Australian Crop Update – Week 37, 2024

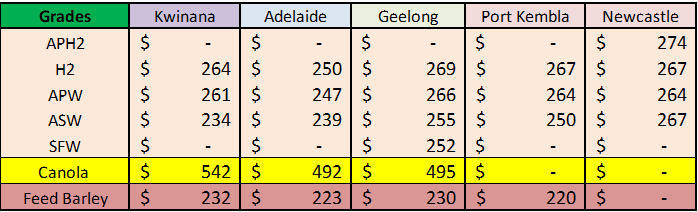

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Australian grain cash markets were firmer across all states last week aided by the strengthening US wheat futures coupled with nearby shorts taking cover and limited farmer selling as well as the ongoing dry weather across southeastern Australia. New crop ASX wheat was up 2.5%. The weather in the worst affected areas of South Australia (SA) and Victoria (VIC) offer no relief over the next couple of weeks which supports the case for further upside on pricing in those zones. We have heard of some grower washouts occurring which is never a good sign. The time for some unlikely yield saving late rains for VIC and SA is rapidly running out. Lentils in VIC and chickpeas in Queensland (QLD) were also firmer for the week.

Elsewhere, crop conditions are very good to excellent. However, absence of early spring rain is expected to curb yield potential compared to some of the big crop seasons that we have seen in recent years, and we will be updating our supply balance sheets in the next couple of days to reflect that – please check your inbox in the coming days.

NDVI anomalies in the most northerly cropping areas in QLD, northern New South Wales (NSW) and Western Australia (WA) seasonally retreated last week as crops turn following several weeks of dry weather and warming temps. NDVI ratings remain historically high for this time of the season, but crops are getting beyond the point where rains will benefit yields (in the north).

Australian Export Update:

Australia exported 1,495,368 metric tonnes (MT) of wheat in July, up 20 percent (PC) from the 1,246,642 MT shipped in June, according to the latest data from the Australian Bureau of Statistics. Containerised export volume was biggest to Asia with little separating the three biggest destinations, namely Malaysia at 28,793MT, Thailand at 27,043MT and Vietnam at 26,799MT.

Bulk export volumes showed Indonesia as the largest receiver of Australian wheat importing 265,701MT, followed by Yemen at 219,430MT and the Philippines at 198,486MT. Australia was expected to export approximately 1 million metric tonnes (MMT) of bulk wheat in August, dropping to 851,000MT in September.

The additions to the stem last week were small which isn’t unusual for this time of the year where ships are being added for early new crop slots. Most of the wheat added in the past week is for an October loading from VIC which will be old crop wheat.

Ocean Freight Market Update:

The market has found its floor in the short term. Rates have stabilised for the most part and are even starting to turn the corner for some. Panamaxes bucked its recent downward spiral and ended the week in the green in both basins. More demand appeared in the Atlantic where we saw better than last done levels being concluded for transatlantic trips, while in the Pacific, owners were happy to see increased enquiry from Australia and Nopac by the end of the week.

It was a mixed bag on the Supramax sector. The Atlantic activity remained slow throughout the week however the rates were able to show some resistance and hold steady. Whereas in the Pacific, Supramaxes found support in Australia and NOPAC which pushed rates up 1-2kpd for pacific rounds.

The Handysize activity has remained subdued in both basins however there has been a clear out of prompt tonnage which has been helping to alleviate the recent downward pressure.

Going forward there is a general sense of optimism for the next couple of months before the usual Christmas slowdown.

Australian Weather:

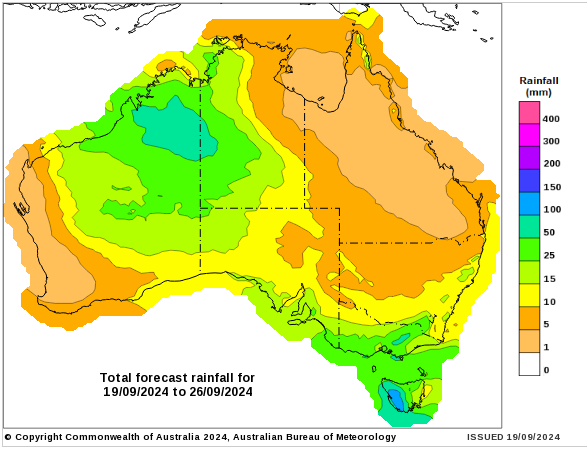

An Antarctic blast bought a heavy frost across NSW over last few days which will no doubt cause some bullish flutters. At this stage, the crops are not stressed and are dense so we think the damage may be limited.

Elsewhere, weather conditions were mild and mostly dry last week. Temperatures started to climb across the northern WA cropping areas late in the week. It appears that cropping areas may not see any meaningful additional finishing rain that would offer additional yield benefits. Forecasts remain mostly dry for the next 10 days which takes us to late in September. The 16-day forecast is showing some rain for WA cropping areas at the end of September but it’s a long way off and the model forecasts have been bouncing around. Traders are saying barley harvest in southern QLD should kick off in early October and we expect wheat will be late October to early November.

There are growing signs Australia's most impactful climate driver, La Niña, will develop during the coming months. La Niña refers to an altered state of the tropical Pacific, lasting anywhere from months to years, when cooler-than-average waters combine with changes in the overlying atmosphere to disrupt global weather patterns. For Australia, La Niña would increase the prospects of a wet spring and summer, and to a lesser degree, potentially subdue extreme summer heat. Another La Niña this year would be the fourth in just five years — well above the average of one every four years, and a frequency only previously seen twice since 1900.

8 day forecast to 26th September 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 18th September 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was slightly weaker to finish last week when valued against the USD closing at 0.6688. The AUD is finding support from a hawkish tone in the latest RBA Minutes, which highlighted discussions among members about potentially raising the cash rate target. The minutes emphasised persistent inflationary pressures should lower market expectations of possible rate cuts in late 2024 at a time when the US is signalling it is about to ease rates.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.