Australian Crop Update – Week 27, 2024

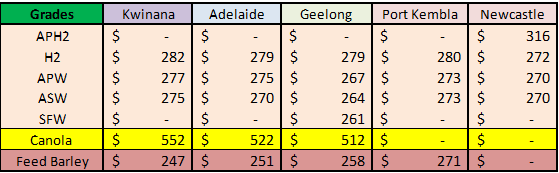

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian cash market was mostly steady to softer last week, although the extent of the changes varied between port zones. Exporters are trying to pull bids down to regain export competitiveness into key markets but grower reluctance to sell is working against this. Canola bids were $10-15 per metric tonne (/MT) higher for the week on the back of the 6% rally in Matif with the gains tempered by the 1.2% strengthening in the AUD.

Forecasters lowered Australia’s 2023/24 wheat exports due to the slower than expected shipping pace in the third quarter of our marketing year which finishes in September. Australia’s wheat prices need to reconnect, although it’s difficult to see where the motivation for selling will come from this early in the crop. Australian wheat is expensive compared to Black Sea supplies landed into Asia. Russian 12.5 pro was quoted at $220 FOB on Thursday by IGC which is around $260-265 c&f Asia.

ABS reported 1.6 million metric tonne (MMT) of wheat exports in May down from 1.85MMT in April and 2.57MMT in March. The Philippines was the largest destination at 334 thousand metric tonne (KMT) followed by Indonesia with 259KMT, South Korea with 170KMT, Yemen with 156KMT and China with 137KMT. Australia’s Oct/May wheat exports for 2023/24 are 14.85MMT which is 39% down on last year’s 22.8MMT. In percentage terms, wheat exports to Asian destinations have declined more than the Middle East and Africa. This is partly due to the heavy reliance on China in 2022/23, where exports are back 42%. But it’s not just China. Exports to South Korea, Thailand and Vietnam are back by a combined 3.5MMT on the same time last year.

Barley exports fell to 330KMT, less than half of the 697KMT in April. Barley exports to April fell to 218.9KMT which was the smallest since the 55.7KMT in August last year, which was the first month of exports after the import tariffs were lifted.

Sorghum exports were 325KMT with 320KMT of this going to China. Most of the exports were shipped from Brisbane with 203KMT followed by Newcastle with 86.4KMT and then 34.5KMT from Sydney.

Canola exports were strong at 677KMT up from 648KMT in April. Europe accounted for 243KMT of the exports followed by Pakistan with 181KMT, Japan 133KMT and 93KMT going to the UAE.

Australian Pulse Market Update:

Yield prospects for Australia’s lentil and faba bean crops have brightened considerably in the past month now that rain has fallen in South Australia (SA) and Victoria (VIC).

Chickpea crops in Queensland (QLD) and northern New South Wales (NSW) are looking like being big with above-average yields expected.

Shipping stems indicate a faba bean cargo which left Port Adelaide on the weekend bound for Egypt has wound up Australia’s 2023/24 bulk program. Prices for faba beans in the prompt market remain high. Trading in the new-crop market remains subdued as production concerns continue to take precedence in growers minds. Regular rain will be needed to see liquidity improve.

Crops in SA have mostly had enough rain to get them into August, but heavier soils in the VIC Wimmera and the state’s south-west need more rain very soon.

Australia exported 45,056 metric tonnes (MT) of chickpeas and 139,011MT of lentils in May, according to the latest data from the Australian Bureau of Statistics. The chickpea figure is roughly double the 22,048MT shipped in April, and reflects India’s long-awaited removal of tariffs on Australian chickpeas. Exports of Australian chickpeas to India jumped from just 270MT in April to 21,916MT in May. India imported 65,529MT of lentils and was the biggest market for May-shipped product, followed by Bangladesh on 39,457MT and Sri Lanka on 14,617MT.

Ocean Freight & Shipment Stem Update:

At the risk of sounding like a broken record, there is still a noticeable absence of fresh cargo leading to a gradual decline in freight rates across the board. Panamaxes continued to decline with little sign of support. The Ultramax/Supramax market also followed a similar path although the US Gulf showed some resistance where rates managed to push 2-3k per. The Indian market continues to struggle with spot tonnage lists beginning to grow. The Australian coast on the other hand is bucking the trend with fixtures now reported in the mid $20k's back to Spore/Japan range. In the Atlantic, the Handy market was uninspiring given the general lack of activity.

There was 604KMT of wheat put onto the shipping stem in the past week. This made it the biggest week for wheat additions since February. The surge in wheat additions should be taken with some caution as there were several ports that had held additions and chose to put them into the stem this week. Nonetheless, 604KMT is a large number when you look at the May wheat exports of 1.6MMT.

Australian Weather:

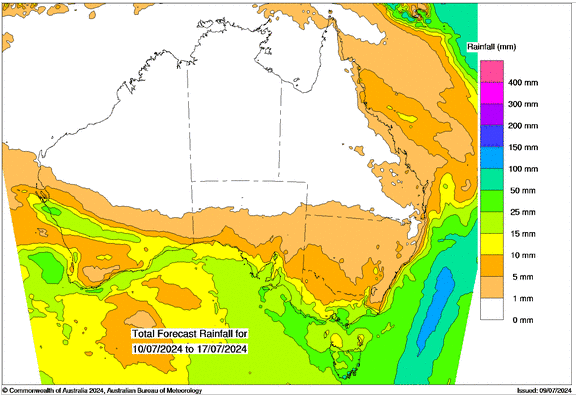

Weather patterns were little changed with limited relief to the ongoing dry in the southern cropping zones. There was some rain across the parts of Western Australia (WA), SA and parts of VIC but the falls were light and will not build soil moisture. However, the Geraldton zone did receive some useful rain earlier in the week. NSW crops are in very good shape with some farmers quietly hoping for a week of dry, sunny weather.

Forecasters are back peddling on the strength of the La Nina forecasts and what that means for Australian rainfall. The BOM has a La Nina watch, but it doesn’t guarantee a La Nina.

8 day forecast to 17th July 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 10th July 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was stronger to close out last week trading at 0.6730. The AUD held its ground against the USD on Friday, which weakened following soft US Nonfarm Payrolls (NFP) figures but stands at its highest level since early January 2024. Last week the minutes of the Reserve Bank of Australia’s (RBA) June monetary policy meeting showed Tuesday that the “board judged the case for holding rates steady stronger than for hiking.” Members observed that inflation was still above central bank targets in most economies, and services price inflation had generally been stronger than expected since the start of the year.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.