Australian Crop Update – Week 32, 2024

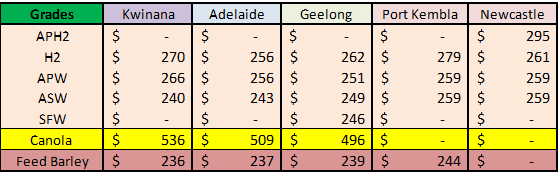

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian old crop cash markets have firmed over the last week on short covering for both domestic and export contracts.

The biggest variable for the next crop is the uncertainty over yields in South Australia (SA) and Victoria (VIC) with the very late start and the lack of soil moisture heading into spring. VIC is slightly better situated than SA but is in a similar situation where crops are two to four weeks later than normal and soil moisture reserves are limited. Both states need a soft spring to achieve average to near average yields. The concern is that yield potential will fall away quickly without soaking rains by the end of the month.

Ocean Freight & Shipment Stem Update:

There was 399 thousand metric tonne (KMT) of wheat, 113KMT of canola, 90KMT of sorghum and 22KMT of barley added to the shipping stem in the past week. It was the largest shipping stem additions in more than a month with more than half in Western Australia (WA) and the rest in VIC and SA.

Another 60KMT of canola was put on the stem in Port Kembla New South Wales (NSW) as well as 50KMT in WA.

All of the sorghum was added in Queensland (QLD).

It was a quiet week in shipping where activity levels struggled to kick into gear with much of the northern hemisphere in summer holiday mode. The week started with panic in the global stock markets and ended with the Singapore National Day holiday, so it wasn't a great surprise that participants had other things on their minds. Panamaxes drifted in both basins with a lack of fresh cargo appearing. As the week progressed, charterers began reducing their bid levels as tonnage grew and owners had to reluctantly accept lower bids.

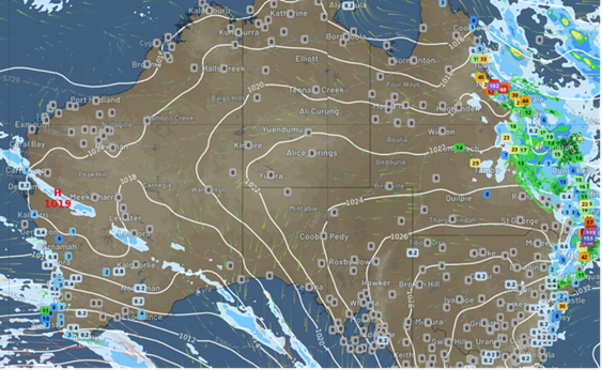

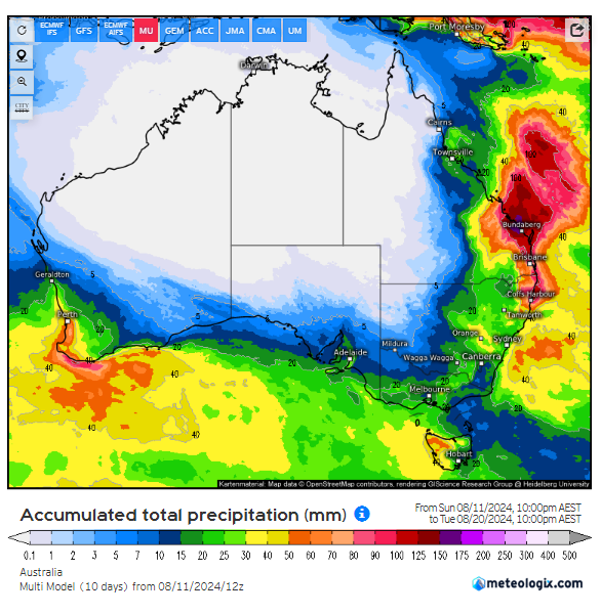

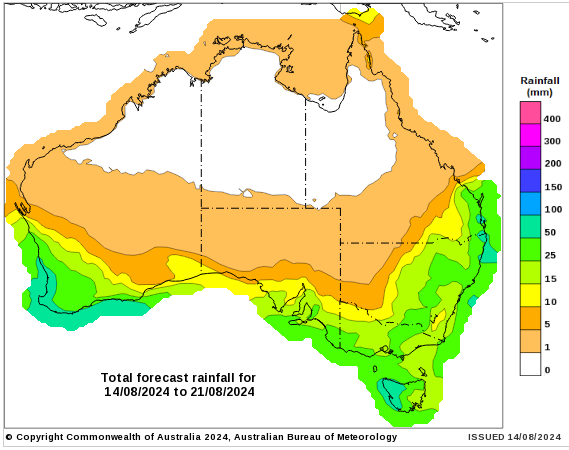

Australian Weather:

WA is forecast to see more showers this week with between 5-10mm predicted across the growing regions. SA is forecast to remain dry through next week with nothing on the horizon for the following week either. VIC is a chance for some showers late next week for a possible 10-20mm. NSW is forecast to be mostly dry next week, and southern QLD will see rain of 15-30mm.

8 day forecast to 21 August 2024

Source: http://www.bom.gov.au/

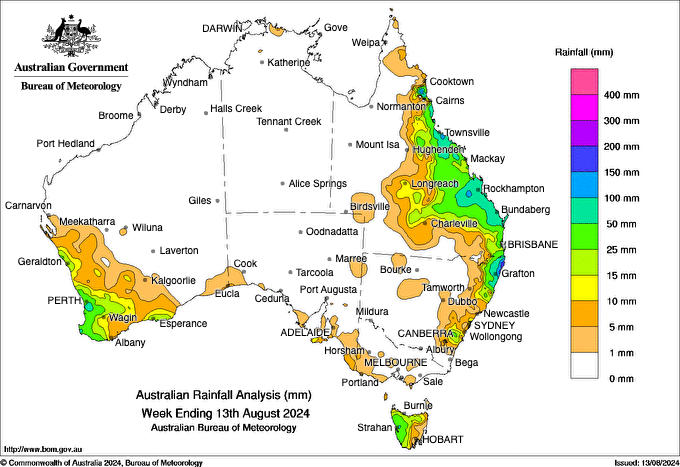

Weekly Rainfall to 13th August 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to close last week when valued against the USD closing at 0.6572. Economists expect the Reserve Bank of Australia to deliver its first post-pandemic interest rate cut in February 2025, lowering the cash rate to 3.6 per cent by the end of next year. The RBA on Tuesday pushed back its timeline for getting inflation back to the mid-point of its 2 to 3 per cent target band until December 2026, six months later than forecast in May and has warned the market about getting ahead of itself on rate cuts.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.