Australian Crop Update – Week 28, 2023

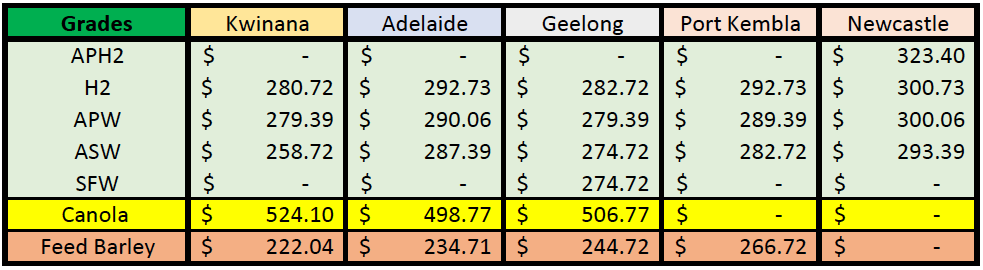

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Grains & Oil Seed Market

Australian domestic markets steadied last week, albeit to varying degrees, after the sharp declines from the previous week. Barley shipments have once again been shipped from Western Australia and imported into Queensland to meet the nearby feed demand. Southern wheat and barley edged higher after last week’s sharp decline.

May 2023 Grain Export Statistics

Australia exported a further 3.33MMT of wheat and durum in May. This lifts the Oct/May accumulative total to 22.9MMT which is up 5MMT on the same time last year. Western Australia exports are up 38% on last year, Queensland is also 38% and South Australia 46% higher. Victoria exports are up 19% and New South Wales 4% higher.

Western Australia exported a record 1.46MMT of wheat in May up from 1.1MMT in April. New South Wales wheat exports slowed to 439 thousand metric tonne (KMT) but larger exports from Queensland helped offset this. China took a further 794KMT in May lifting China’s Oct/May to 6.3MMT vs 4.2MMT at the same time last year. Vietnam was the next largest with 457KMT then Indonesia with 409KMT and then South Korea not far behind with 373KMT.

There was 600KMT of barley exported in May, slightly up on April at 593KMT. Western Australia shipped 380KMT of the May exports or 60%. Saudi was the largest destination with 126KMT. Vietnam was at 125KMT and then Japan at 105KMT. Australia’s Oct/May exports are 5.25MMT which is 9% down on last year. Sorghum exports were 456KMT with 446KMT of this going to China.

Canola exports were up 448KMT from 287KMT in April. This lifts the Oct/May to 4.1MMT which is modestly down on last year’s 4.3MMT. Victoria exported 208KMT of canola in May and 142KMT came from Western Australia.

Lentil exports were huge at 265KMT up from 152KMT in April. There appeared to be some switching from faba beans to lentils which suggests previous months were incorrectly coded. Australia has exported 1.1MMT of lentils in Oct/May which is close to double the previous years 632KMT.

Ocean Freight Market & Export Stem

The freight market remains in a sluggish state although Capes/Panamax seemed to enjoy a mini resurgence last week on the back of iron ore/coal demand. Rates in the Pacific are generally trending sideways however we did hear a 37dwt open Japan was reported fixed for Aussie round voyage at $8,750 which owners are now trying to hang their hat on. Supramax are achieving around $8.5-$9k basis South China for Aussie round voyage and Ultramax $1k premium for same. Bunkers remain relatively stable.

There was 405KMT of wheat added to the stem in the past week. This included 162KMT in WA and 148KMT and the remaining 95KMT in Vic. There was 30KMT of canola added to the stem in SA. Another 50KMT of unspecified grain was added to the stem in Newcastle NAT. There is now 100KMT on unspecified grain to be loaded from NAT in the second half of July.

Australian Weather

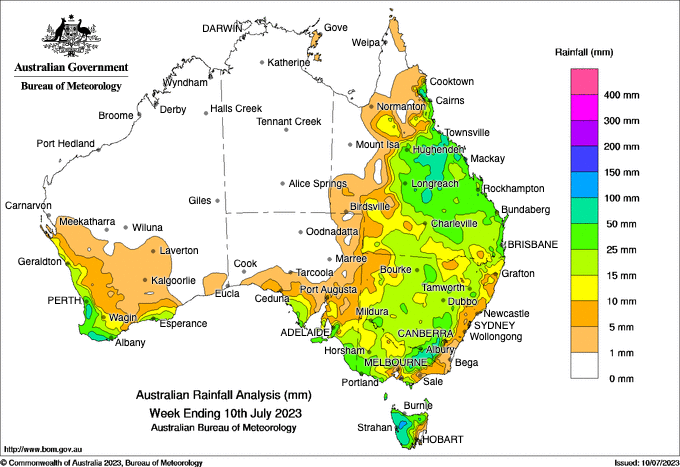

Seeding is now completed in both Western Australia and South Australia. Despite experiencing below-average rainfall in May, timely precipitation during June has significantly improved crop production prospects in both regions. The southern region's favourable climate conditions continue to support sizable crop production. The later-seeded crops are faring better this season due to the consistent falls over the past month.

The most significant issue in the past week was the disappointment from the forecast rain event for northern New South Wales. The recent rain event only delivered 5-15mm across the driest areas of the state where farmers needed upwards of 35mm to entice them to plant the remainder of the crop. El Nino has been flagged as a production risk for some parts of Australia and it's starting to bite. The planting window is nearly closed, and it will take a major rain event to get more crop in the ground. It’s estimated that less than a quarter of the intended wheat plantings in northern New South Wales have been planted. It’s a big deal as these areas accounted for about half the state’s wheat plantings in the 2020/21 Census and it will have a major impact on the NSW 2023/24 winter crop production.

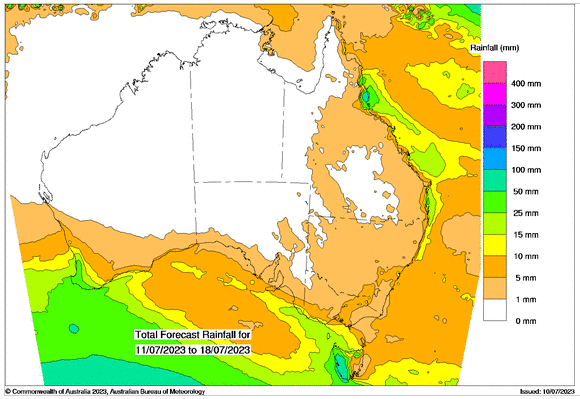

8 day forecast to 5th of July 2023

Source: http://www.bom.gov.au/

Weekly Rainfall to 28th June 2023

Source: http://www.bom.gov.au/

AUD - Australian Dollar

The Australian dollar tracked lower through trade on Monday, scuppered by weaker-than-anticipated China data. Amid a backdrop of weaker risk appetite, the AUD tracked toward intraday lows at US$0.6630, before finding support in a weaker US dollar. The dollar could not maintain the risk-off momentum enjoyed following the China data as treasury yields moved lower, back toward the lows seen in the wake of last week's softer-than-anticipated payroll print. We expect ranges will be well contained leading into US CPI data with the AUD tracking between US$0.6580 and US$0.6730.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au