Australian Crop Update – Week 31, 2024

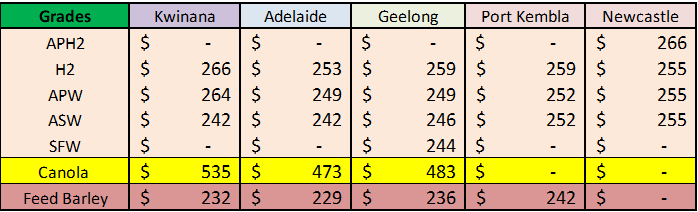

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian grains market was quiet last week with many market participants at the Australian Grains Industry Conference in Melbourne. Cash values did drift lower reflecting the broader view that prices need to soften to re-engage Australia’s wheat export customers for the 2024/25 season. Forecasters and analysts are all now comfortable quoting a 30 million metric tonne (MMT) plus harvest for wheat and a 22MMT plus export surplus as we head into Spring.

The favourable outlook is triggering old crop farmer selling in southern New South Wales (NSW). In Victoria (VIC) wheat farmers are still holding reasonable volumes. New crop selling remains slow in all states where farmers are baulking at starting the season’s selling program at current prices. The consensus sentiment from the conference is that basis needs to fall $15-20 per metric tonne (/MT) for Australia to regain export competitiveness into Asia to move wheat. The lack of export competitiveness was highlighted in the June exports, where wheat shipments to China, Indonesia and Vietnam were disappointing. These countries are critical to moving large volumes of Australian wheat into Asia and without engaging them with price, exports will remain slow. Australia’s June wheat exports would have looked even worse if it wasn’t for feed wheat shipments (likely) into the Philippines and South Korea. While the mood of the conference was broadly bearish from a price point of view there was an expectation that Asia will be looking for good volumes of Aussie wheat for December onwards when the competition from eastern Europe and the Black Sea subsides due to smaller export programs and a smaller, poor quality EU wheat crop. Our sense is that Australia could also compete into East Africa and the Middle East if China remains absent from the wheat market into Q1 and Q2 of next year.

Our Analyst, AgScientia, updated the balance sheets this week to reflect the improved July rainfall in Western Australia (WA), South Australia (SA) and VIC. Yields have been increased following the improved rain in July and the increases in the NDVI readings that have followed. This has further improved crop outlooks in NSW and Queensland (QLD) which were already very good. These states enjoyed ideal planting times and have been seeing regular top up falls through the winter. NDVI readings in NSW and southern QLD range from well above mean to record highs in areas of north west NSW. Collectively, they are near record high levels for this time of the year. Crop conditions are also improving in VIC and SA, albeit from a poor start. The VIC Mallee NDVI’s are above mean but the Wimmera is below, but improving. This will seasonally continue following the improved July rain, but more rain is required. VIC and SA wheat yields are expected to be no more than average at this stage following the late start and below mean NDVI’s at 2.93 tonne per hectare (t/ha) and 2.05t/ha respectively. These will climb further with a favourable spring. Improved July rainfall, and more consistent rainfall patterns have benefited crops in WA. NDVI’s picked up from below mean in early June to mean in the latest readings slightly above and still climbing.

Extended weather outlooks have also turned more favourable in the past couple of weeks as models incorporate more of the La Nina pattern into the forecast. The BOM’s ACCESS-S2 is forecasting above average rainfall is likely (60 to 80% chance) in an area extending across most of southern QLD, NSW, VIC, and eastern SA, as well as along the south west coast of WA, and north east Tasmania. The monthly precipitation anomaly for the extended Europe model (ECMWF SEAS5) is consistent with the ACCESS showing average to above average rain for Jul-Sep. Altogether, it bodes well for Australian winter crops and justifies the + 30MMT wheat production outlook.

Overall, we have increased the national wheat crop to 30.7MMT. This includes 10.6MMT in NSW and 2.0MMT in Qld. WA wheat production has been increased to 9.4MMT. VIC and SA have been edged higher to 4.3MMT and 4.4MMT respectively. National barley production is up to 11.7MMT and canola at 5.6MMT. Forecasts will continue to climb with a soft spring.

For the most part, the old crop premiums have largely disappeared on paper, although protein is still attracting premiums due to grade shortages.

Australian Pulses Update:

Australia exported 39,718 metric tonnes (MT) of chickpeas and 140,549MT of lentils in June, according to the latest data from the Australian Bureau of Statistics. The chickpea figure is down 9 percent (pc) from the May total of 43,849MT, despite the uptick in exports to India and Nepal.

Lentil exports in June were up 8pc from the May figure of 130,295MT, with rises over the month of 5453MT from Bangladesh, 2578MT from Egypt and 2905MT from Nepal the main drivers.

Shipping stems indicate bulk exports of lentils have slowed right down this month to indicate Australia’s rundown on stocks as Canadian new crop prices hit the markets.

On the other hand, there was much talk at the conference about a record chickpea crop. Export slots booked indicate around 300,000MT in bulk alone will be shipped as harvest rolls south from Central QLD to northern NSW and that is expected to keep other commodities off the early season stem as things stand.

Chickpea crop conditions are very good to excellent in all major desi-growing regions.

Australian Export Update:

National wheat exports slipped to 1.26MMT in June down from 1.59MMT in May. The June wheat exports were lower in all states than last month. The Philippines was the largest destination with 271.4 thousand metric tonne (KMT) followed by South Korea with 151.7KMT and then China with 134.7KMT. It was the smallest monthly wheat exports to China in 12 months and the 96.6KMT shipped to Indonesia was the smallest since October 2020. Wheat exports to Asia in July fell back to around 1.0MMT which is just about back to drought levels seen in 2020. Barley exports for June were 725.5KMT up from 363.7KMT in May. China took 530.2KMT which puts the Oct/Jun at 5.48KMT. Malt barley exports to Latin America remain healthy with Mexico taking another 33KMT, Peru taking 17KMT and Ecuador taking 7KMT. There was 251.1KMT of sorghum exported in June. China took ~222KMT and Japan took ~22KMT.

Ocean Freight & Shipment Stem Update:

A balanced week again as we saw rates trend sideways. A mixed bag for Panamaxes where we saw tight tonnage in North Atlantic but was counter-acted by slow South Atlantic demand which proved to be the main driving force across the week. The Pacific didn’t fare any better across the week. There was healthy demand out of Indonesia and Aussie but growing tonnage lists in the Fareast helped put a halt on any potential gains. The supra/ultra market was largely uneventful throughout the week in both basins. Fresh cargo was minimal, and tonnage lists grew longer causing rates to come offer roughly 1-2kpd for rounds. Northern hemisphere summer holidays combined with Singapore National Day on Friday could see another quiet week ahead.

Pressure on the Australian container market has increased with heightened tension in the Middle East and Red Sea continuing to affect services and box locations. Container pricing has increased on average by 100-150% since April from Australian ports, and this has naturally affected our competitiveness.

There was 205KMT of wheat, 144KMT of canola, 85KMT of barley and 53KMT of sorghum added to the stem in the past week.

Australian Weather:

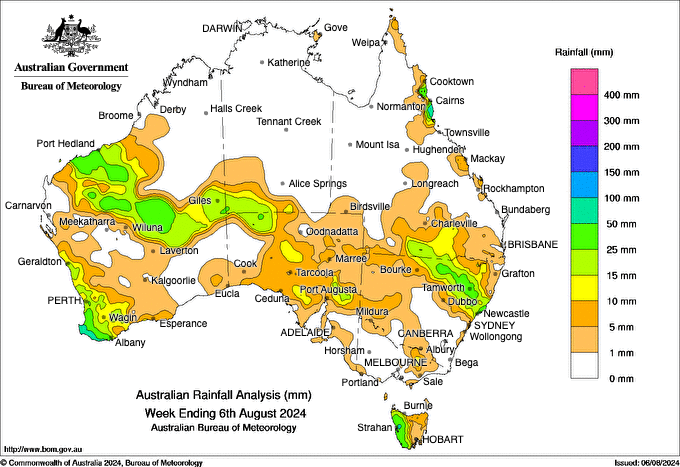

Good July rainfall in WA has bolstered the chances for average to above average winter crop yields. SA and Vic received improved rain in July, however these areas have limited subsoil moisture and require soaking rains ahead of spring to achieve average yields. NSW and QLD remain on track for well above average yields following the wet start to the season.

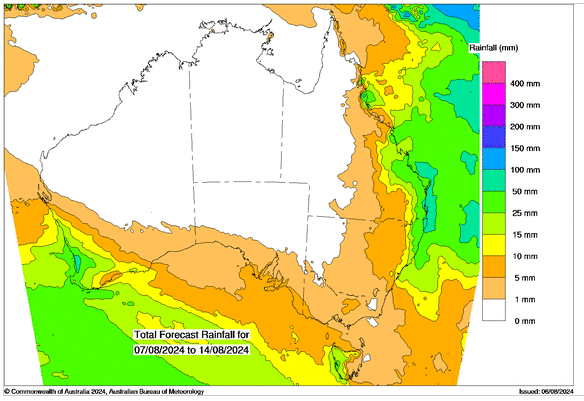

8 day forecast to 14 August 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 6th August 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to close last week when valued against the USD trading a low of at 0.6496 but has since rebounded over .65. The RBA will keep the cash rate on hold at 4.35 per cent after figures last week showed underlying inflation continued to ease in the June quarter. While markets expect the RBA will cut interest rates by February 2025, a handful of analysts think the central bank could act as soon as November.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.