Australian Crop Update – Week 36, 2024

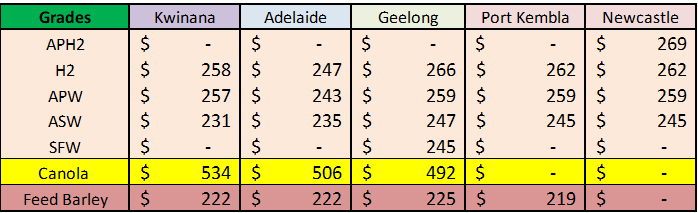

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

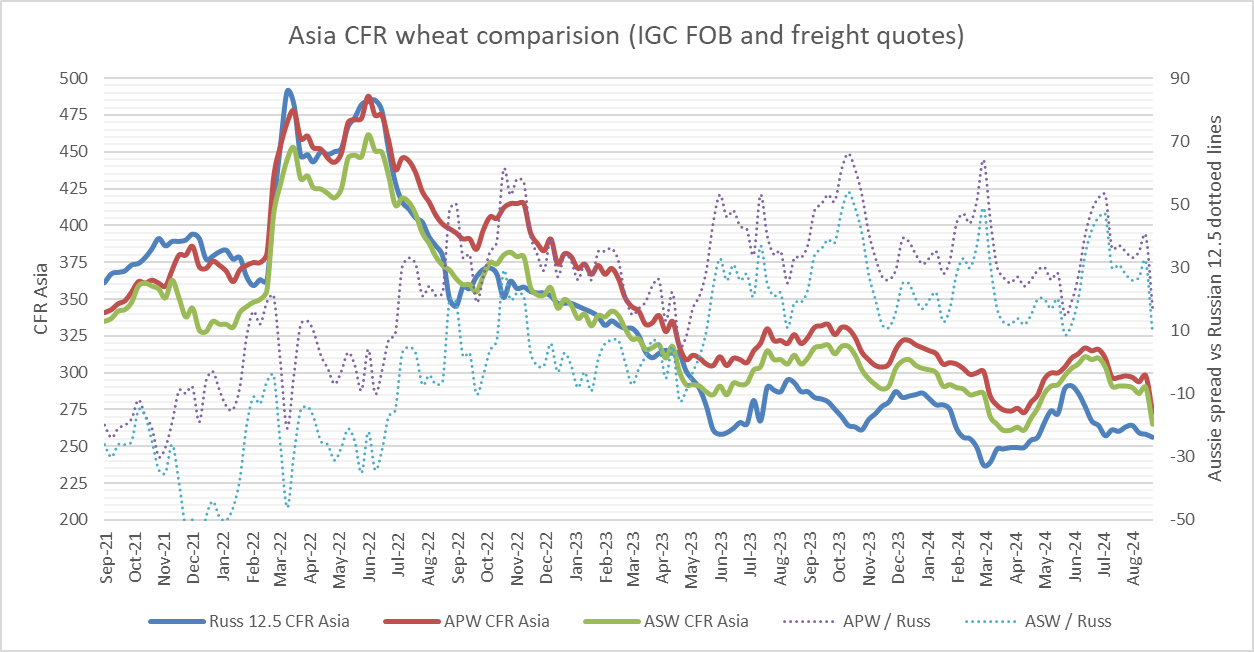

Global wheat influences saw the cash market consolidate last week. However, the underlying issue remains finding demand and then making sales.

Northern grain markets continued to edge higher on slow farmer selling. Barley was a reluctant follower after reports that China is trying to slow feed barley and sorghum imports. Exporter bids and track markets are showing little interest in chasing values higher where competitiveness into Asia is back under pressure following the recent $15-20 per metric tonne (/MT) rally in the east coast cash markets.

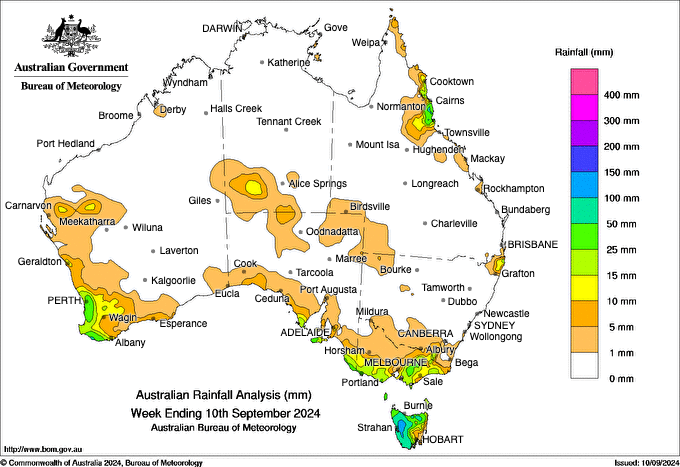

Two weeks of hot, dry weather in Queensland (QLD) has seen traders become more cautious about production expectations and grower selling. Last week’s windy weather has also taken a toll on crops in Victoria (VIC) and South Australia (SA), robbing crops of their limited subsoil moisture. Traders are reporting that crops are visibly struggling after last week’s dry, windy weather. Temperatures have moderated in QLD following two weeks of well above average weather.

NDVI anomaly measures for Australia’s cropping regions improved in central QLD last week and the northern and central cropping regions in Western Australia (WA). South west QLD slipped following the recent heat, but the Downs was unchanged. Northern New South Wales (NSW), central west NSW and the Riverina conditions slipped 2-3%, albeit from record high levels for this time of the year. Conditions remain excellent. In VIC, the Wimmera and Mallee were unchanged and remain 3-4% above average but crops remain vulnerable due to the absence of soil moisture reserves. NDVI’s in the Loddon and the Goulbourn fell, presumably following last week’s winds. Measures also fell in all the SA cropping regions. The northern region fell 3% for the week and is back to the recent lows 8% below average. SA yield potential falls without September rain. WA’s Geraldton, Midland and Upper Great Southern are reflecting record high NDVI anomalies for this time of the year. Our analysts were surprised that the NDVI measures held up as well as they did last week after the dry, windy weather over the past week. However, time is running out for yield saving rain in SA in particular.

ABARES released its September Crop Report early last week. National wheat production was raised to 31.8 million metric tonne (MMT) from the previous 29.0MMT. Barley production increased to 12.2MMT and canola was pegged at 5.5MMT. On the pulses, lentil production was put at 1.8MMT and chickpea output at 1.3MMT. At the state level, winter crop production in NSW and QLD is forecast to rise to near record levels following the favourable autumn and winter. WA winter wheat crop production was lifted to above average following the excellent rains in July and August. ABARES lowered production estimates in SA and VIC on the dry conditions and poor crop establishment. ABARES also raised the 2024/25 winter crop plantings.

We are higher than ABARES in NSW on the back of the excellent conditions. There is evidence of opportunistic larger plantings in north west NSW, further west than the normal planting areas following the good autumn rains. WA has potential to climb from ABARES 10.4MMT (we are currently 10.5MMT) based on the record/near record NDVI ratings.

ABARES did some juggling in the pulse area estimates. ABARES has piled 200,000 metric tonnes (MT) on to its national chickpea estimate thanks to a stellar growing season in QLD and NSW. It is expected to see Australia produce 1.3MMT of chickpeas, up 18 percent from its initial June estimate of 1.1MMT, up 171 percent from the 2023-24 crop, and 70pc higher than the 10-year average to 2023/24.

ABARES forecast for lentil production is up 6pc, or 100,000MT, from the initial forecast to 1.7MMT. “This is more than double the 10-year average to 2023/24, with the expansion in area planted to lentils expected to more than offset lower yields.”

Australian Export Update:

Australia shipped 1.495MMT of wheat in July up from the 1.25MMT in June. WA was the largest export state with 440 thousand metric tonne (KMT), which is it’s the smallest monthly shipments since November 2021. It was closely followed by VIC with 435KMT and SA 404KMT. The NSW wheat export tail continues to wag with a further 193KMT shipped in July. Australia has shipped 17.6MMT for the October 2023 to July 2024 with another two months remaining in the 23/24 marketing year. Indonesia was the largest wheat destination for July with 282KMT followed by Yemen with 219KMT and then Philippines with 209KMT. China exports were only 4.2KMT. Wheat exports to the Middle East (Yemen) and Africa have climbed in June and July.

National barley exports for July were 311KMT and this was reasonably evenly split between feed barley and malting barley. It lifts Australia’s October 23 to July 24 barley exports to ~7.3 MMT which is made up of 4.6MMT of feed barley and 2.6MMT of malting barley. There was 287KMT of barley shipped to China which included 185KMT of malting barley.

A further 304KMT of wheat was added to the stem in the past week following the previous week’s 268KMT. WA accounted for 249KMT of the weekly wheat additions with the other 55KMT added in SA. The wheat additions are now for an October loading. We see the recent kick in wheat additions as confirmation that exporters are connecting with buyers at current price relativities with Black Sea values. Anecdotal evidence indicates that demand remains very comfortable to continue with the very nearby hand to month purchases.

Ocean Freight Market Update:

It was another sluggish week for shipping. Rates continued to slide as fresh cargoes entering the market are being outpaced by growing tonnage lists. Panamaxes were under pressure all week in the Atlantic, especially in the south. In the Pacific it was a quiet start to the week however by Friday, sentiment started to turn positive with an uptick of fresh demand appearing in key loading areas. Not helping the cause is the Aussie market which has remained quiet with most operators opting to schedule own tonnage for liftings. Surprisingly, it was the Far East market that showed the most resilience this week with owners less willing to discount.

Australian Weather:

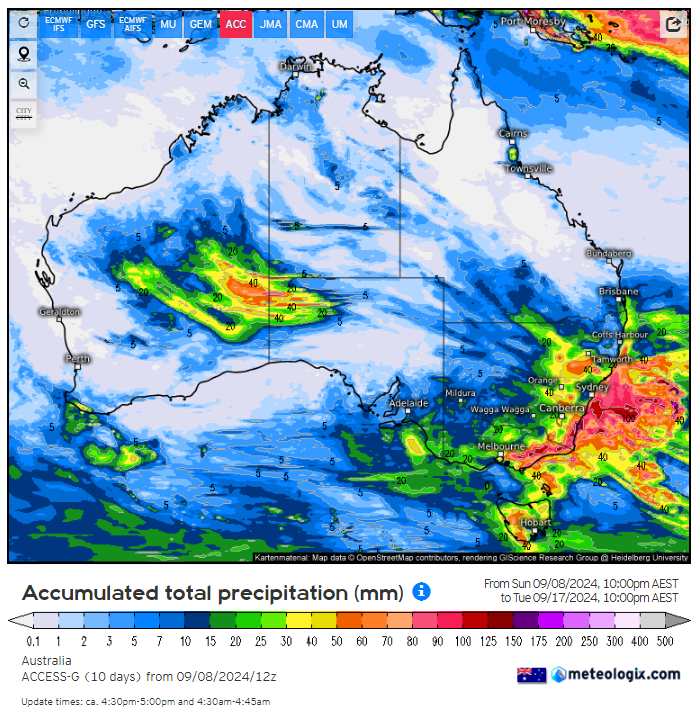

The Multi model has added rain for NSW in the later part of next week which is consistent with the BOM’s ACCESS-S forecasts. It’s trimmed the amount of rain that SA will see. Another bout of windy weather is set to hit southeastern Australia over the next two days. Crops in these areas are already struggling with the dry weather and lack of subsoil moisture and the wind is making it worse. Damaging wind gusts are likely to redevelop in some areas of VIC on Thursday night before becoming more widespread over southern, central, and eastern VIC on Friday.

New Paragraph

Weekly Rainfall to 10th September 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to finish last week when valued against the USD closing at 0.6664. The AUD/USD pair surrendered its intraday gains and turned negative in Friday’s North American session in the aftermath of the United States (US) Non-Farm Payrolls (NFP) data for August, which increased buying interest of the US dollar. Reserve Bank of Australia released new data showing Australia's economy was growing at its slowest pace since the 1990s recession, as households cut back significantly on spending. The economy grew by 0.2 per cent in the June quarter, and by just 1 per cent over the last year, according to the Australian Bureau of Statistics (ABS).

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.