Australian Supply and Demand Update - August 2023

On the back of our visit to Australian Grains Industry Conference (AGIC) the week before last and discussions with our analysts AgScientia, it’s time to pull back the production forecasts. El Niño has been flagged as a production risk for some parts of Australia, and although we are of the school that says we have not met all the parameters of a fully formed El Niño or indeed that an El Niño always leads to large losses in production, we do feel we are moving back towards mean production levels this year after two record years.

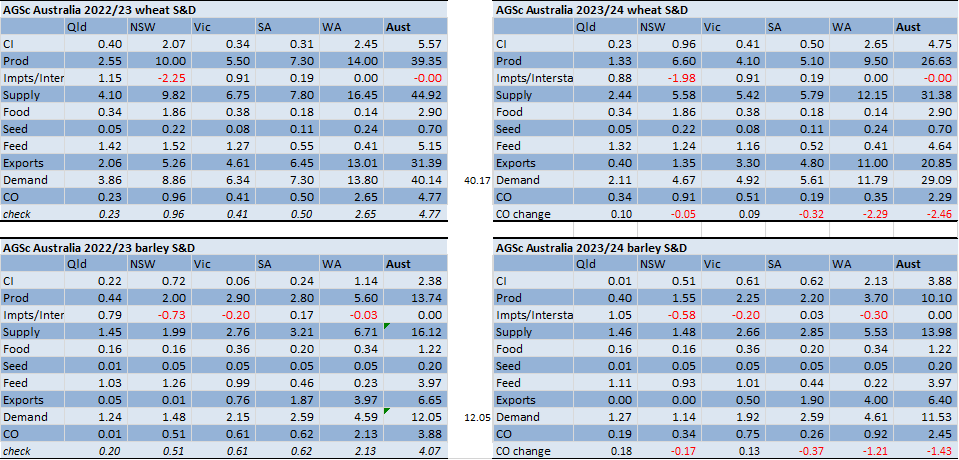

Production Estimates

The planting window is closed. It’s estimated that less than a quarter of the intended wheat plantings in northern New South Wales (NSW) from Mungindi, Collarenebri, Burren Junction, Walgett, Coonamble, and Nyngan has been planted. This is a big deal as these areas accounted for about half of the state’s wheat plantings in the 2020/21 Census and it will have a major impact on the NSW 2023/24 winter crop production. Some areas are better than others. Areas east of Moree are planted and crops are ok, but the larger cropping areas to the west which makes up a large portion of the region only has a small proportion of the crop in the ground.

Based on this, we have cut the northern NSW wheat plantings by a third. We were forecasting a combined planted area across the northern, north western and central west of the state to be 2.2 million (M) hectare (ha) and this is now back to 1.45M ha. Most of the reduction is in the northern and north western areas, with the central west being trimmed by 6%. We have also pared the northern yields back to below average from the previous average assumptions. We don’t believe we are being unduly hasty about the sharp reduction in the northern crop forecast. Agronomists are saying many farmers in the north have already given up on the 2023 winter crop. There is a north/south divide line in NSW and West Wyalong is the cut-off line. Crops to the south of West Wyalong and east of Forbes are very good. However it becomes patchy and problematic to the north. We have edged southern NSW slightly higher, although this has little impact of the sharp reduction in the northern planting assumptions.

The combined changes lower the NSW wheat crop back to 6.6 million metric tonne (MMT). Queensland (QLD) is left at 1.3MMT. Parts of QLD received rain from the recent change however QLD yields will ultimately be a function of the spring weather and finishing rains. We have lifted yields in southern NSW, Victoria (VIC) and South Australia (SA) slightly on the previous forecasts based on the favourable conditions. Western Australia (WA) has been pared back slightly to 9.5MMT given slightly poorer conditions in the north. Together, this puts the Australian 2023 wheat crop at 26.6MMT.

National barley production remains large at 10.1MMT. Favourable weather in the key production areas of southern NSW, VIC, SA and southern WA help to insulate production despite the dry weather worries in the northern cropping areas. We have cut NSW barley production to 1.55MMT with 0.75MMT in the north of the state. We have left QLD barley production at 0.4MMT.

Demand Predictions

Domestic demand assumptions are largely unchanged. Feedlot numbers in the north are expected to remain high courtesy of the cheaper cattle prices and the ever-increasing capacity. Feedlot operators have shown in recent years they will keep the pens near capacity most of the time. The question in the north is which feed grains and where will they be sourced from. We estimate the QLD feed grain usage for 2023/24 at 2.6MMT with 70% of this coming from the feedlots.

We have reduced the interstate wheat movements from NSW to QLD as traders focus on exporting more of the NSW crop from its nearest ports and Grain Corp maximises its rail efficiencies rather than focusing on volume as they have done for the previous three sessions. We have 575 thousand metric tonne (KMT) of NSW barley going into QLD as well as 100KMT from SA and 300KMT from WA. We are forecasting 2023/24 wheat exports at 0.4MMT.

NSW wheat exports predictions have tumbled to just 1.35MMT with the sharply reduced crop. VIC wheat exports climb to 3.3MMT with a carry over of 0.5MMT and SA up to 4.8MMT with a carry over of around 0.02MMT. WA exports hold at 11.0MMT with the large carry in while the carry over stocks shrink to 0.35MMT. National 2023/24 carry over wheat stocks fall by 1.4MMT to 2.45MMT.

The large barley production estimate of 10.1MMT allows for sizable exports from the southern cropping areas. We have boosted barley feeding at the expense of wheat with the big spreads which we expect continue. Feedlots, poultry and pigs continue to maximise barley feeding. Nonetheless, this still allows for exports of more than 6MMT which won’t be easy given the Black Sea pricing and how uncompetitive Aussie barley is into Saudi, which has been the major export destination in recent years. We expect that China will relent and lifts its anti-dumping measures on Aussie barley imports this month, but this doesn’t mean it will be easy. China is more comfortable on its feed grain imports now they have Brazilian corn as well as a sizable volume of downgraded domestic wheat which is expected to flow into domestic feed channels.

Weather

Looking forward. Spring weather will determine yield outcomes from here. WA saw some light showers of 5-10mm early this week. This front also offered slight showers for SA, VIC and southern NSW. WA is expected to see another weak front early next week. The extended 46-day model is forecasting average to slightly below average rain for WA, SA and VIC during August and below average for NSW and QLD. WA is expected to see generally mild weather through August while the model points to above average temperatures for northern NSW and QLD over the same period.

Supply and demand charts

Information and images to write this update was sourced from the below:

The University of Sydney: https://www.sydney.edu.au/news-opinion/news/2023/07/18/how-will-el-nino-impact-the-world-s-wheat-and-global-food-supply.html

Ag Scientia: https://www.agscientia.com.au/

Bureau of Meteorology: http://www.bom.gov.au/

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.