this continues to suggest the Australian grower is a reluctant seller. It is still difficult to connect with overseas buyers, but the gap is closing. Another factor that may support Australian export sales in the coming months is the freight risk for getting Black Sea wheat into Asia which is increasing with the conflict in the Middle East. An increasing number of owners are now refusing to send their vessels through the Suez and Red Sea route. Interestingly, the consumers attitude seems to be at least accepting that the seasonal low is now in place and price risks lay more to the upside.

ABS released the August grain exports last week. There was 1.212MMT of wheat exported in August down from 1.478MMT in July. VIC was the largest wheat export state in August with 375 thousand metric tonne (KMT) followed by WA with 330KMT. This lifts Australia’s Oct/Aug wheat exports to 18.8MMT with one month remaining in the 2023/24 marketing year. Wheat shipments to China have collapsed in recent months. There was 10.9KMT of wheat shipped to China in Aug following the 3.7KMT in July. Philippines was the largest destination with 257KMT followed by Indonesia with 231.5KMT. Yemen was the only other destination with more than 100KMT (105KMT).

Barley exports were 310.5KMT, modestly higher than the 303.7KMT in July. Malt barley exports exceeded feed barley shipments for the second consecutive month.

There was 294KMT of sorghum exported in August. China accounted for 265KMT of this with 25.3KMT also shipped to Japan. There was 131KMT shipped from Brisbane, 33KMT from Gladstone, Newcastle 112KMT and 16.5KMT from Sydney.

Canola exports for August were 375.5KMT, slightly down on the 386KMT in July. WA shipped 155KMT and VIC 150KMT. Japan was the largest destination with 120.1KMT, the UAE with 90.7KMT, then Pakistan with 95KMT followed by Bangladesh with 55.5KMT. No canola was shipped to Europe.

Pulses Update

While plans are being made to export a mammoth chickpea crop out of NSW and QLD – consumers need to be aware that this may keep wheat off the stem until January.

The fava bean crop is a tale of north v south. In the north farmers started to take in the crop and reports on the quality received are encouraging. However, in the southern states farmers are battling the elements and although it has remained cool, some of the crop has already been turned over to livestock – particularly in Mid North SA. Elsewhere the plants are still looking for another drink as rain forecast after rain forecast fails to deliver the necessary moisture.

Lentils are facing a similar story.

Ocean Freight Update:

It was a subdued week for the shipping market with the Chinese Golden Week celebrations. Panamaxes lost ground in both basins at the start of the week before rallying on Thursday and Friday to end the week on a positive note.

It was a challenging week for the Supra/Ultra owners as we saw rates gradually decrease from Monday to Friday. The Pacific was noticeably quiet because of the regional holidays and owners had to entertain lower than last done levels to get covered.

The Handy market performed the best as we saw rates hold and even improve in some areas. Period levels remain firm with owners not willing to part way with tonnage for any less than 15-16k for large Handies and 16-17k for Supra/Ultras.

Export Stem Update:

There was 164KMT of wheat, 120KMT of canola, 54KMT of barley and 30KMT each of sorghum and chickpeas added to the stem in the past week. Just to be clear on methodology, we try to wait until there is an ETD of the vessel for a slot before we add a vessel to the stem.

Australian Weather:

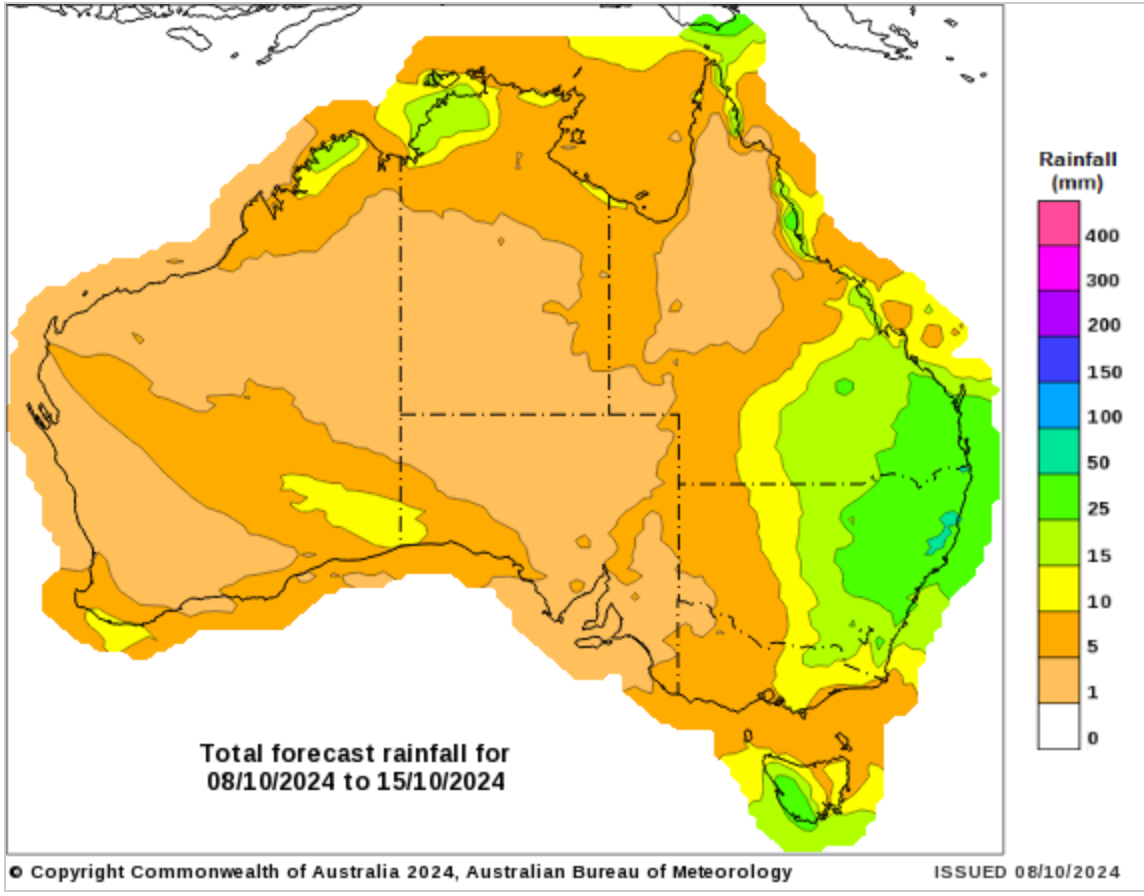

Weather models have added rain for this week for central and eastern Australia, but models vary on where it will fall. Storms will develop north of Brisbane in the next 24 hours, and this will also influence the northern NSW coastal areas. A developing trough from northern Australia is expected to pull moisture across central Australia early next week. Models are mixed on where this will fall and should get some clarity through the week. The ACCESS and ECMWF have most of the rain along the northern coastal areas with the GFS calling for inland rain (which is influencing the multi model). Interestingly we are seeing relatively cool temperatures through most growing regions and this leads us to believe yields are being pulled back too quickly by some, and that, in fact, this crop is in general being allowed to mature gracefully rather than being given a short hard finish. Time will tell on that one.

8 day forecast to 15th October 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 8th October 2024

Source: http://www.bom.gov.au/

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.