Australian Crop Update – Week 28, 2024

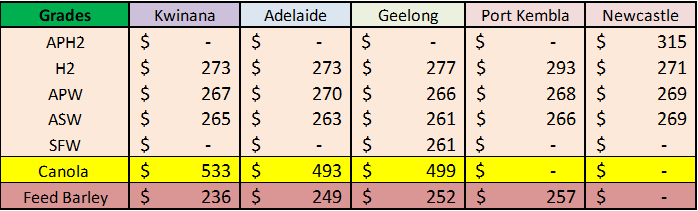

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

Local cash market bids continued to slide last week with falling global values and the stronger Australian dollar. The Aussie dollar was 0.6% higher for the week and is now up 2.2% in the past four weeks and seems set to break out of its range against USD weakness. Farmer and trade selling is slow but there appears to be some steady volume as some participants come to the realisation the weakness in values may continue as the northern hemisphere harvests are bought in.

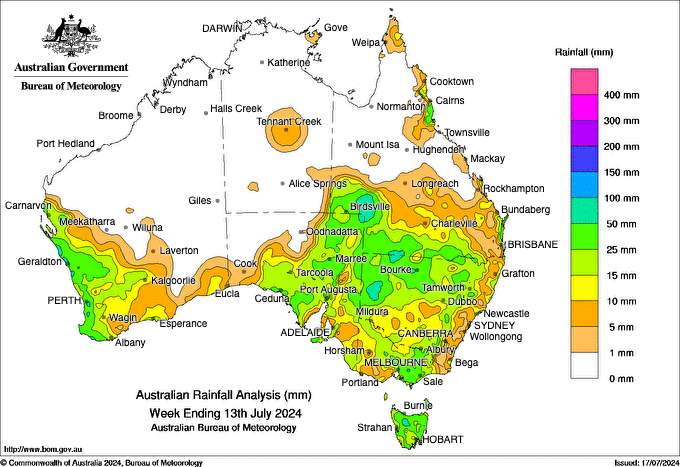

More scattered rain fell across the Australia’s cropping regions last week. The heaviest of the falls were in the northern cropping zones in Western Australia (WA) and the east coast with lighter falls across the southern cropping zones. In WA, there was 15-40mm in the Geraldton zone. South Australia (SA) also picked up more light showers which will benefit crops, but it falls short of the soaking rains needed to build soil moisture reserves. In New South Wales (NSW), there was 20-40mm across the north west of the state and up to 20mm across the south and central west. The central and western Darling Downs received 5-15mm for the week.

Overall, the northern cropping zones enjoy above average moisture, but the southern cropping zones are looking for more rain to build moisture reserves ahead of spring.

Ocean Freight & Shipment Stem Update:

The Market over the past week (possibly months now...) has been steady with no huge gains or losses on any sectors. Panamax in the Atlantic showed some improvement of the back on more demand ex east coast South America. The far east was more subdued but there has been more cargoes appearing ex Nopac and Aussie so rates have remained stable. On the supra/ultra sectors in the Pacific we saw improvement on the back of more Indonesian coal cargoes appearing while the far east was also supported with fresh steel and backhaul shipments. The handysize market was stable over the week, and we saw owners being able to consolidate previous gains without really being able to push the market further on. We await some clearer market direction because, at the moment, we are close to range-bound particularly on the smaller tonnage.

Container Freight Market Update:

The Red Sea crisis continues to upset the supply and demand balance in container shipping. Since the conflict started, shippers have had to contend with soaring spot rates on the Asia to North Europe and Asia to US West Coast which have risen 53% and 79% of 2020 peaks respectively.

Global container port congestion is worsening reaching 9 million TEU which is close to the peak of 9.6 million TEU seen during the COVID-19 pandemic. The ongoing Red Sea situation has forced container ships to detour around the Cape of Good Hope adding approximately 12% to TEU-mile demand. Rising congestion is driven by strained port infrastructure and the logistics of vessel re-routing amidst strong year-to-date trade volumes. At the Port of Singapore, the busiest container ship in the world, up to 61% of calls were delayed with transhipped and outbound containers experiencing a 10-day dwell time.

Data released toward the end of June indicated the revenues of the Suez Canal have fallen to $337.8 million in May. The figure is 64.3% lower compared to revenues of $648 million achieved in May 2023. Falling revenues follow a decrease in the number of vessels transiting the Suez Canal due to re-routing around the Cape of Good Hope. Vessel crossings have dropped from 2,396 ships in May 2023 to 1,111 vessels in May 2024. Equally, bulk cargo volumes through the Canal have dropped by 68.5% from 142.9 million tonnes to 44.9 million tonnes.

Australian Weather:

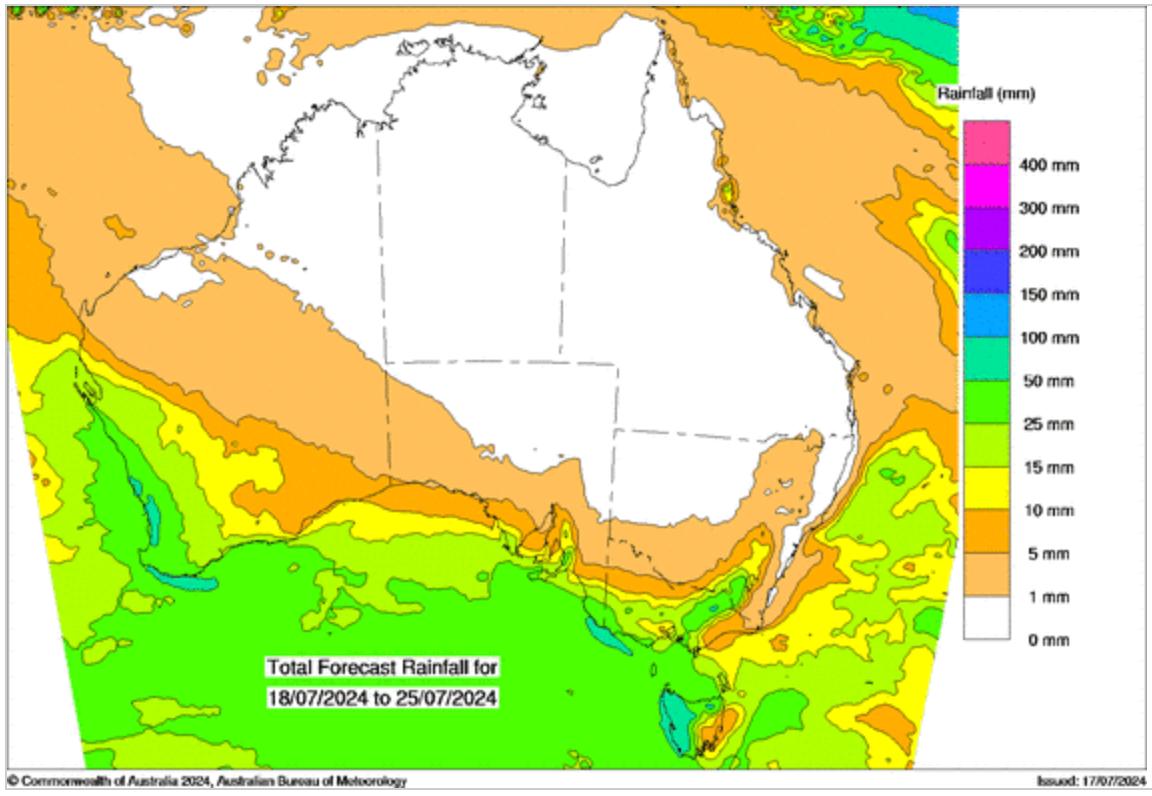

The Australian Bureau of Meteorology (BOM) extended rainfall forecasts are now showing above average precipitation for NSW, SA and Queensland (QLD) for August to October. This is consistent with the extended European model with is now pointing to above average rain for July-September. The BOM’s extended climate outlook remains on a La Nina watch but it appears to be adding in more of the La Nina pattern into the late winter and early spring rainfall patterns.

8 day forecast to 25th July 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 13th July 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to end last week when valued against the USD trading at 0.6780 at the close. The AUD has risen from just over 64 US cents in mid-April to around 67.80 US cents in recent days on the back of an expected rate cut in the US in September. China has announced its Trade Balance data for June showing a trade surplus of $99.05 billion, a significant increase from the previous figure of $82.62 billion.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.