Australian Crop Update – Week 34, 2024

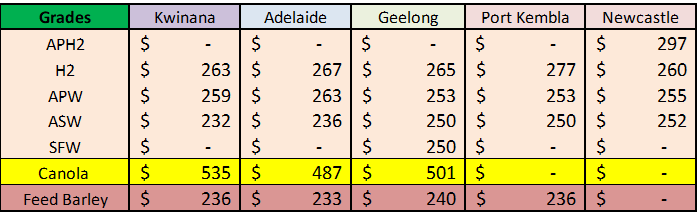

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian grain market continued to soften throughout last week on expectations of a large Australian wheat crop and a further weakening in global values. The cash market appears to be trading a 32-33 million metric tonne (MMT) wheat crop with the belief the crop will continue to climb with a soft spring in Western Australia (WA). Across all grades, markets were lower by some USD7-10 per metric tonne (/MT) on FOB equivalents with the largest declines on the east coast. The only grade holding the same values were the higher protein grades as the expectation of the crop profile is that the significant proportion of the crop will be lower protein.

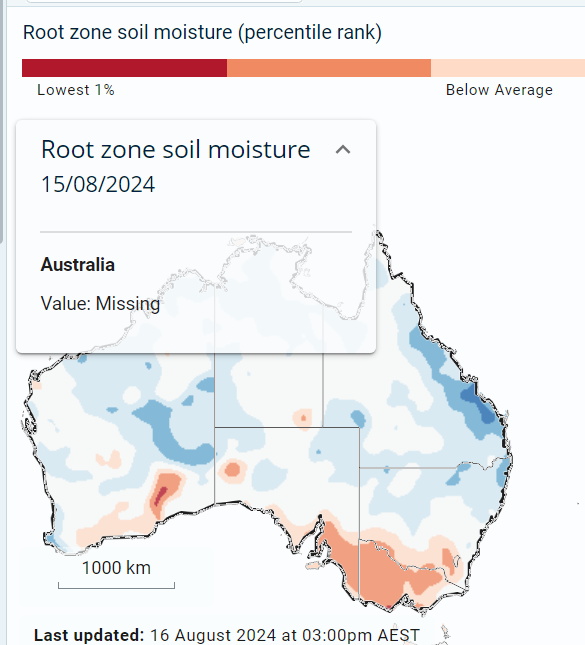

In terms of Vegetive Indexes, northern New South Wales (NSW) and central NSW are at or near record highs for this time of the year and southern NSW is improving. Queensland (QLD) saw solid weekly gains following rains last week and Victoria (VIC) improved last week but from a low base. Lack of soil moisture is leaving yields vulnerable in the south, but rains are keeping values stable for now. WA’s crop potential is staring to climb with NDVI measures as high as the 2022 crop at an equivalent time of crop progression.

Last week, our analysts released un updated Australian wheat and barley Supply & Demand report (it should be in your inbox, or you can read it here). Yields were raised in NSW, QLD and WA following the good rains received during August. NSW wheat production has been raised 1.6MMT to 12.2MMT. QLD is up 0.2MMT to 2.2MMT and WA is up 1.0MMT to 10.4MMT. VIC and South Australia (SA) were trimmed on the back of continues below average rainfall through winter. This lifts the national wheat crop to 33.2MMT from the previous 30.7MMT forecast.

National barley production has been raised to 12.0MMT. Northern NSW wheat yields have been lifted to around 3.4-3.5 tonnes per hectare which is close to the record highs seen in 2020/21 and 2021/22. It is understood that some individual farm yields are on track for significantly higher yields than this but the average yields that come through the ABARES and ABS data, even in the recent record yields came in well below the anecdotal numbers reported. Ultimately, this year’s yields are relative to previous years and the recent bumper crops just a few years ago offer recent benchmarks.

Australia’s 2024/25 wheat exports are raised to 24.1MMT on the back of the bigger crop. This included ~6.0MMT from NSW and 10MMT from WA. East coast wheat exports are forecast at 10.1MMT. This is a big number in the current soft demand environment where importers are in control and are trying to pull values lower.

Export Stem & Ocean Freight Market Update:

Another lacklustre week for shipping across the board. The Atlantic appears to still be affected by the traditional summer holiday period with little urgency to try push activity along. The Pacific is suffering from low demand and growing tonnage lists. Panamaxes had a disappointing week where we saw limited activity in the Atlantic causing rates to drift as the week progressed. The Pacific didn’t fare any better with NOPAC and Aussie markets being quiet and the little demand that did appear from Indonesia was absorbed at rates below last done levels. Supramaxes found some support in the Atlantic on the back of more US Gulf cargoes which help pushed rates up by circa 2-3kpd in this region. The Pacific was subdued with tonnage lists growing throughout the week which made charterers reluctant to engage initially as they felt they had both time and plenty of candidates to choose from. The Handy market followed a similar trend to the Supramaxes. An uneventful week for bunkers where VLSFO is still averaging between 550-600pmt in most major ports.

It was a very lean week for shipping stem additions. There was 45 thousand metric tonne (KMT) of wheat and 38KMT of canola added to the stem in the past week.

Australian Weather:

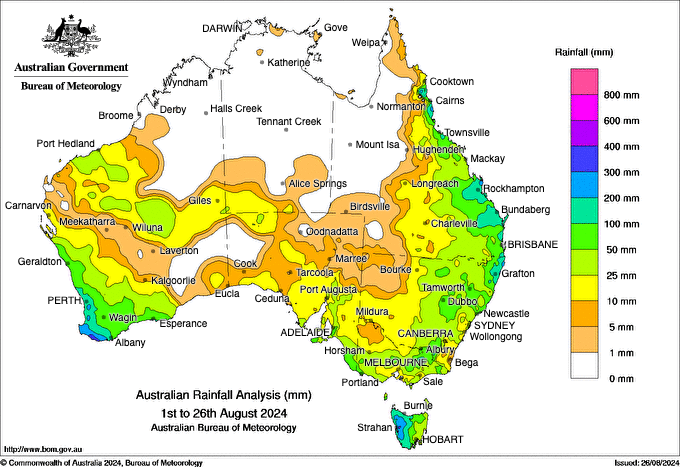

WA received more rain last week. This included 20-35mm across the Geraldton zone, 5-20mm across the Kwinana zone, 20-50mm in the Great Southern and 20-40mm around Esperance. SA received light showers although falls were limited to 2-5mm in most cases. The VIC southern regions received its best rain in months last week with 15-25mm received. Last week’s rains across WA reinforces the case for a large WA winter crop.

Month to date rainfall - August 2024

Source: http://www.bom.gov.au/

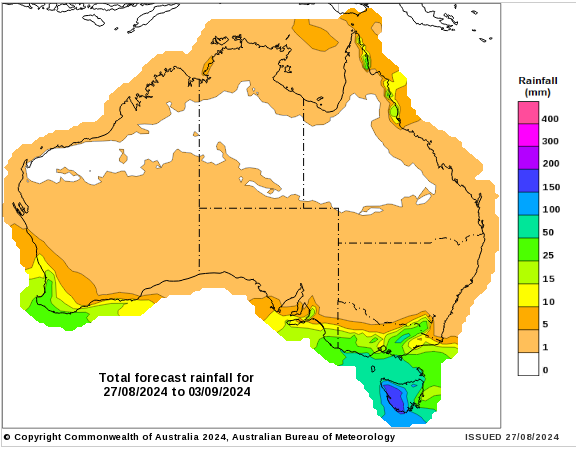

8 day forecast to 3rd September 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 26th August 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to finish last week when valued against the USD closing at .6778. This upward move comes as the US dollar weakened following Federal Reserve (Fed) Chair Jerome Powell's dovish speech at Jackson Hole where he effectively confirmed the markets expectation of US interest rate cuts in September and beyond. The Australian dollar, by contrast, was bolstered by last week's Reserve Bank of Australia (RBA) meeting minutes, which reveal a reluctance to ease monetary policy soon. The RBA projects inflation to stay above the 2-3% target until the end of 2025, suggesting interest rates may remain elevated for an extended period. Governor Bullock has recently stated that the bank has no plans of cutting in the near term. In all likelihood, incoming inflation data will neither justify a cut or a hike. So once again, we must watch, but it is unlikely to change the course of the RBA’s 4.35% interest rate.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.