Australian Crop Update – Week 32, 2023

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

Global markets were sharply down at the end of last week. However, there were only smaller declines in Australian cash prices as the grower becomes increasingly reluctant to sell given events in the Black Sea, talk of Indian imports, Chinese bans being lifted and so on. There was also limited farmer selling with ongoing production uncertainties associated with the impact of El Nino weather patterns.

China to Lift Ban on Australian Barley

The Australian Government was notified that China will lift its trade sanctions on Australian barley from Saturday. The announcement comes roughly three years after the 80.5% duties first cut off what was once as much as a A$1.5b annual trade and led Canberra to file a case at the WTO. This lift will allow Australian growers and producers to re-enter the Chinese market. Traders were expecting this announcement, but it still offered a kick in the farmer bids. China uses 3-4 million metric tonne (MMT) of malting barley annually and they would typically like to import this from Australia, as Australia has a $30 per metric tonne (MT) plus freight advantage over France where China has been importing more barley from over the past three years. Ukraine barley isn’t available because of the Black Sea grain deal expiring in July.

The immediate reaction to this news has been positive with feed barley values rising sharply. It remains to be seen whether this pricing relativity carries into harvest.

Ocean Freight Market Update

The freight market maintains its range-bound status with little to report from the past week’s events. Panamax bucked the trend to some degree but any improvement in levels is coming from a very low base. It's difficult to say specifically but activity from European Community Shipowners' Associations (ECSA) seems the primary push behind Panamax rates. Otherwise, it is very much unchanged for the Ultramax/Supramax sizes. We remain of the opinion that the Handymax market is perhaps under-priced at the moment, especially for nearby tonnage.

Also notable at the moment are Panama Canal delays which have crept up to 18 days (reduced rainfall having curtailed water levels in the lakes/lock system). Presently about 32 ships are transiting each day versus 36-38 in normal operation. Bunkers have also risen appreciably in recent days on the back of Saudi oil production cuts.

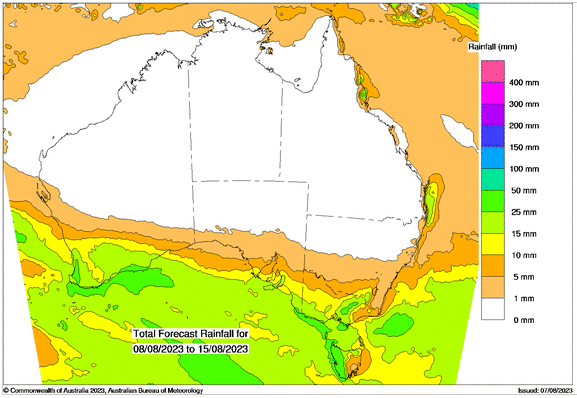

Australian Weather

There was good rain in parts of Western Australia (WA) last week, which saw 10-20mm across the northern zones. 10-40mm also fell across the southern zone of WA. Crops needed this rain, which buys more time for crops that are still dry. Falls were heaviest along the coast and lighter on the eastern fringe of the cropping zone. There was little rain for the main part of the central WA cropping zone which is the state’s largest production area. There was little meaningful rain for the other states, which increases crop stress in northern New South Wales (NSW) and Queensland (QLD), with temperatures typically set to climb in the second half of August in the north as we near spring. This would lock in low yields without rain.

8 day forecast to 15th August 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 8th August 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

Last week was a disastrous week for the Australian Dollar giving up nearly 1.2% and passing through US$0.66 amid increasing economic headwinds. Having marked a weekly low of US$0.6516 the AUD seemingly found some support through trade on Thursday, only to give up gains leading into Friday’s all-important US non-farm payroll print. Attentions this week turn to Wednesday’s Chinese CPI update as the first real headline item on the macroeconomic docket. The Chinese economic slowdown remains a significant headwind capping the AUD upside and another deflationary print will likely exacerbate Yuan weakness and weigh on the AUD.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.