Australian Crop Update – Week 29, 2024

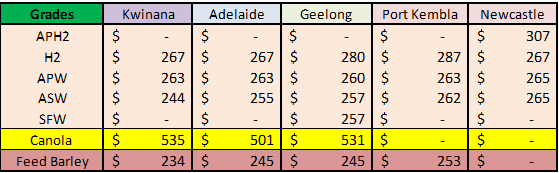

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian domestic grain prices remained under pressure in all states last week. Canola was the exception with bids stronger in old and new crop positions. The old crop premium to new crop is shrinking for wheat and barley. Sorghum pricing is easing as well, as exporters are covered for nearby shipments and China bids fade for new demand.

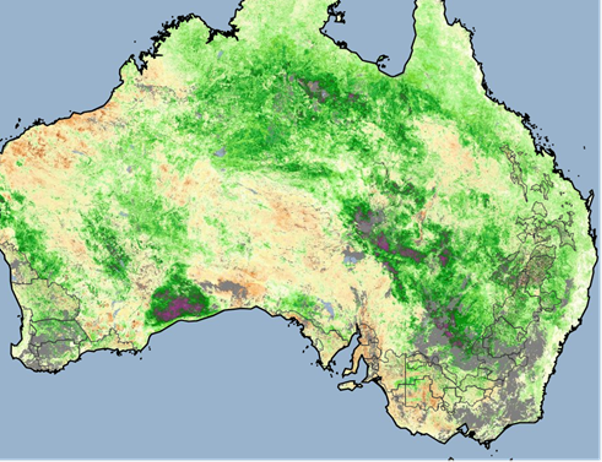

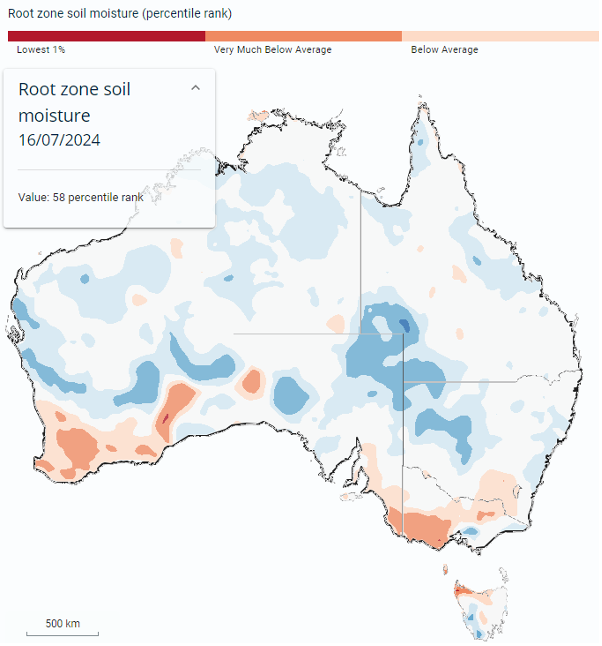

Overall, crop conditions improved last week. Large crops in New South Wales (NSW) and Queensland (QLD) are now assured with enough soil moisture to carry the crops to harvest. Western Australia (WA) is on track for average to slightly above average crops, but this is dependent on spring rains as soil moisture reserves are low. South Australia (SA) and Victoria (VIC) are also improving but they will need good spring weather if they are to achieve average yields.

Extended weather models are now pointing towards wetter than normal weather for the August to October as they factor in more of the expected La Nina influence.

Ocean Freight & Shipment Stem Update:

It’s been another quiet week for shipping stem additions which is to be expected as markets transition towards new crop and values compete against northern hemisphere new crop. Only 155 thousand metric tonne (KMT) of wheat was added to the stem in the past week down from 426KMT a week earlier. There was 69KMT of barley and 35KMT of canola added as well.

We are still in a balanced market. Panamaxes saw some support in North Atlantic with more cargo appearing in the market against tonnage lists tightening early in the week, while the South Atlantic cooled slightly across the week. The Pacific remained stable across the week with supply/demand equation holding steady. The Supras/Ultras was fairly uneventful throughout the week. However, interesting to note, that there were some rumours of Charterers willing to fix in period tonnage again which could point to a sense on optimism for Q3 and Q4. Handysize followed the same path of the bigger sizes and trended sideways for the most part. This week has started on the same note so without more cargo appearing or tonnage list growing we are expecting another steady week.

Australian Weather:

WA received beneficial rain last week. This included 20-30mm across all zones. SA also received another round of showers to support the later plated cropping areas. Lighter falls were seen in VIC with 5-15mm and NSW received some light rain for the week, although nothing significant. Improved rain across WA, SA and VIC is being reflected into the normalized difference vegetation index (NDVI) readings. Overall, QLD and NSW NDVI anomalies are well above average. Nothern NSW is near record high, the Central West and Southern NSW is well above average. Anomalies are improving in VIC.

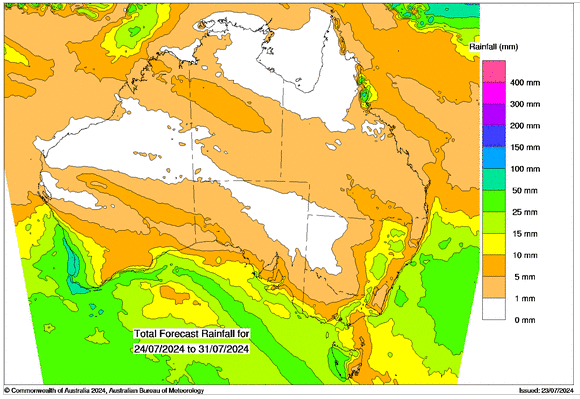

8 day forecast to 31st July 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 24th July 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to close last week when valued against the USD trading at 0.6670. The AUD saw considerable losses falling below 0.6700 due to the strengthening of the US dollar amid increased risk aversion. Commodity prices are affecting the Aussie dollar with Iron Ore prices plunging 1.70%, extending their losses for the last two weeks to more than 3.70%.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.