Australian Crop Update – Week 33, 2023

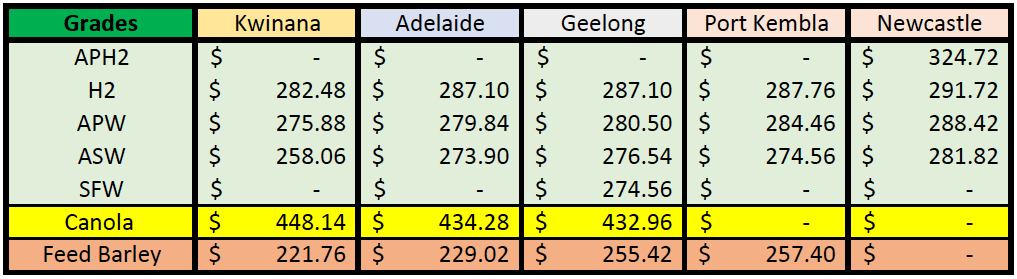

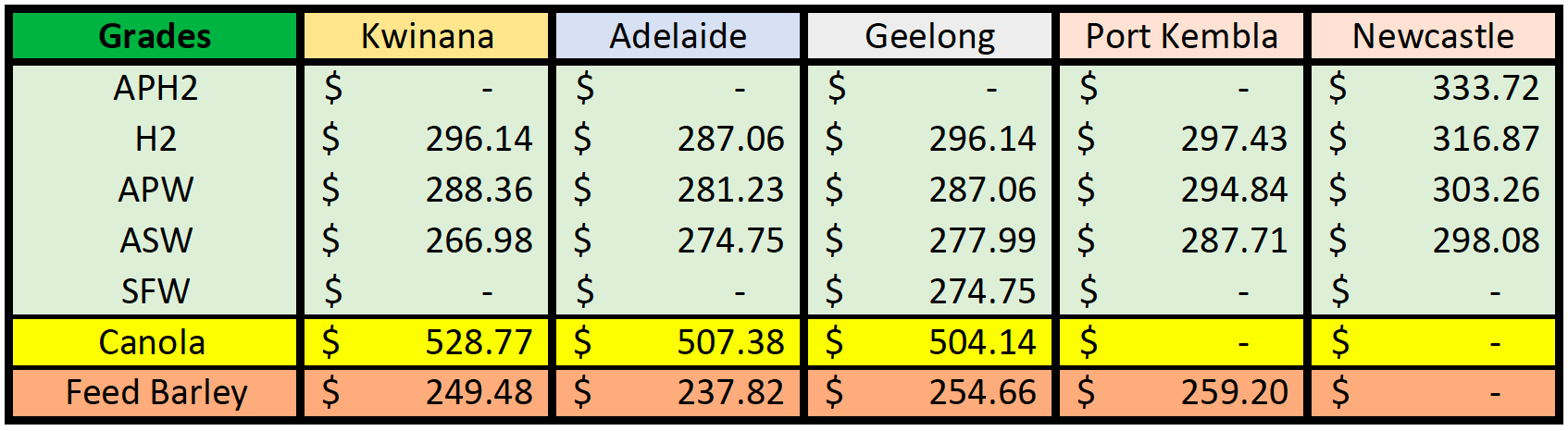

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains Market Update

There were some notable gains in the Australian domestic markets last week, particularly in wheat and barley. East coast Australian grain was higher by USD8-10 per Metric Tonne (MT) while the largest gains were from Western Australia (WA) up USD15/MT for wheat and USD17/MT for barley following the news of China’s decision to reverse the tariff on Australian barley last week. Indeed, China has started booking cargoes of Australian barley. Traders have supposedly booked a number of cargoes however the exact quantity is not known.

New crop prices for wheat remain strong in the north of New South Wales (NSW) where dry weather has resulted in a lower planted area, but prices continue to fall in Southern NSW, Victoria (VIC) and South Australia (SA) where crops are in good condition as we approach spring.

Australia exported 418,075MT of feed barley, 47,807MT of malting barley and 395,370MT of sorghum in June, according to the latest data from the Australian Bureau of Statistics. On feed, the June figure was down 22 percent (pc) from the May total of 534,560MT. Saudi Arabia on 184,000MT, Japan on 155,090MT and Thailand on 32,571MT were the three biggest markets.

On sorghum, volume has dropped 10pc from the May peak of 440,921MT. China on 275,462MT accounted for 70pc of June shipments, with 60,000MT to Kenya and 30,000MT to Sudan the second and third-biggest markets.

USDA Report Recap

The USDA saw some reductions in production with EU, Canada and China each losing 2-3 million metric tonnes (MMT) of production. However, USDA also reduced demand so that stocks to use went up slightly. It is worth noting that Ukraine production was up 3.5MMT however it is unknown know how accessible that grain will be.

There were similar patterns in barley, with crop losses in some of the key producing nations but demand down by close to the same number.

Ocean Freight Market Update

Last week saw the freight market bounce back to life. Sharp rises across all sectors are the consequence of a general increase in demand. We have noticed for almost two weeks that trader activity was increasing across the commodities from fertiliser to scrap metals, especially on the Handymax sizes.

Last week it became apparent that the Atlantic and Southeast Asian markets were suddenly short on tonnage, particularly in spot positions. It was almost like a slow tightening reached a critical tipping point and owners realised they had the ascendency again. As usual, this caused plenty of "waiting for the bottom" cargo interests to jump in as charterers got FOMO (Fear Of Missing Out) on the basement levels of the last three months.

Adding to the sense of urgency for cargo interests has been the rapid rise of bunker prices. Singapore has leaped from the $580's pmt 10 days ago to mid $650's pmt. No one foresaw the fuel prices rising so dramatically and the combined effect of the freight market sparking into life with the fuel rise is causing much uncertainty. We have well and truly broken out of the range-bound mentality although it remains to be seen for how long.

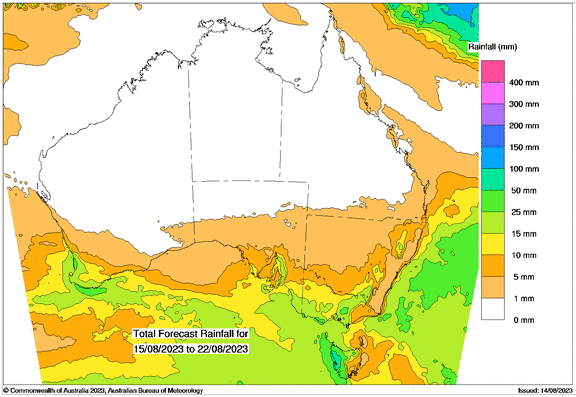

Australian Weather

The weekly rainfall totals show good falls in VIC as well as parts of WA and Southern NSW. The rain in Southern WA came on the back of good rainfall received last week, which was needed given the region received very much below average rainfall from May-July. A small part of SA also saw light showers of less than 10mm during the week. Queensland (QLD) and Northern NSW only saw coastal showers, with cropping areas missing out. Dry season conditions are expected to continue for the northern part of Australia over the next fortnight. There is increasing crop stress in Northern NSW, with concerns that a hot, dry spring could limit yields in both Northern NSW and QLD. For August to October, below median rainfall is likely to very likely (60% to greater than 80% chance) for much of Australia. The northern WA cropping areas are also suffering from lack of water, but this is being offset by the favourable conditions in the southern regions.

8 day forecast to 22nd August 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 14th August 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar continued its downward spiral on Friday, overwhelmed by a stronger US dollar and ongoing Chinese economic uncertainty. US PPI data unexpectedly edged higher, propelling US yields upward as markets prepare for the possibility of one more Fed rate hike. This was in stark contrast to comments from outgoing RBA Governor Philip Lowe. It is clear the RBA hopes it has done enough to control inflation. China data showing a steep decline in bank lending and concerns over potential defaults in the property sector saw the AUD give up 0.3% on the day and 1.1% for the week, sliding below US$0.65 to mark lows at US$0.6486.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.