Australian Crop Update – Week 33, 2024

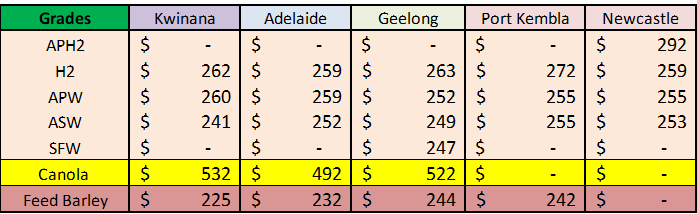

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Negative global influences pressured the Australian cash markets last week. Rains across Queensland (QLD) and most of New South Wales (NSW) have all but locked in bumper yields for the north and as a consequence, old crop markets are giving up the inverse and the two cash markets are starting to trade on a par in the east.

Australian domestic consumers have become increasingly comfortable with old crop supplies and the prospects for a large new crop and are buying hand to mouth. Last Friday, the Grain Industry Association of Western Australia increased their Western Australia (WA) grain forecast to 17.4 million metric tonne (MMT) from 16.3MMT in July after improved rainfall. Wheat was slightly increased to 10MMT, with barley increasing to 4.27MMT. We will look to update the balance sheets later this week

Due to dry weather, The South Australian (SA) Faba Beans market is firm; they need more rain to get growers to sell.

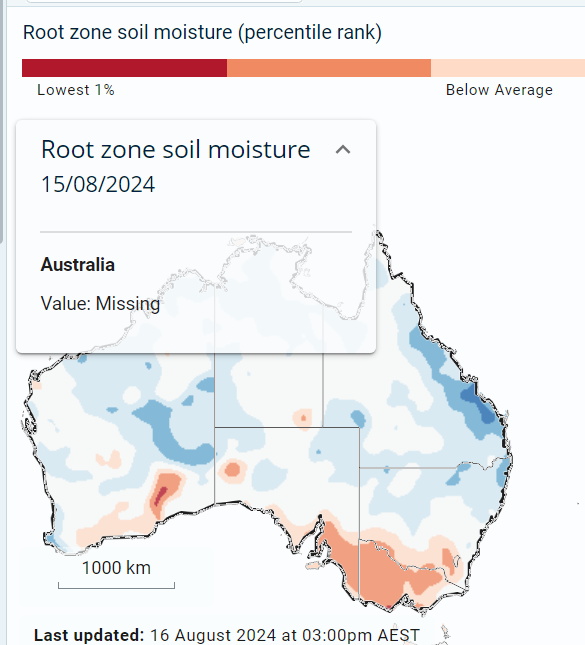

Soil moisture levels were close to or above the median in all states except Victoria (VIC). The first week of August showed a reduction in soil moisture in SA and VIC.

Ocean Freight & Shipment Stem Update:

The market is still struggling to find its direction, not helped by another week scattered with holidays in both the Atlantic and Pacific basins. Panamaxes are facing soft sentiment which is gently eroding rates across the board as owners struggle to find a positive note to halt the decline. In the Atlantic, a lack of fresh demand has caused the market to be nervous about the near-term future. However, it should be noted that grain round voyages are still trading at a slight premium to other rounds. So if we do see demand pick up in the traditional grain loading areas, there should be a steady floor for rates to push again. The Pacific will be looking (rather hoping...) to find something similar this week. The Supra/Ultra market was largely uneventful throughout the week with rates generally trending sideways. The Handy market was quiet but steady.

There was 216 thousand metric tonne (KMT) of wheat and 81KMT of canola added to the stem in the past week

Australia exported 725,085 metric tonnes (MT) of barley and 249,071MT of sorghum in June, according to the latest export data from the Australian Bureau of Statistics. The feed barley component at 485,276MT was more than double the 216,118MT shipped in May, with shipments to China accounting for 79 percent of the total.

Australian Weather:

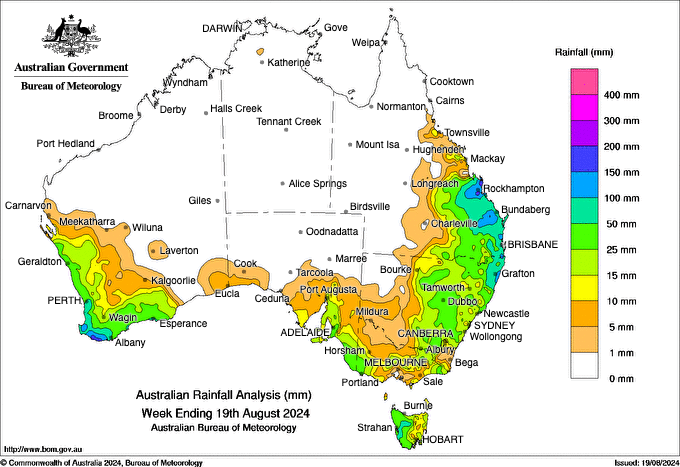

QLD and northern NSW received good rains throughout last week. This included 30-50mm in QLD and 15-30mm in NSW. Southern NSW farmers are looking for rain ahead of spring to maintain the well-above average yield outlook. Rainfall tallies across VIC cropping areas for the week were disappointing. There was only 5-10mm received and more is needed in August otherwise yields will suffer. SA received good rains with 15-25mm falling while lighter totals were seen in WA cropping areas.

Overall, Australia experienced higher precipitation than forecasted (134% vs. 120% of the median forecasted) in July, mainly due to increased rainfalls in WA and SA (144% vs. 89% of the median forecast in WA). The latest August 2024 forecast indicates higher figures compared to the previous estimate (139% vs. 11% of the median previous forecast), driven by an increase in rainfalls in in SA, VIC, and WA.

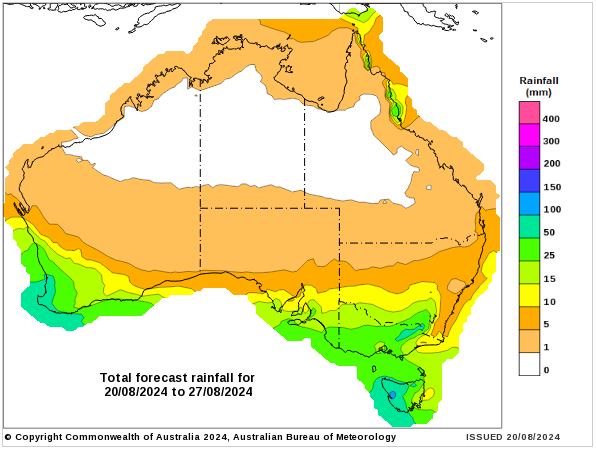

Looking forward, most forecasts predict more of the same.

8 day forecast to 27 August 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 19th August 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to close last week when valued against the USD closing at 0.6644. Last week on the data front Australia’s unemployment rate ticked higher last month, even as employers added about three times as many jobs as expected. The job gains will probably discourage the Reserve Bank from cutting its key interest rate in the near term.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.