Australian Crop Update – Week 35, 2024

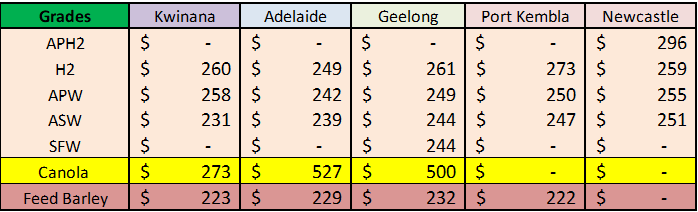

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

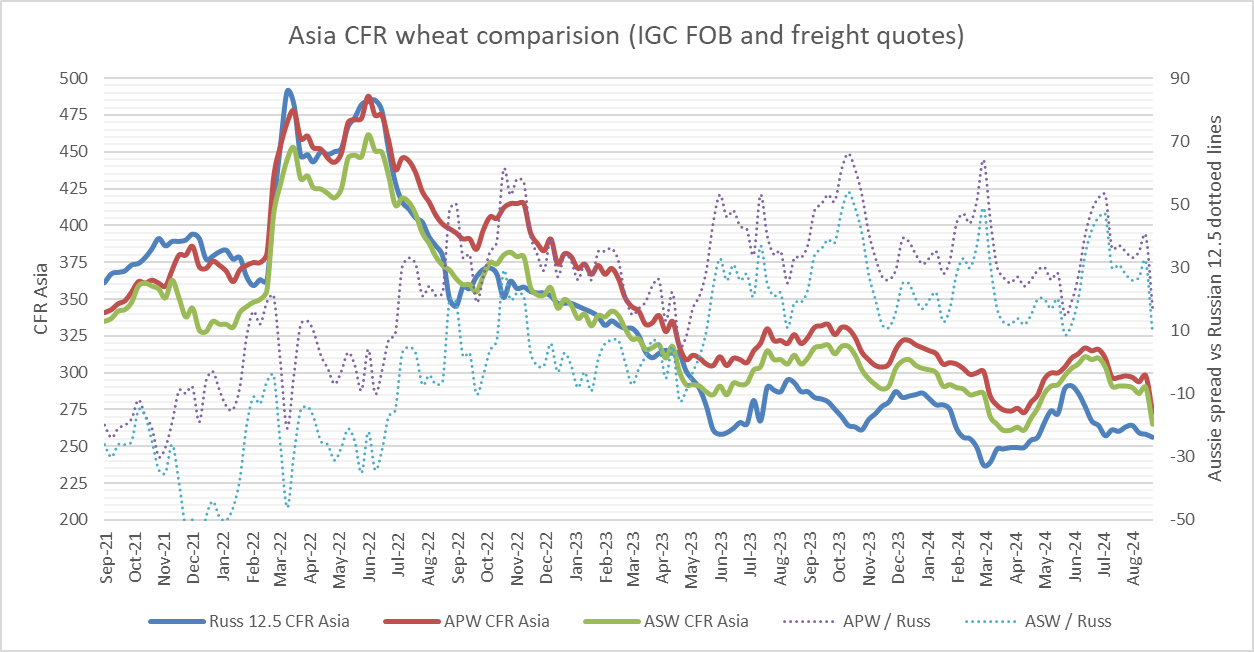

The Australian grain markets have reacted to hot, dry weather with reports surfacing of emerging export demand late in the week. Local values have plunged over the past six to eight weeks as the prospect of a bigger crop comes closer to reality. Domestic buyers have looked for extended coverage at current price levels given the Black Sea wheat markets look to be establishing seasonal lows and Australian new crop prices are down to levels which should buy Asian demand when carries to current Black Sea prices are considered. Australia’s wheat is no longer expensive against the Black Sea into Asia. Similarly, tighter Black Sea export supplies surpluses to Asia are likely to be felt from November forward if current export pace is maintained. Interestingly, the “canary in the cage” container exports are already starting to connect with Asian buyers in the past week to 10 days as we expected. Southeast Asian bulk buyers are also running their eyes over current new crop values, although they still seem happy to be patient and will have taken comfort from an article from Bloomberg last Thursday reporting that China was seeking to halt further feed barley and sorghum imports amid softer local demand and improved domestic crops. The article said Beijing convened a meeting with top grain importers and suggested they halt feed barley and sorghum imports. China’s domestic grain markets haven’t been immune from the downturn in global markets which are the lowest since 2020. Low prices are hurting farmer profitability around the globe and Chinese farmers will be feeling the same. Australian exporters appear to be adopting a cautious approach with new crop feed barley prices back 3-6% for the week. Although demand for the malting industry would seem to be unaffected.

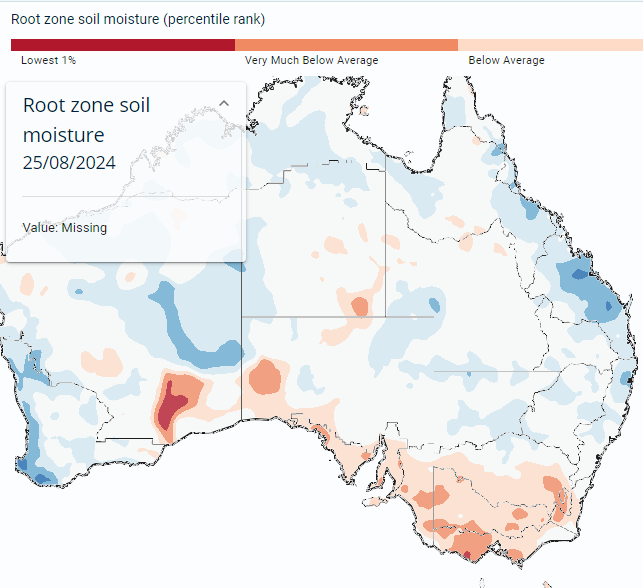

Crop conditions remain extremely favourable in Queensland (QLD), northern New South Wales (NSW) and Western Australia (WA), according to the latest NDVI data. They also improved in Victoria (VIC) and South Australia (SA) last week following recent rain. Overall, QLD and northern NSW remain at record NDVI levels for this time of year. WA readings have also climbed to record or near record levels. VIC is up to average, while SA is average to below average. Poor soil moisture levels are now the major problem for SA and VIC. Recent rains have given crops a timely lift, but they need rain to finish, or yields will suffer.

Export Stem & Ocean Freight Market Update:

Last week was a negative week for shipping. Panamaxes continued their recent slide with rates coming under pressure all week. In the Atlantic, the USG market struggled off the back of minimal fresh cargoes appearing in the market. ECSA demand remained steady, but rates were affected by the week’s end due to the negative sentiment in that basin. The Pacific followed suit. Supramaxes were slow all week with minimal fixing activity reported as Charterers opted to sit and wait rather than commit at last done levels. The Handies held ok in the Atlantic, but the Pacific players are starting to feel the pinch on the back of growing tonnage and less demand, especially from Australia and New Zealand.

It’s been a relatively active week for shipping stem additions for this time of the season. This included 268 thousdand metric tonne (KMT) of wheat additions, 177KMT of barley as well as 60KMT each of canola and sorghum. There were also lentil additions in VIC. The QLD forward stem is booked out with chickpeas which will be the first of the new crop production to be exported from Australia.

Australian Weather:

QLD temperatures were in low to mid 30’s for all last week which is approximately 10 degrees Celsius (C) above normal for this time of the year and about +5-8C higher for northern NSW. It is not as hot in the north this week. Hot weather is not an immediate concern as crops conditions are outstanding in QLD and NSW and they have plenty of sub-moisture. The concern however is that the hot weather will lower yield potential if the hot, dry pattern was to persist into the second half of September. Big crops need ongoing moisture to maximise yield potential, and more importantly mild temperatures. Prolonged heat is the larger concern as it will push the crops to maturity earlier than normal and not allow them to make the most of the excellent start, as they did in 2021 and 2022.

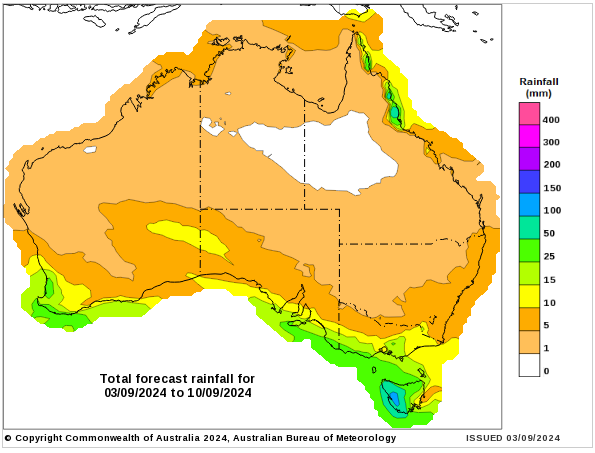

Cropping areas aren’t expected to see any significant rain over the next week. SA may pick up some light showers at the end of the week which could benefit the Mallee regions most. The BOM’s ACCESS-S is forecasting an improved chance of rain for the east coast and WA for the second week.

The Australian Bureau of Meteorology issued its latest September-November seasonal update late last week where they forecast above average rain for much of eastern Australia, while WA trends dryer. Rainfall is likely (60 to 80% chance) to be above average for most of eastern Australia. The chance of above average rainfall has increased over much of eastern Australia during the last week but decreased in southwest WA. Average maximum temperatures are expected to be warmer than normal across most of Australia although southeast WA’s cropping regions are expected to be shielded where average temps are expected to be near normal.

8 day forecast to 10th September 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 2nd September 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to finish last week when valued against the USD closing at 0.6756 after it pushed through 68 cents earlier in the week. The Aussie dollar declined by 0.70% in Friday's session as the USD strengthened in response to July's Personal Consumption Expenditures (PCE) figures. Despite this, the Reserve Bank of Australia's (RBA) hawkish stance, suggesting interest rates will stay stronger for longer, may limit further declines in the AUD versus the USD. Last week, Australia’s monthly Consumer Price Index (CPI) jumped by 3.5% in the year to July, compared to a 3.8% increase seen in June, according to the data published by the Australian Bureau of Statistics (ABS). The increase was slightly higher than the 3.4% economists had expected, suggesting interest rate cuts may still be months away.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au