Australian Crop Update – Week 38, 2023

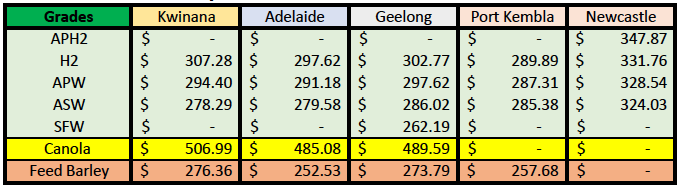

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

An El Niño and a positive Indian Ocean Dipole are underway, according to Australia’s Bureau of Meteorology. Climate models indicate El Niño is likely to persist until at least the end of February. The bureau said in its Climate update El Niño typically leads to reduced spring and early summer rainfall for eastern Australia, and warmer days for the southern two-thirds of the country.

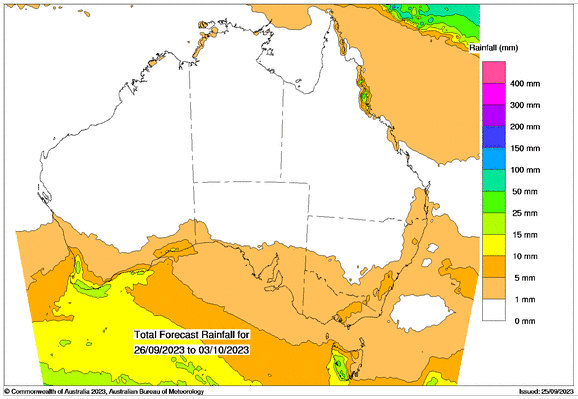

Harvest is underway in Central Queensland (QLD) and wheat quality is reflecting reasonable proteins based on early quality analysis. Southern QLD harvest will start in 10 days moving further south as combines and trucks finish the northern regions. Proteins will be higher, but yields are dropping, and it is likely we will start slipping below 24 million metric tonne (MMT) for wheat as the dry weather scenarios for wheat production kick in. Farmer selling is non-existent, and this is unlikely to change for another month when harvest starts in some of the areas where farmers are still expected to have near-average yields. Farmer selling is expected to remain reserved throughout the season with the smaller crops and mostly favourable balance sheets following three bumper years and the extension of El Nino like conditions. There is some rain in the 14-day forecast for the southern regions, but the north remains resolutely dry.

New crop barley continues to edge higher at US$270 FOB which is above $290 C&F parity to China and a long way from competing into the Middle East.

Wheat additions to the shipping stem have stopped on the East Coast and have slowed significantly in Western Australia (WA) and South Australia (SA). There was 100 thousand metric tonne (KMT) of canola put on the stem in WA last week but that is slow for this time of the year when shippers typically try to get early shipments into the EU.

Barley continues to dominate the shipping stem additions on the back of Chinese sales. There was about 200KMT of barley added to the stem in the past week. There were also a couple of wheat vessels which were switched to barley. This compares to 162KMT of new wheat vessels put onto the stem in the past week. There was 135KMT of barley added in SA and 62KMT in WA.

Australian Pulse Market

Ocean Freight Market Update

This ocean freight market is finely balanced. An already firm market due to grain loading activity in the Atlantic was pushed higher when China came out for it's periodic coal spree from Indonesia. If we follow the pattern from recent history this effect will last 5-10 days and then as the coal demand disappears, we will see the market ease back off to its former levels fairly quickly. This process may be exacerbated by impending Golden Week holidays in North Asia countries - though these are already widely heralded as the next "circuit-breaker" opportunity for the wider global freight market to reset along more negative lines.

Australian Weather

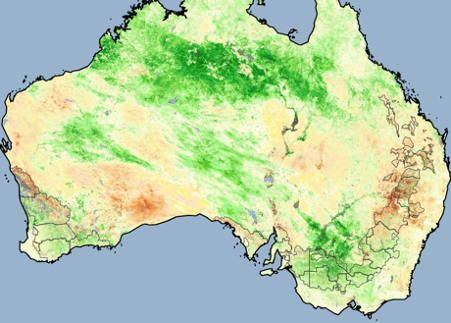

The big question is how much yield has been lost with the dry weather. Weather forecasts remain dry, and it looks like this could continue into October. This will have the harvest coming in one to two weeks earlier than normal. The Normalized Difference Vegetation Index (NDVI) anomaly data continues to show a sharp divide between the north and the south. QLD and Northern New South Wales (NSW) conditions have fallen 11-18% in the past four weeks and 4-8% last week. The declines are reflective of crops that a running out of moisture, rather than a normal maturity and dry down. However, the data shows the southern cropping areas in Southern NSW, Victoria (VIC), Southern WA and parts of SA to a lesser extent are holding. NDVI measurements in these areas are flat to down 4% on the past four weeks despite the heat and dry weather. These crops are still accessing soil moisture. Yields in these crops will fall with the dry weather but they will still have average to above average yields depending on the region.

8 day forecast to 3rd October 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 25th September 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is slightly stronger to start the week against the USD. The AUD staged a comeback versus the Greenback (USD) on Friday, and it remains set to finish this week with decent gains. Overall US Dollar weakness, along with investors seeking risk, and dropping US Treasury bond yields, are the reasons behind the reaction. Hence, the AUD/USD is posting gains of 0.51%, trading around 0.6450 once the pair bounced off the US 64 cent low.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.