Australian Crop Update – Week 26, 2024

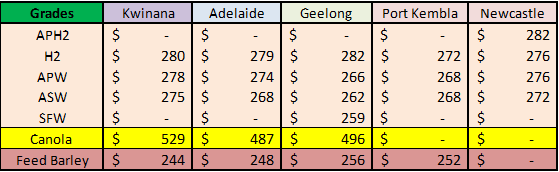

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

The Australian cash markets were steady to softer last week as they responded to more rain and offshore weakness. Old crop premiums for the higher grades are starting to come under pressure amid limited demand and overseas competition but on the other hand, supply is increasingly limited. In general, market participation is very limited with the nearby shorts sufficiently covered after the increased selling through June, while farmer selling has slowed.

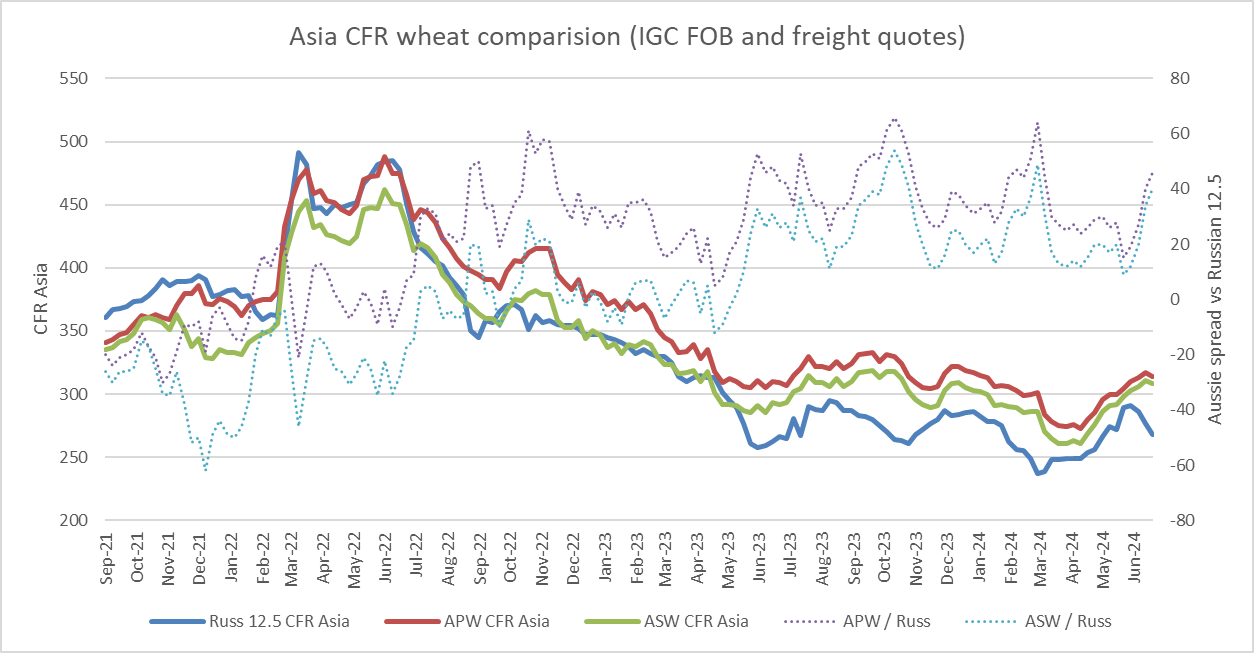

The trade was bidding much lower over the last 10 days as buyers reacted to stiff global export competition into Asian destinations as the new crop northern hemisphere harvest pressure is felt. It’s difficult to see this changing in the near term with the northern hemisphere harvest set to continue through July and into August which will keep the pressure on the c&f markets. Export sales are hard to make at the widening price relativities.

Australia’s markets have ignored a lot of the decline in US wheat futures in June which has seen the Australian basis rally by USD$22 to 30 per metric tonne (/MT). Australian farmers are slow sellers of old and new crop, and this is unlikely to change until we get to spring. At the same time, exporters are finding it difficult to connect with overseas buyers with the widening spreads between Australia wheat and Black Sea wheat landed into Asia and other destinations. History shows the spread between Aussie wheat and Black Sea wheat must narrow to find demand, but it may not happen until we get closer to the new crop positions.

Western Australia’s (WA) Geraldton zone received more beneficial rain last week, but limited rain fell across WA’s southern cropping areas. Falls in the Geraldton zone ranged from 10-50mm with most areas seeing 20-30mm. Falls tapered away in the Kwinana zone with most areas only seeing 5-15mm.

South Australia (SA) also picked up showers through the week. The coastal areas on the Eyre Peninsula’s (EP) west coast and lower EP saw the best of it. There was a general 10-15mm on the Yorke Peninsula and 5-12mm in the Lower North and the Murray Mallee. There was some patchy rain in Victoria (VIC) with the Wimmera picking up 5-15mm, but only 1-5mm in the Mallee.

Ocean Freight & Shipment Stem Update:

A quieter week for bulk shipping but rates appear to be holding steady for now, largely underpinned by tight tonnage supply. Panamax continued to struggle with the Atlantic proving the more positive basin on the back of some fresh enquiry. Supra/Ultras in Asia are still trading around 16-18kpd for Pac/Aussie rounds. The handysize market demand/supply remains balanced and rates have overall held their levels.

On the Aussie coast, we saw a few prompt ships cleared early in the week which in turn helped stabilised the rates.

On containers, Singapore port has experienced severe congestion over the past few weeks and this is leading to substantial vessel delays for ocean carriers and a sharp increase in container rates for shippers who are already dealing with the difficulties created by cancellations and diversions away from the Red Sea.

The Shanghai Containerized Freight Index (SCFI), which is considered a benchmark for container freight, rose from USD 2,305/TEU on May 10 to USD 3,475 on June 21, an increase of 50%.

Reports indicate that nearly half a million containers are currently stuck at the port of Singapore. According to Drewry’s Ports and Terminals Insight, in the first five months of the year, throughput at the port of Singapore grew 8% year-on-year but is not enough on its own to challenge existing handling capacity. However, the rerouting of container vessel services away from the Red Sea in response to the Houthi attacks resulted in a 22% increase in average parcel sizes in the period between January and May and this has created efficiency bottlenecks which are, according to some reports, spreading to other Asian hubs.

To address the bottlenecks, the Maritime and Port Authority of Singapore (MPA) has reopened the previously shuttered Keppel Terminal. This move has increased weekly throughput from 770,000 TEUs to 820,000 TEUs, offering some relief to the port terminals and yards. In addition, to alleviate the severe congestion, Singapore also plans to expedite the opening of new berths. Terminal operator PSA will inaugurate three new berths later this year to boost overall port handling capacity and it is hoped things start to ease in Q4 of 2024. However, none of this helps the issue of container lines not being able to call in the Red Sea. That issue seems set to continue without an end or solution in sight.

Last week was another week with limited activity for the shipping stem additions. There has been about 250 thousand metric tonne (KMT) of wheat added to the stem in the past week, 60KMT of barley and 30KMT of canola. The wheat additions were split between WA and VIC with a 25KMT vessel added in SA. May wheat exports are expected to be down on April’s 1.86 milliom metric tonne (MMT). Australia’s grain exports are expected to remain slow until new crop supplies come on stream.

Australian Weather:

The Bureau of Meteorology (BOM) released its Jul/Oct forecast last week, which shows a continuation of the drier than normal pattern in Australia’s southern cropping zones. For July, much of Australia is expected to see typical rainfall for the month, although the dryer than normal pattern continues in the south with a 60-70% chance of normal rain across far southeast Australia.

8 day forecast to 8th July 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 30th June 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar (AUD) was slightly stronger to close out last week when valued against the US dollar (USD) trading at 0.6670. Friday's session recorded a significant uplift in the AUD against the USD following an unexpected inflation reduction in the US in May. On the data front, last week Australia’s monthly inflation rate increased to its highest level in 2024 in the latest indication that the Reserve Bank won’t be cutting interest rates soon and might yet hike again.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.