Australian Crop Update – Week 27, 2023

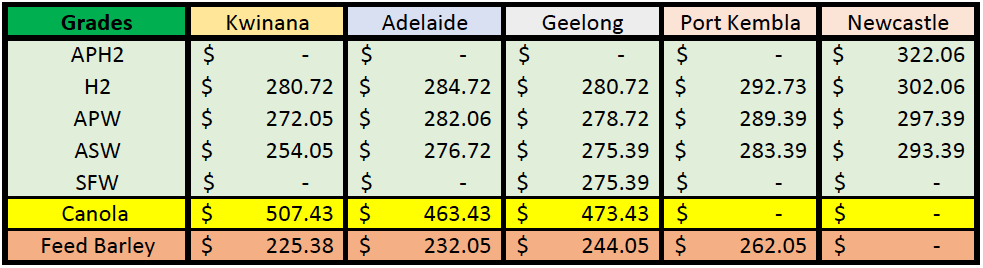

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian domestic bids were sharply lower last week on the forecast rain as well as the washout in US futures. Farmer bids were down in all zones and all grains, apart from canola which held its own and was firmer in some areas due to changes in the Matif. Heavy rains then fell across the cropping areas of Queensland (QLD) as the major weather models have proven to be accurate in forecasting, although it remains to be seen whether this influences the grower’s mindset re sales. Northwest New South Wales still did not get enough, and these areas are desperate for rain to boost soil moisture for crops already seeded and finalise plantings.

NDVI anomalies declines across most of Western Australia, New South Wales and Queensland in the past week. South Australia improved while Victoria was mixed. In terms of departure from average over the past 20 odd years, Qld is about normal although the western fringes are lagging. NNSW (extends down to Condobolin) is behind normal, SNSW, Vic and SA are all ahead of normal. Anecdotally, most farmers in these parts are saying crops are as good as they have been at this time in the past three seasons, which is a high benchmark. WA is mixed. Geraldton and northern Kwinana are behind average. Crop conditions improve in the southern Kwinana and upper Great Southern but aren’t as good in the lower Great Southern and extends into the Esperance zone.

The week began with further declines in wheat markets following a surprisingly bearish USDA planting report which showed the farmer planted an additional two million acres of corn than the market was expecting. This is important as it amounts to an extra 8-9 million metric tonne (MMT) based on a 175 bpa yield. It largely nullifies the yield losses due to the dry weather over the past month.

Australian wheat and barley remain globally expensive. New crop APW wheat is around USD283 FOB on a replacement basis. This compared to Russian wheat at around $235-240 FOB. Barley is USD220 FOB equivalent. The barley also looks expensive against new Black Sea quotes which fell to USD180 FOB last week.

Ocean Freight Market & Export Stem

There was 332 thousand metric tonne (KMT) of wheat, 170KMT of barley and 75KMT of canola added to the export stem in the past week. Although the wheat additions are up on the previous two weeks, there has been a noticeable slowdown in the shipping pace. Most of the wheat additions were in Western Australia as well as some smaller volumes in South Australia and New South Wales. The 170KMT of barley added to the stem in the past week was the most in 10 weeks with some talk Vietnam may have taken some cargoes. It’s interesting to note that all the barley additions are in handy size vessels with Australian barley no longer competitive into Saudi it makes sense the demand would be in Asia. There was 75KMT of canola added to the stem in the past week.

The market appears to be range-bound with cargo volumes just enough to keep levels steady. This is traditionally a quiet period so in the nearby, there doesn’t appear to be much opportunity for change. Levels remain much as they were last week; large Handymax’s around $7-7.5kpd, Supramax’s $7.5-8.5kpd, Ultramax’s $8.5-10k and Panamax’s $8-10kpd (all basis Pacific Round Voyage). Period rates are slowly easing but it's still notionally higher compared to voyage charterer values.

Australian Weather

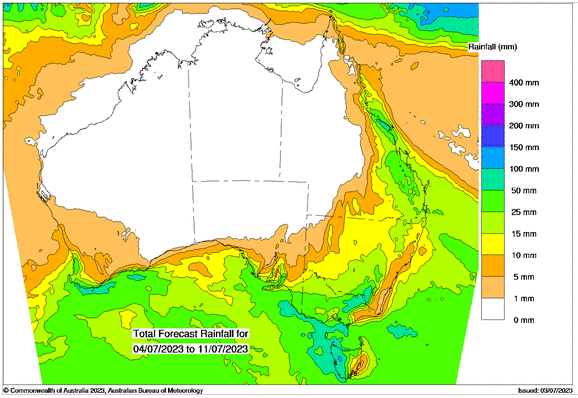

Heavy rains fell across north west Qld in the past 24 hours as the major weather models have been accurately forecasting for about a week. The system is forecast to push south east towards Brisbane in the next 48 hours although the heaviest rains will continue to be centred around northern and central Qld. A similar pattern continues through the week although the rainfall totals will increase along central and southern Queensland through the week. Lighter falls are slated for NSW with only showers expected to push south of the border.

8 day forecast to 5th of July 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 28th June 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar outperformed through trade on Friday buoyed by softer US data and a surge in positive risk sentiment. The AUD traded toward lows near US$0.6615 before softer than expected US consumer spending and a further downturn in inflation pressures helped bolster demand for equities and risk assets. The AUD bounced off lows near US$0.66 and climbed back above US$0.6650 to mark intraday highs just south of US$0.6670. This week the AUD is expected to be range bound between 0.6580 to 0.6730.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.