Australian Crop Update – Week 26, 2023

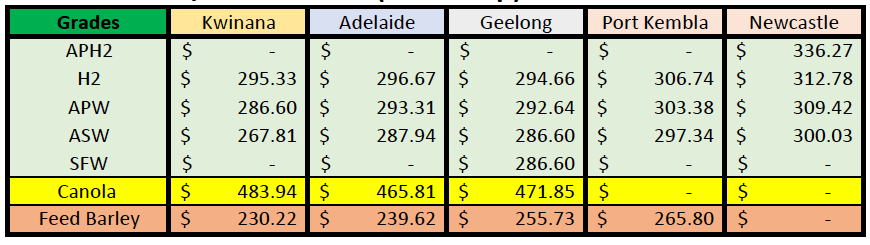

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian domestic grain prices were stronger last week with the bids strengthening and there seems to be plenty happening behind the scenes and on the price inputs. Global inputs were volatile with the sharp gains in CBOT wheat on fund short covering with the drought in the corn belt. Investors are nervous about pushing this too hard to quickly as they know grain futures will tumble just as quickly if the forecasts offer improved rain. Investors pushed markets sharply higher early in the week before turning more defensive ahead of the weekend where weather patterns could change while markets are closed for a couple of days.

Dry weather in the north and tight old crop supplies are keeping the old crop bids supported. East coast shipping stem additions have slowed considerably in the past month or so, but the strong early export pace means the old crop wheat supplies are relatively tight. The supply and demand shows that Queensland and New South Walers will be tight and even Victoria will be a lot tighter than we thought just a few months back.

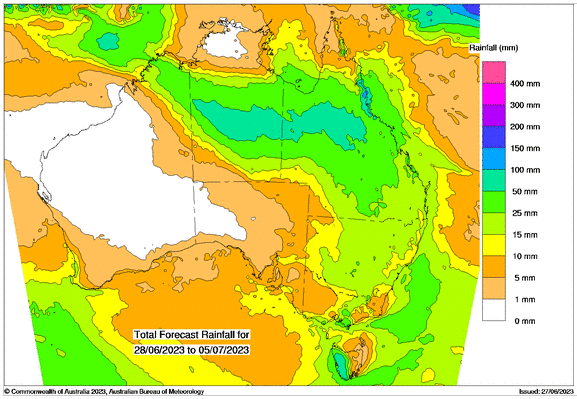

South Australia, Victoria and Southern New South Wales are off to a favourable start to the 2023/24 cropping season with farmers across these parts saying crops are better positioned at mid-June than they have been over the past three seasons. Western Australia is patchy with farmers looking for a soaking rain to consolidate crops over the winter and build soil moisture ahead of spring. New South Wales is desperate for soaking rains to build soil moisture on the crops that are in the ground. Weather models offer a good chance of rain next week for these areas although it’s still a week out and a lot can change.

Ocean Freight Market & Export Stem

Another quiet week in the freight markets. Lack of cargoes remains the ultimate issue - especially in the Atlantic where the USG is very quiet. Ultimately this is attributable to the prevailing economic malaise. Operators are putting their own tonnage into their business and holding fire on future cargoes because there is a widely held perception the market will not get much lower therefore there is only a loss to be booked in. Conversely, the market up-side is on the ships but they are still hard to fix on period because tonnage suppliers are still holding out for disproportionately high prices. High potential losses on any fixable first legs are discouraging operating activity. What we are left with is a largely prompt market for both ships and cargoes. Ultramax are fixable around $10kpd for Pacific and a touch discounted for Continent. Panamax are fixing similar levels though the b/h to Atlantic is much more discounted - sub $5kpd from PRC deliveries. Nice spec Handymax vessels remain $7.5-8.5kpd for Pacific round voyage and low teens for sp. Older 32kdwt types are discounted to $8-9kpd.

There was 377KMT of wheat, 84KMT of barley, 67KMT of canola and 75KMT of sorghum added to the shipping stem in the past week. The favourable seasonal start in Victoria is helping to flush out old crop farmer selling from the Victorian farmer. Western Australia accounted for 178KMT of the wheat additions in the past week, Victoria 124KMT and 75KMT South Australia. Wheat additions have certainly slowed in recent weeks as the season progresses, but also in the growing disparity between Australian and Black Sea supplies. This hasn’t been just because of the slowdown in the east coast exports as the old crop supplies tighten. Western Australia has added 680KMT of wheat to the stem in the past four weeks compared to 1.33MMT in the previous four weeks. New South Wales and Queensland wheat stem additions have slowed, although Victoria continues to advance.

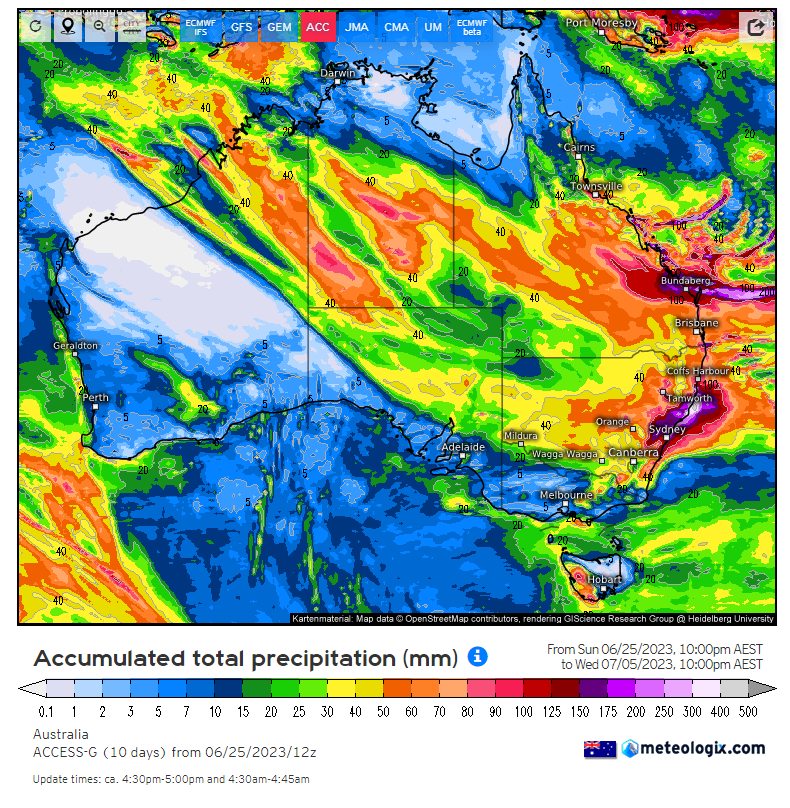

Australian Weather

Central Australia is set for an unseasonable deluge this week and this rainfall pattern is set to result in some significant rain for northern New South Wales and Queensland. June is typically the driest month for central Australia. The rain would allow unplanted areas to be seeded and offer valuable moisture to crops ahead of spring.

8 day forecast to 5th of July 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 28th June 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar is slightly weaker to open the week when valued against the Greenback trading at US$0.6600. On Friday, the Aussie faced severe selling pressure and the AUD/USD fell to its lowest level since early June towards the 0.6660 area, as Australia’s S&P Global PMIs for June registered mixed data on Friday.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.